A Non-Bank Financial Sector Paying Double-Digit Yields Stands to Benefit

The failure of three regional banks and the challenges facing the entire sector remain in high focus of market participants this past week, after it was disclosed that PacWest Bank (PACW) saw another round of deposit flight, this time 9.5%. Despite some banks showing a pause in withdrawals, sentiment remains largely bearish as the rising risk of a credit crunch for community and regional banks looms large in the minds of investors.

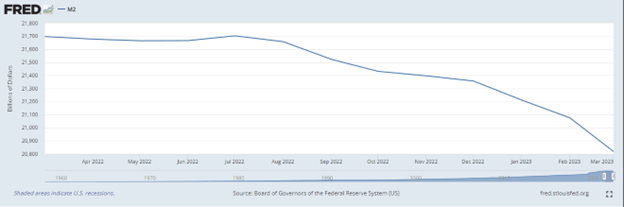

As is with each and every banking crisis, the FDIC steps in to help put out the fires, and then together with Congress, enact of slew of new regulations designed to target the few bad apples operating in the sector, but the ripple effects spread through the entire sector. The Fed has already been shrinking its balance sheet for the past year with M-2 money supply, decreasing available capital to banks to slow the economy well before the demise of Silicon Valley Bank, Signature Bank and First Republic Bank.

With PacWest Bank and potentially others on the ropes, any large-scale rescue effort by the FDIC, Fed, Treasury and Congress will very likely bring with it a whole set of tighter lending standards that results in making it difficult for borrowers to obtain financing. The blame falls on the risk managers at banks overinvesting in low-yield, long-dated Treasuries and jumbo mortgages, not the borrowers. But as this scenario unfolds, it will likely lead to tighter lending standards and less capital available to the credit markets.

In a recent interview with Bloomberg, Jamie Dimon said it’s time for regulators to help put an end to turmoil in the banking industry, but he’s already predicting policymakers will take away the wrong lessons from this year’s upheaval.

“I think it’s going to get worse for banks — more regulations, more rules and more requirements,’’ JPMorgan Chase & Co.’s chief executive officer said in a Bloomberg Television interview from Paris last Thursday. “If you overdo certain rules, requirements, regulations — there are some of these community banks that tell me they have more compliance people than loan officers.’’

At the recent Berkshire Hathaway annual shareholder meeting, Warren Buffet was quoted as saying “If a CEO gets a bank in trouble, the CEO and directors should suffer.” When that doesn’t happen, it “teaches the lesson that if you run a bank and screw it up, you are still a rich guy… that is not a good lesson to teach the people who are holding the economy of the world in their hands.”

“That is what First Republic was doing,” he said. “It was in plain sight. The world ignored it until it blew up. You have to have a punishment for people who do the wrong thing.”

So far, as is case with SVB and First Republic, no one has been put on trial or gone to jail. Such is the case with the well-connected elite that donate generously to their favorite high-placed elected officials.

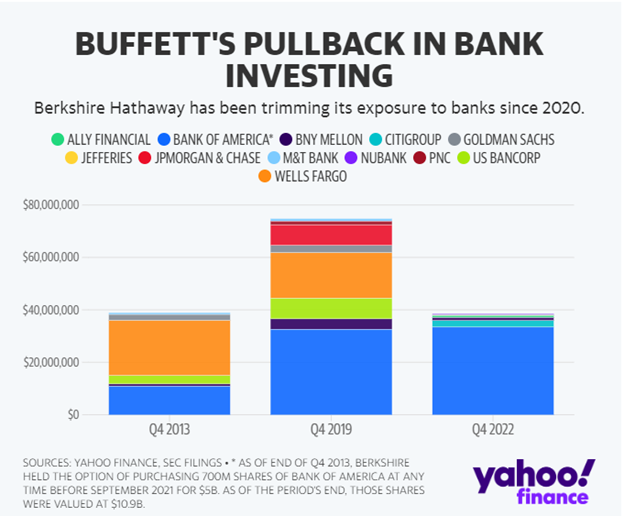

To be sure, Buffett has been reducing his bank holdings. Buffett also made it clear that he is ready for a worst-case scenario in this banking crisis, citing a cash hoard that is approaching $130 billion. “We want to be there if the banking system temporarily even gets stalled,” he said. “It shouldn’t. I don’t think it will. But it could.”

