There’s Always a Bull Market for Income Investors Somewhere

We’re into the seventh year of zero percent interest rates, and income investors are wondering out loud when that string will be broken by the Fed looking to hike the Fed Funds Rate as early as September. If they do decide to raise rates, it will be by a quarter point, or 25 basis points. Then they will see how the markets absorb the move, look for further strengthening in the economy and then consider a second rate rise in December, but more likely out in the first quarter of 2016.

The bond market is clearly nervous; whether that is justified when crude oil, copper and other economically sensitive commodities are deeply depressed runs counter to conventional thinking. Yet there is upward pressure on the long end of the yield curve that has bond investors up at night. The market continues to play out the headline risk of China, Greece, Iran and, most lately, cyber attacks and exchange disruptions. The U.S. bond market, several times larger than the equity market, is showing remarkable stability, trading within a very tight range where the benchmark 10-year Treasury Note yield is between 2.20% and 2.45%.

Rather than jumping on the bandwagon of the Fed’s desire to tighten rates or staying up all night with one eye open on Bloomberg television, investors should look to sectors that have a clear advantage because of current conditions. One of these market subsectors is the energy-refining industry that sells gasoline, diesel fuel, jet fuel, lubricants and solvents. As crude oil is the feedstock of all these refined products that are all seeing higher domestic demand, the present price of West Texas Intermediate (WTI) crude trading below $53/bbl provides handsome profit margins that are translated into rising quarterly distributions.

The old saying that “there’s always a bull market somewhere” holds true for income as well as equity investors. There are counter-intuitive investment strategies that are appropriate for certain market environments. With crude prices looking like they will be down for a good while, the market conditions for refining operators will remain bullish for some time, maybe several quarters out into 2016, especially if Iran is allowed to come back online legally.

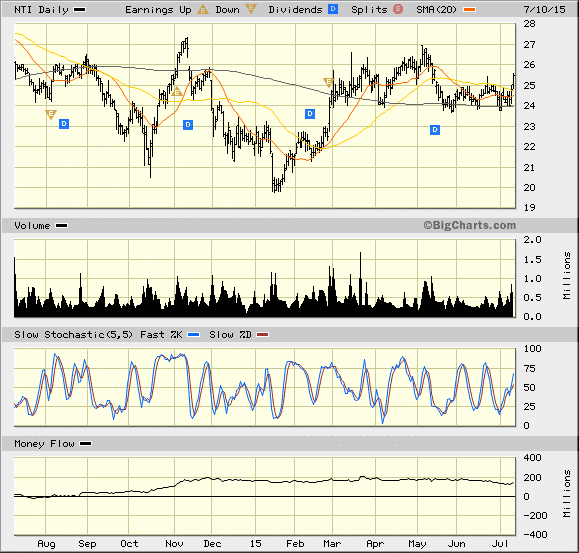

This past week, Cash Machine added a second refining master limited partnership (MLP) to its stable of high-yield assets: Northern Tier Energy L.P. (NTI). The company engages in refining, retail and pipeline operations in the United States. Within the refining division, the company owns and operates the Minnesota Pipeline, moving 455K barrels of crude per day. In addition, NTI operates a chain of 270 convenience stores under the SuperAmerica brand name that provide an outlet for gasoline and diesel products. It’s the right way to have the energy market working in one’s favor until oil prices stabilize and begin trending higher.

And I’m not alone in my positive view on Northern Tier. Within days after I recommended the stock to Cash Machine subscribers, analysts at RBC Capital initiated coverage of the company with an “outperform” rating and a price target of $30, or roughly 25% higher than our entry point. In addition, the most recent quarterly distribution of $1.08 implies a $4.32 annual payout that translates to an elephant-sized 16.9% current yield. However, it’s worth noting that the stability of distributions from refiners is not entirely set in stone, but the current market conditions argue very well for a continuation of strong payouts.

Opportunities are sometimes not so obvious when you mention the word “energy” to most investors, but when you take the other side of that trade, it’s like turning lemons into lemonade, or in this case crude oil into jet fuel. This is the kind of investable income strategy that I look for to propel our total returns for investors who need income without worrying about whether the floor is going to fall out from under the bond market. Northern Tier Energy LP is timely strategy.

In case you missed it, I encourage you to read my e-letter column from last week about stable dividend stocks in a volatile market. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.

Upcoming Appearance

I will be attending the San Francisco MoneyShow, July 16-18, at the Marriott Marquis. To register, click here. Mention priority code 038970.