Blue Light Special In Utility Sector

Sales of antacids are soaring as investors have buckled up for what will likely be another volatile market defined by wild swings.

Market participants are trying to get a rational handle on the impact of the global supply chain and the new case count of the coronavirus (COVID-19) outside China. The investing landscape has been like watching a high-speed train wreck that has now played out over eight trading days.

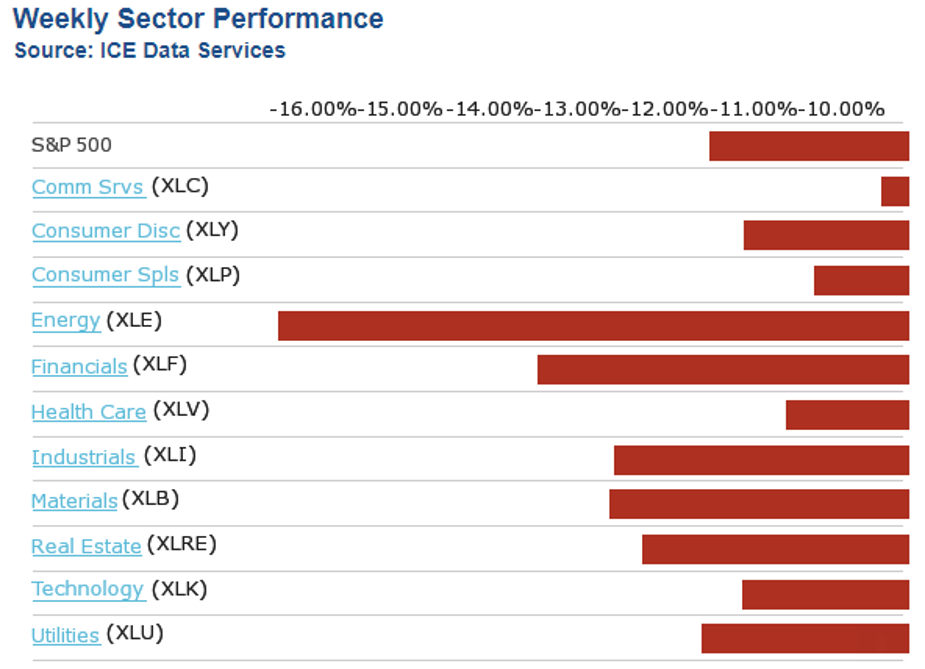

Last week, the S&P suffered its biggest one-week loss since the 2008 financial crisis, surrendering 11.5% in value and bashing the portfolios of investors heavily weighted in energy and financials. Plummeting demand for crude in China and record low Treasury yields caused the energy sector to drop 15.4% and the financial sector to fall 13.5%.

These are world-class hits. If there isn’t a pandemic in the world due to the COVID-19 virus, there certainly still is fear among investors and trading desk staffs around the globe.

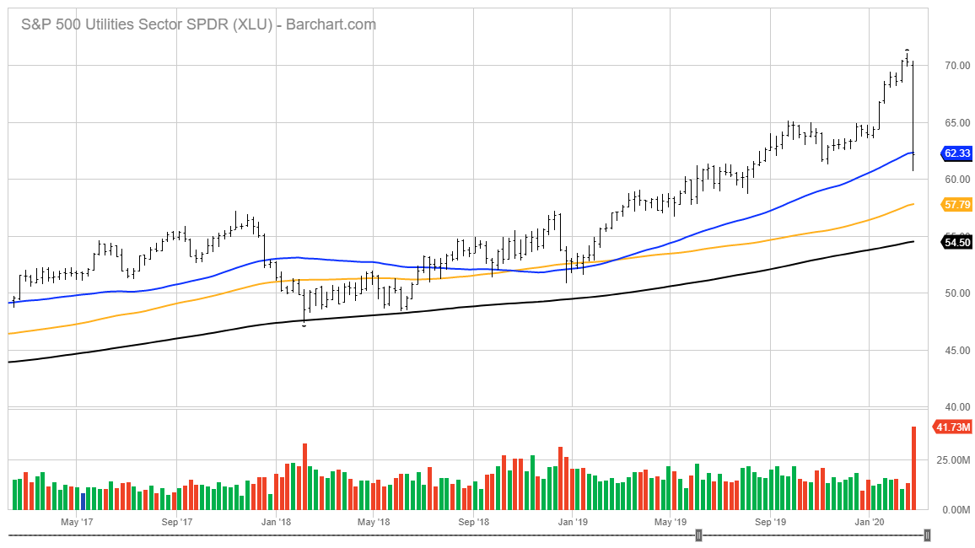

What was most notable is that when panic selling set in, no sector was left intact. The fact that the utility sector shed nearly 12% is the kind of capitulation that was last seen in early 2009 when investors sold “the good stuff” out of sheer panic-stricken fear. Last Friday’s session took the Utilities Select Sector SPDR ETF (XLU) knifing down through its 200-day moving average on a towering 92.27 million shares being traded.

Below is a three-year chart of the XLU where the sell-off briefly violated the 20-week moving average (blue line) before closing right on the trendline. Clearly, the utility sector was trading way over its skis on a purely technical basis, if not on a valuation basis as well. Share price changes last Wednesday, Thursday and Friday not only were incredible — they were also irrational. Alan Greenspan coined the phrase “irrational exuberance,” but what we saw in the utility sector last week was “irrational hysteria.” Shares of XLU now yield 3.07%.

