A Crisis of Clarity Rippling Through Regional Banks

The past week of volatility exhibited in the banking sector was epic.

It was along the lines of a redux of 2008, when some high-profile mortgage lenders and investment banks dealing in risky practices went bankrupt, filed for Chapter 11 or were acquired for pennies on the dollar. To say the recent events in the regional bank sector and with Credit Suisse are surreal would be an understatement.

Oh, how history does repeat itself — in various forms — but with the same pattern of hubris, greed and sheer stupidity.

Take Barney Frank for instance. As one of the authors of the Dodd-Frank Act enacted to prevent the excessive risk-taking that led to the financial crisis, it appears there is some twisted irony as to how Mr. Frank was a sitting board member of now-failed Signature Bank that was one of only a handful of banks allowing customers to deposit and transact in cryptocurrency assets 24/7 beginning in 2018.

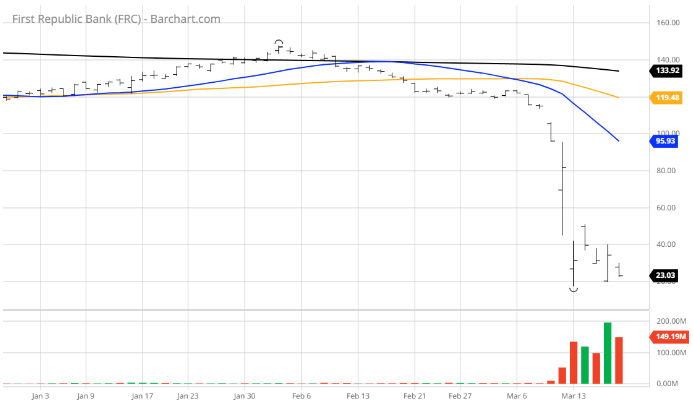

One can look at the demise of FTX and the fall-off its leader Sam Bankman-Fried as the spark that led to the collapse of crypto-centric Silvergate Bank and the further chain reaction that ignited fears of depositors at Silicon Valley Bank and Signature Bank for their exposure to start-ups, crypto and commercial office space. From there, the market was taking down shares of banks with large uninsured deposit bases. First Republic Bank (FRC) is the newest poster child of this contagion.

No sooner than one day after 11 banks transferred $30 billion over to First Republic to shore up its deposit base, news reports indicated that top executives at the struggling financial institution sold millions of dollars of company stock in the two months prior to the regional bank panic. So, the rally in FRC shares last Thursday on the rescue plan fizzled Friday on news of the timely stock sales by company insiders.

The other deadly transgression by bank executives was reaching for yields on their bond portfolios. The banks invested in long-term bonds where the difference in yields compared to short-term bonds was minuscule, thereby taking huge risk of principal.

When money rained on the bank system from the roughly $4.7 trillion created in pandemic stimulus, banks invested heavily into long-dated government bonds. When the rate on the 10-year Treasury briefly rose to 1.75% in March 2021, banks rushed to buy.

The decision to do so by “risk managers,” instead of accepting 0.40% on 3-year T-Notes, is proving to be pretty short-sighted. At 1.75% for 10-year paper, there is really only one direction yields of that duration can go (higher), and only one direction for long-term bond prices to go — lower. To the extent these risk managers didn’t ladder their bond holdings borders on reckless, as if printing trillions of dollars wouldn’t somehow be inflationary down the road. And all for trying to bank a spread of 1.3% between the 3-year and 10-year Treasuries.

2-year T-Note www.cnbc.com

10-year T-Note www.cnbc.com

The obvious question sweeping the markets is how many, and to what extent, other banks are also underwater with their bond portfolios, their uninsured deposits and their exposure to commercial office space. In recent days, there have been numerous CEOs of small to mid-size banks putting forth statements that what happened at Silicon Valley Bank, Signature and Silvergate is unique, since those institutions engaged in non-traditional activities. They go on to say that all is well and their institutions are safe and sound, yet there is no mention of their Treasury holdings and a maturity schedule, a breakdown of commercial real estate loans and the level of uninsured deposits.

Transparency is what investors and depositors want most. Banks should immediately make public their current holdings and details of their financials and balance sheets amid this crisis. The warm and fuzzy statements do nothing to shore up confidence.

Caution takes hold when banks announce “there is nothing to worry about,” and then don’t back it up with internal numbers. With first-quarter earnings season approaching in April, investors will have ample opportunity to investigate the details of each bank during the earnings calls that follow the posting of quarterly results.

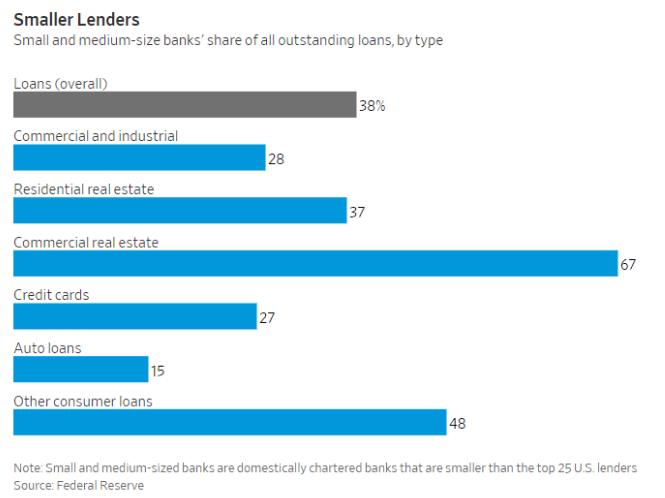

“Smaller banks are crucial drivers of credit growth, the fuel that powers the economy,” the Wall Street Journal reported on March 19. Banks smaller than the top 25 largest account for around 38% of all outstanding loans, according to Federal Reserve data. They account for 67% of commercial real estate lending. The possibility that other banks have similar problems has triggered a sell-off of financial stocks as investors scrutinize bank solvency. This, in turn, stoked public alarm about the safety of deposits and the size of unrealized losses.

This week will hopefully begin to provide some much-needed clarity of the risks within the wider banking sector. It is widely accepted that lending standards just tightened up for both businesses and consumers to raise capital ratios. Additionally, some pundits are suggesting recent events could trigger a wave of weaker banks being swallowed up by bigger banks to avoid the potential of further bank runs. These mergers could be voluntary or at the direction of state bank regulatory agencies.

What the market seeks most is a rapid response by the bank industry, the Fed and Treasury to prevent a further ripple effect. The fact that the Fed and Treasury jointly agreed to guarantee all deposits above the $250,000 FDIC level of insurance at Silicon Valley Bank is fueling a fresh debate about the moral hazard of universal deposit insurance. The potential for unintended consequences is high. If all funds are guaranteed, there’s at least some incentive to take on higher risks with depositors’ funds to chase profits.

What should come of recent events is that there should be more stress testing, more often with stricter mandates about where capital is concentrated. I think if these directives were made known to markets sooner than later, the ground under the banking sector might stop shaking. Let’s hope sound minds and proper decision making prevail in the days ahead.

P.S. Join me for a MoneyShow virtual event where I’ll be on a panel moderated by Roger Michalski and will be joined by my colleagues Jim Woods and Mark Skousen. In addition, the entire event focuses on investing for income, real estate, Master Limited Partnerships, dividend-paying stocks, bonds and more.

To sign up for this free event taking place March 21-23, click here now.