Under the premise of a forthcoming squeeze on bank credit, two sectors that stand to benefit in filling the void are private credit and business development companies, or BDs, as they are known by. Private credit pools have been around, but have gained rapid popularity in recent weeks per the regional bank chaos. These pools of money are formed by private equity, institutions, family offices, foundations, endowments, etc.

They provide mostly floating rate loans that generally pay 5-7% over the Secured Overnight Financing Rate (SOFR), currently quoted around 5%, thereby generating yields of 10-12% These private transactions are negotiated directly between the lender and the sponsor/borrower, with an extensive focus on due diligence and downside protection. Private lenders aim to negotiate stronger structural protections, including covenants and higher call premiums. Private credit deal flow remains robust as borrowers seek certainty of terms, flexibility in structuring and a more efficient process than the public market.

The cost of this loan has recently soared amid higher interest rates. A $1 billion loan from a private equity firm for a company rated non-investment grade — or junk — now averages an interest rate of up to 12%, up from around 7.5% average in 2021, one of the executives interviewed by Reuters said.

So, how do investors get in on the private credit action that is dominated by non-retail parties? There are two ways. They can buy share of stock in publicly traded private equity firms, but then you get all the exposure to the troubled commercial real estate they are contending with, or take the second option of buying shares in carefully researched business development companies (BDCs) that use public markets to sell shares to raise capital that is deployed in the same kinds of loans being made by private credit pools.

BDCs, by definition, are regulated investment companies, similar to REITs, whereby they are required to pay out 90% of all net investment income. They can use leverage and derivatives to hedge as well, making them an uniquely attractive alternative asset class that pays out comparable yields to that of private credit.

A well-run BDC is lending to small- and medium-sized private businesses operating in defensive industries, structuring loans that are also floating rate with similar terms, many of which include equity kickers if the borrower is a company that eventually goes public or is acquired in a private transaction. Key target areas of lending include:

- Industrial manufacturing and services

- Insurance

- Value-added distribution

- Healthcare products and services

- Consumer products

- Aerospace and defense

- Business services

- Tech-enabled services and SaaS models

- Food and beverage

A well-run BDC’s portfolio will have the majority of the loans structured as senior secured debt, again tied of SOFR or LIBOR. There are 57 publicly traded BDCs to choose from, and again, many are invested in areas of the economy that are much more vulnerable to an economic downturn than others. It’s vital to go through the portfolios of each BDC of interest to see their loan mix. And for the most part, those companies and industries they are lending to are all listed on their websites.

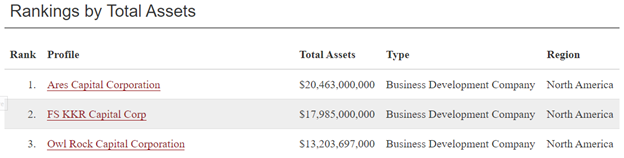

The top three largest are:

Source: www.swfinstitute.org

What makes BDCs so compelling from an investment standpoint is the dividend payouts that are now averaging between 10-13%, matching yields to that of private credit pools. (Bryan Perry has no ownership position in the stocks mentioned.)

So, let’s compare the double-digit yield to the S&P 500. According to Investopedia: “While it assumed its present size (and name) in 1957, the S&P actually dates back to the 1920s, becoming a composite index tracking 90 stocks in 1926. The average annualized return since its inception in 1928 through Dec. 31, 2022, is 9.82%. The average annualized return since adopting 500 stocks into the index in 1957 through Dec. 31, 2022, is 10.15%.”

The question posed here is, if the S&P’s historical return is roughly 10%, then in this current investing environment, it might prove worthy to have some assets where the dividend income matches the historical performance of the S&P. If sticky inflation, an ever-rising debt ceiling (what ceiling?), a bungled Fed policy and a regional bank sector mired in disarray have got you down, spend some time on the BDC sector and see how America’s businesses are accessing the capital they need expeditiously to maintain and grow the top and bottom line. It’s the old story of turning lemons into lemonade.

IMPORTANT ANNOUNCEMENT: We are having our Eagle Virtual Trading Event tomorrow, May 16. If you haven’t signed up for this yet, there’s still time. Just click here now to sign up for free. Believe me, you won’t want to miss this online event — as we bring together all of Eagle’s investment experts at the same time to reveal the Second Half Outlook: 7 Ways to Beat the Market. Reserve your seat now by clicking here.

P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.