Crazed Comptroller Nominee Promotes Eliminating All Private Bank Accounts

This past week, President Joe Biden raised the hair on the back of Wall Street and Main Street when Biden announced his intention to nominate Professor Saule Omarova of Cornell Law School to be the next Comptroller of the Currency.

This is just another “check the progressive identity box” for Biden within a larger movement to steer America toward socialism and, in this case, economic communism.

Source: www.newsbinding.com.

Omarova graduated from Moscow State University in 1989 on the Lenin Personal Academic Scholarship. Almost four decades later, she still holds the view the Soviet economic system is superior to that of the United States and that the U.S. banking system should be nationalized and controlled by the Federal Reserve.

Omarova spoke at the Law and Political Economy Project’s “Law & Political Economy: Democracy Beyond Neoliberalism” conference in March. In the virtual conference, she called for the elimination of all private bank accounts and deposits. Her writings promote transferring all bank deposits to “Fed Accounts” at the Federal Reserve AND floated the idea of how the Federal Reserve could take money from Americans during an inflationary environment.

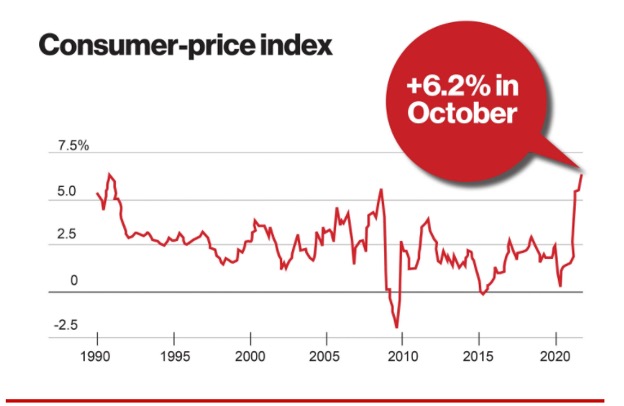

Imagine that, with inflation running at its highest level in 31 years, per last week’s Producer Price Index (PPI) and Consumer Price Index (CPI) data, the notion of Americans seeing Omarova instruct the Fed Bank to seize funds from private citizens’ bank accounts to pay for the inept policy handling of inflationary expectations would be at her and her financial gulag’s discretion. So, when government screws up royally, the U.S. central bank officials would have to right to exercise a margin call on taxpayer bank accounts to pay for their mistakes. There is a long history around the globe of governments expropriating cash and property for the “greater good.”

Source: www.seekingalpha.com.

If anyone thinks this idea is a stretch, let’s look at a few modern-day examples:

In 2013, the European Union (EU) had decided in its infinite wisdom to rob the personal bank accounts of Cyprus citizens to pay for its bailout of the country. The EU had said in a statement it was a choice between the “catastrophic scenario of disorderly bankruptcy or the scenario of a painful but controlled management of the crisis.”

In 2008, Argentina’s government nationalized $30 billion in private pension funds to shore up its coffers, triggering an 11% selloff in the Buenos Aires stock market.

In 2010, Hungary’s government made the citizens an offer they could not refuse. They could either remit their individual retirement savings to the state or lose the right to the basic state pension (but still have an obligation to pay contributions for it). In this extortionate way, the government gained control of $14 billion in individual retirement savings.

In 2001, Ireland’s National Pension Reserve Fund was established for the purpose of supporting pensions of the Irish people in the years 2025-2050. The scheme was also supposed to provide for the pensions of some public sector employees. However, in March 2009, the Irish government earmarked $4 billion euros from this fund for rescuing banks. In November 2010, the remaining savings of $2.5 billion was seized to support bailout efforts for the rest of the country.

These are small potatoes compared to what would take place in the United States if inflation pushed the economy into a recession while government spending continues to soar, risking a downgrade of U.S. sovereign debt from its AAA rating. The very idea that there is a clear template of governments finding retirement savings as a convenient source of revenue should have investors on high alert with the nomination of Omarova.

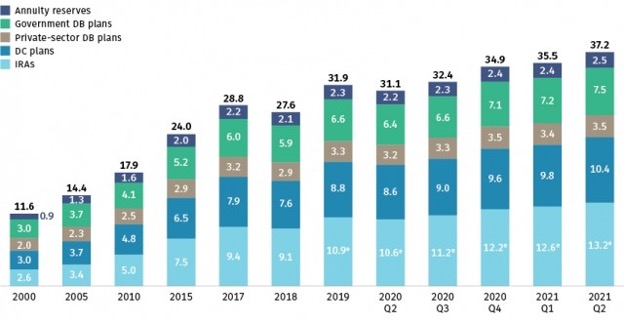

Total U.S. retirement assets were $37.2 trillion as of June 30, 2021. Retirement assets accounted for 33% of all household financial assets in the United States at the end of June 2021. Of this amount, roughly $7.5 trillion was held in federal, state and local government retirement plans — the rest was held in private accounts — just about what it would take to pay off the current federal debt.

Source: www.ici.org.

She has advocated that asset prices, pay scales, access to capital and credit should be overseen by federal agencies, as well as by unaccountable bureaucracy and so-called “intelligentsia.” Her idea of establishing a National Investment Authority to be overseen by an advisory board of academics was rejected by the Senate in the current infrastructure bill that will be signed by Biden this week.

Adding more fuel to her anti-capitalist fire, Omarova would pursue the establishment of an independent Public Interest Council of richly paid academics with broad subpoena power to supervise financial regulatory agencies, including the Fed. It would be akin to a chamber of untouchable czars or overlords, take your pick. The council, she notes, “would not be subject to the constraints and requirements of the administrative process.”

Citizens of all means and net worth should be very afraid of the fact that Omarova even got this far in the process. This is radicalism on steroids. As the comptroller, Omarova would have supervisory powers over roughly 1,200 financial institutions, able to crack down on banks that don’t goosestep to her dictates. Even Treasury Secretary Janet Yellen opposes her nomination. The Comptroller of the Currency reports to the Treasury Secretary.

If, somehow, Omarova does become the Comptroller of the Currency, it won’t only be bad for the financial sector, it won’t be good for the market, for private citizens or for America.