Bullish Takeaway from Jackson Hole Meeting

In light of the dramatic events in Washington, D.C., that now include a threat to shut down the government if a border wall isn’t funded, the stock market managed to stay focused on the economy and the bullish catalysts for stocks to close higher on the week.

Low inflation, a lower dollar, lower energy prices and fresh talk of lower taxes took hold of investor sentiment that brought buyers off of the sidelines leading up to what many hoped would be a market-moving gathering of central bankers last Friday and Saturday at the annual Kansas City Fed Conference in Jackson Hole, Wyoming.

Arguably the most anticipated events of last week were last Friday’s speeches from Fed Chair Janet Yellen and European Central Bank (ECB) President Mario Draghi that turned out to be non-events as the two central bankers provided the market with little to no new information. Ms. Yellen praised the Fed’s regulatory efforts, while Mr. Draghi spoke in favor of open trade and argued for raising potential output growth, which was received as dovish.

Mr. Draghi also gave no indication of curtailing the current ECB’s quantitative easing program, which will most certainly be well received by European markets.

The U.S. Dollar Index (92.49) moved sharply lower following the speeches, ending Friday at its lowest level since January 2015. Meanwhile, U.S. Treasuries finished mostly higher, as the 10-year yield dropped three basis points to 2.17% and the 2-year yield settled flat at 1.33%.

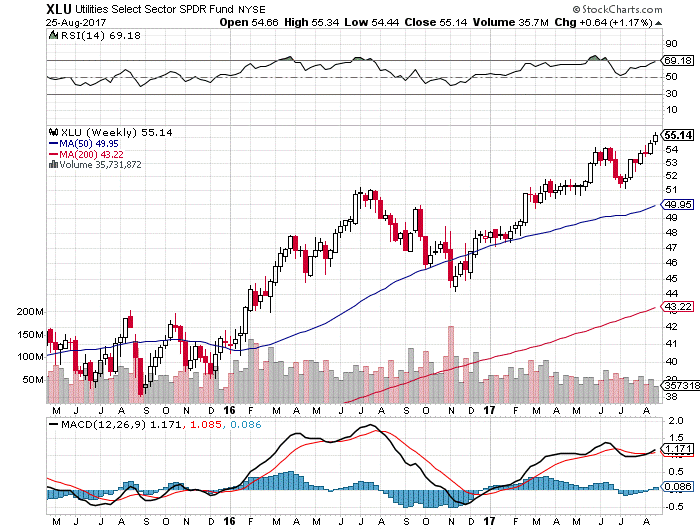

There is a bit of an anomaly taking place that is getting almost no mention by the business media. While the major averages are grinding out new closing highs against an economy that is posting gross domestic product (GDP) growth of 2.5-3.0%, the utility index, as measured by the Utilities Select Sector SPDR Fund (XLU), was trading at a new all-time high this past week. (I have no position in XLU.)

What makes this situation a bit unusual is that this past week also saw copper prices hitting a three-year high, along with other base metals, signaling optimism about global growth. Historically, owning utilities alongside a breakout move for the metals sector has been like mixing oil and water. But with inflation readings tame and the U.S. 10-year Treasury trading near a 10-month low, frustrated money targeting yield has been patiently waiting for rates to rise and is aggressively going after dividend stocks and funds such as XLU, which sports a current yield of 3.17%. It also signals that institutional money does indeed buy into the notion that interest rates are going to stay low for an extended period.

The rallying cry for higher stock prices remains loud and clear

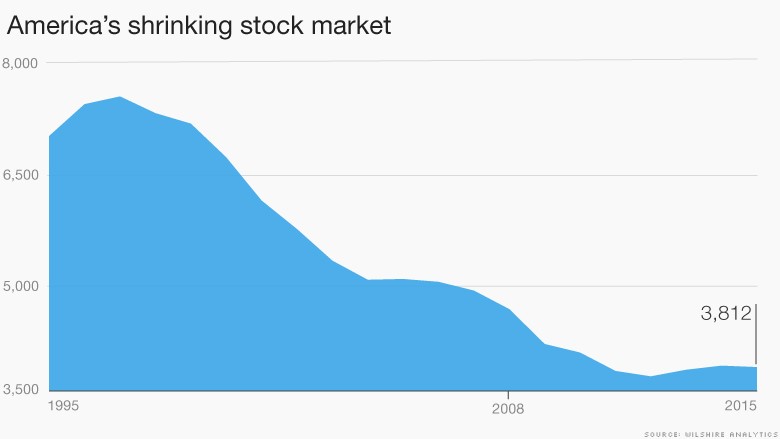

There are two clearly defined camps that see the bull market in starkly different terms. The first declares that we are not even at the halfway mark for what will be a 20-year bull market because of the structural power of low interest rates. Companies are harnessing the debt markets to fuel record stock repurchases, to strengthen balance sheets and to finance acquisitions. But most of all, the stock market is shrinking due to the velocity of mergers, companies going private and the absence of Initial Public Offerings (IPOs).

