‘Come Fly With Me’ – It’s Time To Buy The Airlines

This past week, there have been three key developments for the travel industry that should provide for a strong catalyst for the airline industry and the stocks within the sector. First of all, the Centers for Disease Control and Prevention (CDC) have cut back the number of days required to quarantine from ten to five.

Secondly, Dr. Fauci went on record this week in a CNBC interview and stated that he thinks that the Omicron variant will start to burn out in late January.

Thirdly, tax loss selling in this beaten-down sector will be over as of Dec. 31.

In this scenario, including improving optimism by governmental authorities and the weight of tax-loss selling being lifted, it stands to reason that after several false starts this year, airline stocks could take wing and outperform the highly popular technology, health care and consumer discretionary sectors that led the Santa Claus rally into the end of the year.

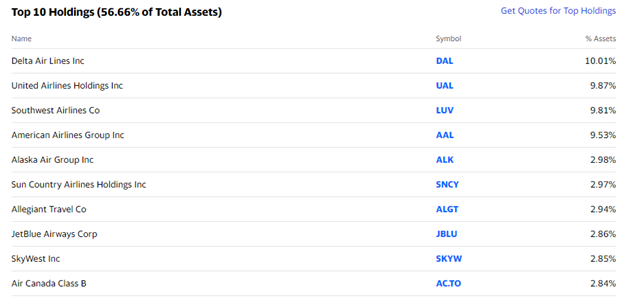

The U.S. Global Jets Exchange-Traded Fund (JETS) provides a lower risk and more diversified way to play the potential rebound for the airlines and the companies that support the industry as well. The top ten holdings account for about 57% of total assets, but the ETF also holds all of the smaller airlines and some key travel names like Expedia Group Inc. (EXPE), Booking Holdings Inc. (BKNG), TripAdvisor Inc. (TRIP), Sabre Corp. (SABR), Boeing Co. (BA) and General Dynamics Corp. (GD).

For investors that prefer single stock selection, there are some easy choices to consider, depending on whether domestic travel, international travel or both are the desired areas of investment. It stands to reason that there is more up-to-the-moment information about air travel within the United States that does not require a COVID-19 test to board an aircraft. For international flights, air passengers traveling to the United States are required to present a negative COVID-19 test result or documentation of recovery.

It stands to reason, then, that as long as Omicron is still making its way through society, both here and abroad, the lower-risk investment proposition is to consider the carriers whose hubs and routes are predominantly based in the United States but also have small exposure to Mexico, Central America and the Caribbean. Southwest Airlines Co. (LUV), Alaska Air Group Inc. (ALK) and JetBlue Airways Corp. (JBLU) top this list.

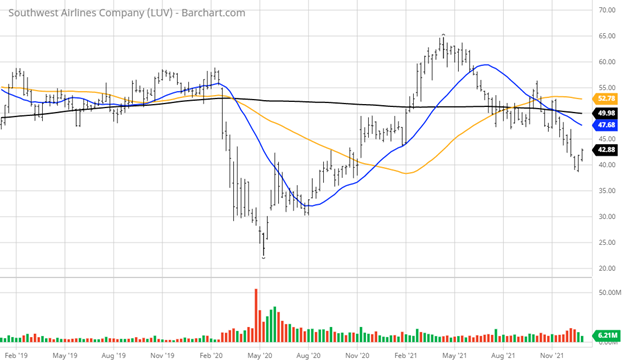

I personally like the chart belonging to Southwest Air the most, as it actually traded above its pre-pandemic high prior to the Delta and Omicron outbreaks. Since then, LUV has seen its shares trade back down to the low $40s, where there looks to be some buyer interest.

Understand that by no means is there an “all clear” sign that the pandemic is on the verge of being extinguished. However, remember that the final phase of the Spanish flu pandemic was the most contagious, but also the least deadly. While there seems to be some correlation, but that’s just an observation that is not supported by any empirical evidence.

In any event, the market looks three to six months out to perceive what may be the case in the future, and this is a good set up to consider buying into. It has been a brutal year for the travel business, and if COVID-19 does run its course by early spring 2022, there is nothing but blue sky ahead for airline stocks.