Seeing Ballast Income in the Midst of Market Storms

When market volatility rules the investing landscape for weeks at a time, taking the time to screen for companies that are impervious to the triple-digit swings and the downward bias is an enormously useful exercise. While the Dow has retreated by 13%, the S&P by 12% and the Nasdaq by 18%, with numerous subsectors of the market down by more than 20-30% (biotech, energy, materials, metals, etc.), there are specific income-producing stocks that have weathered the correction in a manner that deserves serious examination.

The level of uncertainty that has gripped investor sentiment is the source of fearful selling. And the major unknown quantities regarding Fed policy, the bear market in commodities, the prevailing weakness in emerging market growth rates and the impact, or lack thereof, surrounding central bank stimulus and fiscal engineering may drag on for several more quarters. No one knows definitively when stabilization of markets will take hold, but amidst the stormy conditions, there are some beacons of light within the rough waters.

Most income stocks that pay yields in excess of 5% have been negatively impacted by the market sell-off. Pessimism about the ability to maintain higher than 3-4% yields takes hold because there is a general feeling that anything trading with a yield above 4% must be risky when, in fact, many investors fail to understand the structure of “pass through” securities. I can’t fix that disconnect, as much as I write about it week after week, year after year. It’s all good when there are tailwinds for high-yield assets, but when a correction comes along, what people don’t fully understand or appreciate triggers broad-based selling out of fear of principal loss.

Regarding my opening commentary about where investors can find ballast income when the market is enduring Category 5 hurricane conditions: investors who are satisfied with 3-4% dividend yields can find solace and safety in the following three stocks, as they have truly passed the litmus test of the past six weeks of volatility, the likes of which have not been seen since 2009.

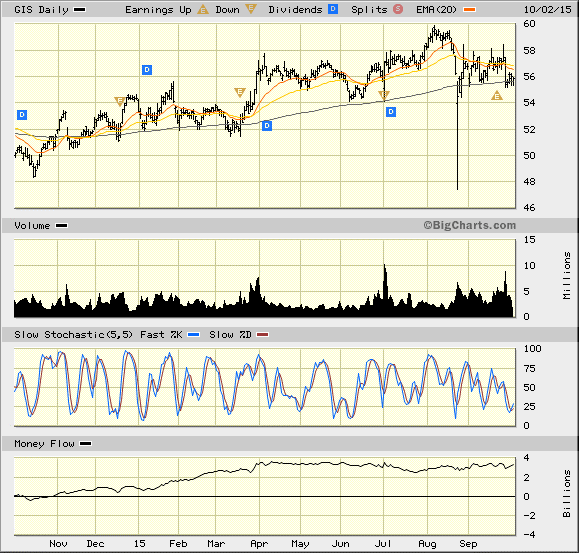

General Mills (GIS) — current yield 3.15%

Leading food company growing its organic and all-natural business lines

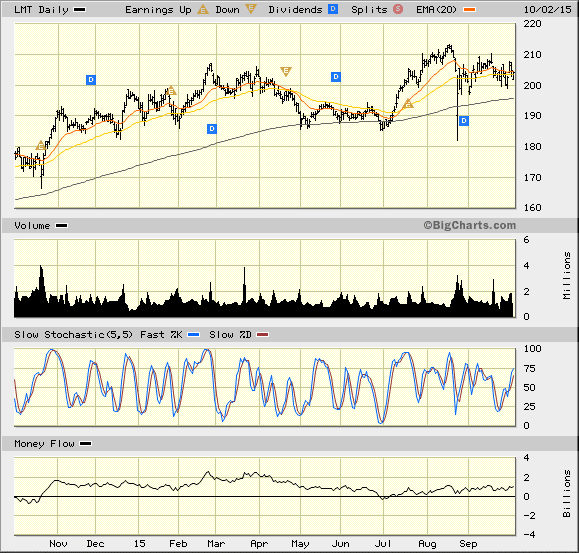

Lockheed Martin (LMT) — current yield 3.23%

America’s largest defense contractor

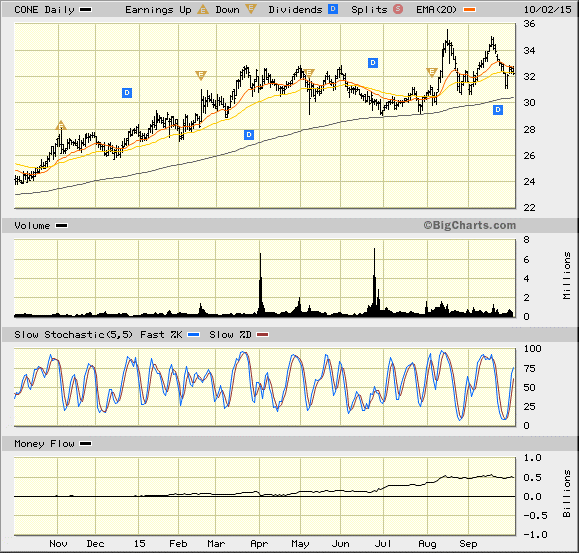

CyrusOne (CONE) — current yield 3.91%

Real estate investment trust operating data centers for corporate and wireless markets

Outside of money markets that pay essentially zero percent, certificates of deposit (CDs) that pay no more than 1.25% for five-year maturities and 10-year Treasuries that are now yielding less than 2.0%, investors seeking out ultra-stable share prices accompanied with yields that are 50% higher than 10-year T-notes’ do have options. The three fortress names noted above are a way to move from the position of doom and gloom laid out by Carl Icahn this past week to Gene Kelly’s in “Singin’ In The Rain.” There’s always a bull market somewhere.

In case you missed it, I encourage you to read my e-letter column from last week about how Fed actions have stimulated investors’ appetite for high-yield companies. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.