The number of publicly listed U.S. stocks peaked at a record 7,562 in 1988. By 2015 there were just 3,812 U.S. public companies. (source: CNN Money, “America’s Stock Market Is Shrinking” – July 9, 2015). Simply put, there are more companies disappearing than entering the stock market. Granted, there was a massive wave of startup companies that peppered the new issue calendar leading up to the dot-com crash. But even since 2002, when most of the damage had been accounted for, the trend continued to show a pronounced move lower for the number of listed companies. With that said, the long-view bulls argue that there is just so much money sloshing around (supply) and fewer and fewer stocks to buy (demand).

The other camp claims the bull market for stocks is more than eight years old now, which makes it the second-longest bull market since the end of World War II. There has been a lot of change in the last 8-plus years, yet the one constant throughout has been the persistence of low interest rates. Low interest rates, which have been an offshoot of low inflation, low growth and a high level of asset purchases by the Federal Reserve, have been at the core of the stock market’s success. They have been the basis for every buy-the-dip effort and they have been the marching cry for pundits who have suggested there is no better investment alternative than stocks. Low rates have helped rationalize lofty equity valuations and they have fueled corporate earnings expectations.

The second camp that sees the market, in its late innings of bullishness, is blowing the horn of the eventuality of higher interest rates because the global economy is indeed picking up speed and rising rates are only a matter of when and not if. Under this scenario, the market would have to, in my view, undergo a reset that would be more of a garden-variety correction and nothing more unless, for some reason, inflation took off, which is not foreseeable at this time. Even still, the threat is always out there. Higher interest rates become problematic for stocks on several levels:

- They lower the present value of future cash flows

- They reduce earnings prospects for indebted companies by increasing their interest expense

- They can curtail growth prospects as investment projects get deferred due to higher financing costs

- They create increased competition for stocks by providing other investment alternatives; and

- They leave investors less inclined to pay up for every dollar of current earnings for slower-growing companies, which creates valuation pressure

When the S&P 500 bottomed on March 6, 2009, the yield on the 10-year note was 2.87% and the S&P 500 traded at 10.0x forward 12-month earnings. Today, the yield on the 10-year note is 2.17% and the S&P 500 trades at 17.4x forward 12-month earnings. This goes to show how low interest rates can drive multiple expansion, yet it also exposes how rising interest rates can lead to multiple contraction.

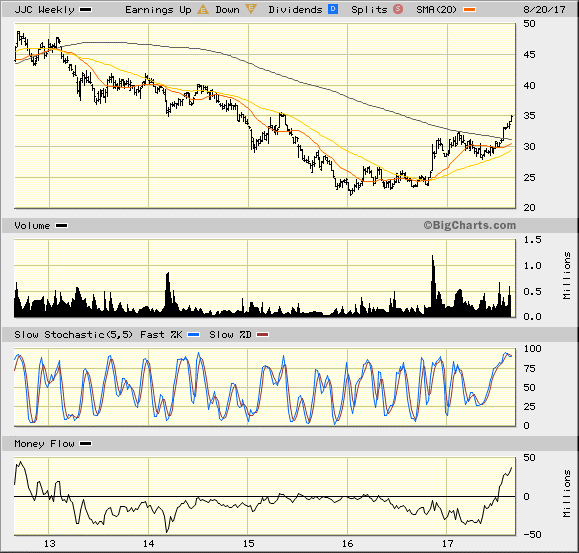

Source: BigCharts.com

For now, the inflation genie is still in the bottle. But it does warrant watching how certain inputs like copper, as measured by the iPath Bloomberg Copper Subindex Total Return ETN (JJC), in which I have no position, are making a counterintuitive move in a direction that is worth mentioning and should be monitored closely.