Bulls Embrace Huge Trillion Dollar Economic Bridge For Passage

Congress has returned to Capitol Hill this week to hash out another bailout package, as the $600 per week unemployment checks run out at the end of the month.

The momentum to pass a bill in the next 10 days is politically huge for both parties, and while there are a variety of differences as to how the bill should be structured, there is clearly bipartisan support to match or exceed the $2.2 trillion stimulus bill that Congress passed in March. The likelihood of extending the federal unemployment assistance checks is high, but they are probably going to be reduced from the $600 level in order incentivize recipients to look for work.

In the $3.5 trillion stimulus bill that was passed in May, Democrats proposed another round of one-time checks to families that will likely be part of this new bill as well. It has the support of Treasury Secretary Steve Mnuchin.

Some have argued that COVID-19 has taken a 20% share of gross domestic product (GDP) in the United States. Thus, once the second-quarter earnings season is on the books, we’ll have a much more accurate read on the dual impact of the shutdowns and the evolving remote economy.

It is also probable that the Payroll Protection Program (PPP) will be expanded and extended for small businesses in order to allow them to take out a second loan. If this plan is coupled with an aggressive forgiveness program, it will turn the loans under $150,000 into grants as the economy faces a second wave of widespread pandemic-related shutdowns. The Small Business Administration (SBA) has stated that this forgiveness program would account for 86% of the 4.9 million PPP loans that have been issued to date and roughly 27% of the $520 billion that has been lent out.

And then there is the Federal Reserve, which has taken on the role of Atlas by deploying a broad array of actions to limit the economic damage from the pandemic, including up to an initial $2.3 trillion in lending to support households, employers, financial markets and state and local governments. That was back in late March.

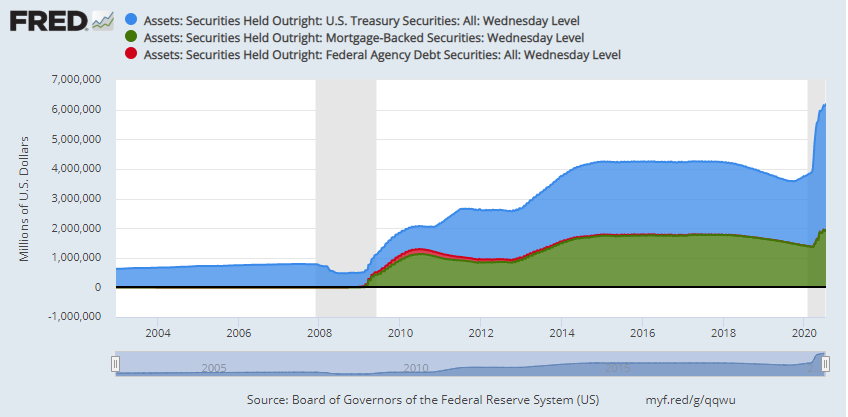

On June 10, the Fed announced that it would buy at least $80 billion a month in Treasuries and $40 billion in residential and commercial mortgage-backed securities until further notice. Between mid-March and mid-June, the Fed’s portfolio of securities that it held outright grew from $3.9 trillion to $6.1 trillion.

Fed Chair Jerome Powell has fashioned his own super-sized version of the Fed put, which catapulted the stock market off its 2009 low and helped lead to the longest economic expansion of the U.S. economy on record. While these current efforts have good intentions behind them, they are corrupting the natural process of price discovery that is endemic to the functioning of a free market economy.

At some point, artificial price supports will produce a real disruption of capital markets when the Fed elects to start unwinding its position as soon as evidence of a recovering economy and a significant downward trend of the coronavirus data begin to emerge. However, the Fed’s September 2018 attempt to convince the market that monetary policy did not need to be accommodative at that point, that there was room for rate hikes in 2019 and that it would continue with its quantitative tightening effort at $50 billion per month wasn’t well-received at all. The S&P 500 slumped 20% in the fourth quarter of 2018.

I’m sure that dismal finish to 2018 is still fresh in the minds of the Fed’s leaders. So, they will likely let the economy overshoot to the upside, risking the possibility that inflation will exceed 2%, before considering any form of quantitative easing (QE) tightening or rate increases. The Fed’s dual mandate of price stability and maximum sustainable employment are its long-range goals.

From the massive fiscal stimulus intervention, it is logical to conclude that price stability has been achieved under the present circumstances within debt and equity markets. However, with unemployment at 11.1% and reopening efforts being hampered by the spreading pandemic, further job gains will likely be less robust compared to May and June.

Therefore, it stands to reason that the Fed will continue to have its foot on the gas until the unemployment rate gets back down to 6% or better — and that could be a year from now, given permanent downsizing and elimination of thousands of small businesses in the wake of this viral crisis.

Based on his recent testimony, Fed Chair Powell has made it abundantly clear that there isn’t much the Federal Reserve won’t do to help keep liquidity and credit flowing to support the recovery from the COVID-19 shutdown — and stocks have rallied on this promise. So, it’s not hard to fathom the fact that the stock market trending higher when the Fed is blowing up its balance sheet and Congress is about to pass its fifth stimulus package for what could be upwards of $2 trillion.

These are certainly historic times. We don’t know when the coronavirus will be eradicated, there is little to no guidance as to what earnings season will produce, there is rising probability of the emergence of disciplinary actions that will target China and the House, Senate and White House are completely up for grabs come November.

What investors do know with a high level of certainty is that trillions of dollars are going to pour into the U.S. economy for the rest of 2020. And, because of this firehose of new money, the natural law of supply and demand is at work. For example, take the Wilshire 5000 Total Market Index, which was first introduced in 1974 and is the broadest stock market index of publicly traded American corporations.

It is often used as a benchmark for the entirety of the U.S. stock market as it is widely regarded as the best single measure of the overall U.S. equity market. Yet, the Wilshire 5000 Total Market Index gets little, if any, mention. As of June 2020, it actually contained only around 3,500 stocks, while accounting for roughly 40% of global stock market capitalization. Merger and acquisition activity, leveraged buyouts and stock repurchase plans are rapidly reducing the supply of U.S. equities — and now more money than ever before is being created.

Whether any or all of the current “unknowns” get worked out, all of this shows that way more money is chasing fewer stocks. The fact that investors favor companies with strong fundamentals, accompanied with the Fed’s continual fiscal tailwind, favors the bull trend.