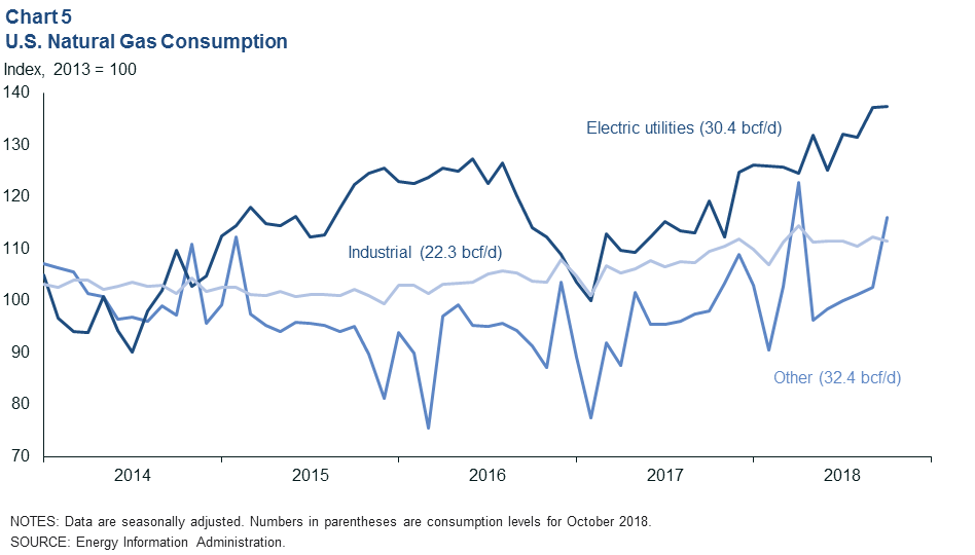

While the growth of renewable energy is admirable, all the solar, wind, geothermal, hydro, biomass and wood pellet sources account for about 15% of the total power that is produced from utilities. Natural gas dominates the fuel of choice for most utilities, soaking up roughly 35% of all domestic natural gas production.

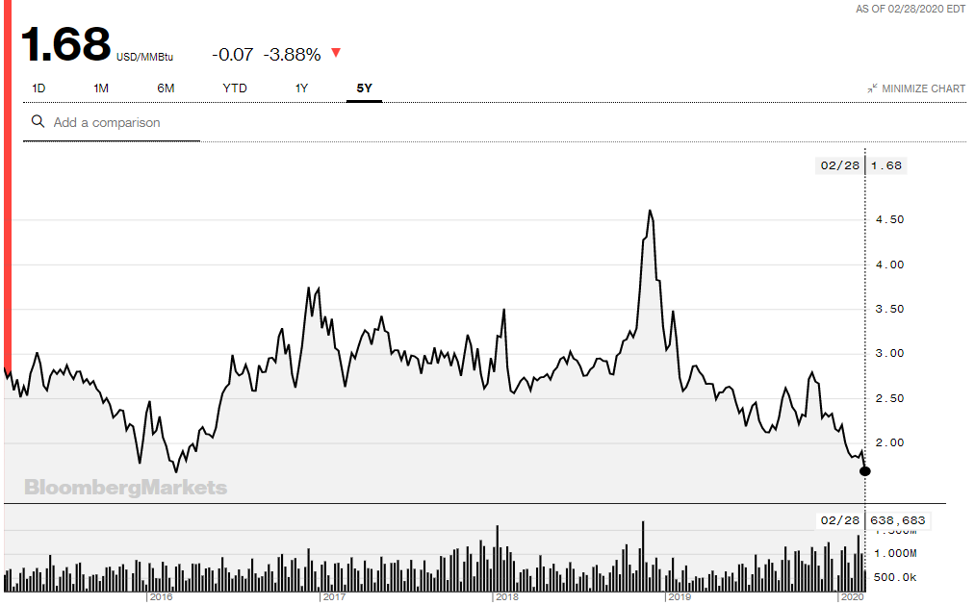

As power companies move away from coal, the cheapest replacement that can scale to meet the demands of end markets is natural gas. Renewables have a long way to go before passing up natural gas as the go-to future fuel for now. It’s clean, it’s in abundant supply inside the borders of the United States and it is cheap — super cheap. The price of natural gas has fallen to below $1.70/MMBtu, a level not seen since March 2016.

When the largest and most important input to your business is trading at historic lows, it stands to reason that business conditions are not just stable but have a sizeable tailwind. If you’re an operator of an electric utility, you are locking in long-term forward gas contracts the size of Texas with prices down at these levels. This current condition is like being Starbucks and seeing the cost of coffee beans get cut in half.

And here’s the other thing. The supply of electric vehicles hitting the road is about to climb into the millions over the next few years. Home charging and commercial charging stations are going to be a huge growth driver for electric utilities. It’s quite an investment proposition and one that is now on sale, courtesy of the coronavirus correction.

Investors seeking yield that’s at least two times that of the 10-yr Treasury bond and generated from a source of qualified dividend income that doesn’t have any currency or foreign market risk need look no further than the U.S. utility sector. Within the XLU ETF, there are several stock holdings that yield over 4%. Last week’s panic-driven price drop has given investors a window of opportunity that will likely close quickly.