A Highly Tactical Trade in Rare Earth Treasures

One of the most compelling stories in the world of commodities that should be on everyone’s radar involves the market of rare earth elements, or REE.

As a sector that is essential to the modern global economy, it is not widely covered by Wall Street mainly due to the concentration of the industry among privately held companies and governments. But the few opportunities that exist to invest in this space have the potential to deliver huge profits.

Rare earth elements are materials vital to the production of military defense systems, advanced computer processors, smartphones, LED lights, flat screen TVs and clean energy technologies. Military applications include the production of permanent magnet materials that are essential to the most technologically advanced weapons systems. Within the green technologies space, REEs are used in electric vehicle batteries, magnets in the production of EVs, wind turbines and solar cells.

The big issue at hand is that China currently controls the production of over 80% of the global REE supply. In 2020, China produced 140,000 tons of REEs, whereas the United States produced only 38,000. The ramifications of China locking the United States out of this market for political and economic reasons would have a deeply negative impact on these industries, and is thus a high priority to advance America’s mining of REEs.

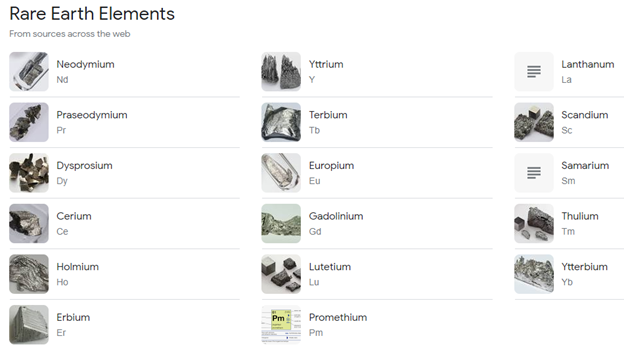

There are 17 rare earth elements found in certain pockets of the earth’s crust derived from the rare-earths ores: bastnasite, monazite, xenontime and ion-adsorption clay. Of these, five are listed as “critically” in short supply and risking industry disruption.

Demand for these rare earth materials is rapidly growing where both the Trump and Biden administrations labeled the vulnerability as a national emergency, calling for expanded domestic supply. In fact, bipartisan legislation was introduced in the U.S. Senate in January 2022 to force defense contractors to stop buying rare earth minerals from China by 2026.

This was followed up with the Biden administration invoking the Defense Production Act on April 7, 2022, providing support for the mining, processing and recycling of critical materials. So, the race is on for new development of REEs in North America.

Enter Tactical Resources Corp. (OTC: USREF) that began trading on the OTC exchange less than a month ago on June 15, 2022. Tactical Resources is a mineral exploration and development company focused on rare earth elements based in Vancouver, British Columbia. The company holds interests at the Peak Project in western Texas, the Lac Ducharme property located in Quebec and the SAM property in Northern Saskatchewan.

Source: www.tacticalresources.com

The primary asset that is driving the investment proposition over the near term is the company’s interest in development and production in The Peak Project located about 70 miles outside of El Paso, Texas, and two miles from the Round Top Rare Earth Element project co-owned by Texas Minerals Resources Corp. and USA Rare Earth where there are large proven rare earth mineral reserves. Geologically, the Peak Project asset is found within the Sierra Blanca Complex, the same Complex that hosts Round Top.

Tactical Resources is party to an agreement with the Sierra Blanca quarry that allows, for a fee, access to and the first purchase right of “waste rock,” also known as tailings material, on the Sierra Blanca property, together with certain rights related to development and processing of the tailing material.

Tactical Resources aims to take tailings from the active 1,800-acre Sierra Blanca Quarry that provides fill for the Union Pacific railway. This rock quarry produces ballast that Tactical Resources will extract valuable rare earth minerals from this waste stream. Currently, 6 million tons of tailings material are available with the quarry generating 2,800 tons of tailings per day.

Tactical Resources plans a strategic focus on five key rare earth metals: neodymium, praseodymium, dysprosium, terbium and yttrium. The Chinese price of praseodymium-neodymium alloy, used to make super strong magnets for EV motors, doubled last year and has gained more than 10% so far in 2022 to top $184,000 per ton.

Since the quarry is fully operational, this offers Tactical Resources a potential to fast-track its project permitting and production. In addition, the location already has significant infrastructure in place, near gas lines, railroads and interstate highways thereby decreasing capital expenditure for operations. And the Board of Directors experience includes ex-Newmont Mining, Goldcorp and Teck Resources.

At present, MP Materials Corp. (NYSE:MP) is the only rare earth minerals producer in the North America, and trades at a $5.5 billion market cap with its shares trading at around $30, having tripled in price from late 2020. Shares of Tactical Resources Corp. (USREF) are trading at just $0.75 and with only 21.37 million shares outstanding, any serious accumulation of the stock will likely drive it higher.

It is not often when young companies seize an opportunity deemed critical by the U.S. government, with support, backing and fast-tracking in place. That, and the strong pricing for rare earth minerals that target fledging industries, really sets up Tactical Resources for an exciting second half of 2022 and a phenomenal outlook for the future of the company, as well as what looks to be a rare opportunity for investors.