Energy Rally Is A Bull Trap

Being long in the energy sector for the past two years has been the house of pain for investors seeking “value” in the once-lucrative energy patch.

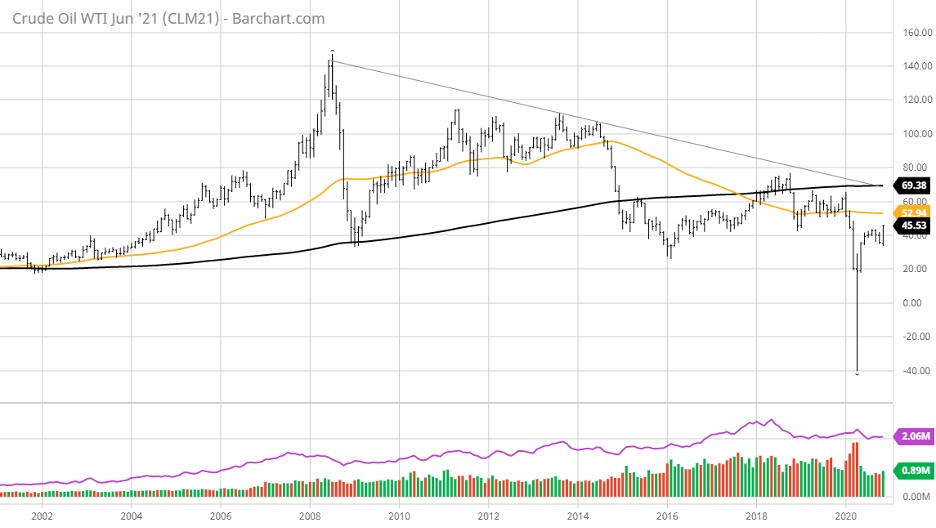

There are negative structural forces working against the global oil and gas industry that are not going away and are why this recent rally for the sector should be called into question. WTI crude has rallied to $45/bbl., as of last week, an impressive move that caught the market flat-footed, with several leading energy stocks bouncing 30% or more in the past four to five weeks. As part of the value trade, the energy sector got swept up in the rotation fueled by optimism for a rebound in global gross domestic product (GDP) growth in 2021.

Issues affecting the energy industry include a global transition to electric cars and trucks, the rise of renewable energy sources, more energy-efficient businesses and homes, tighter regulations on carbon emissions and Environmental, Social and Corporate Governance (ESG) investing by pensions, asset managers and investors alike. If demand way outstripped supply, then the sector could easily handle these pressures, because the world depends on energy — plain and simple.

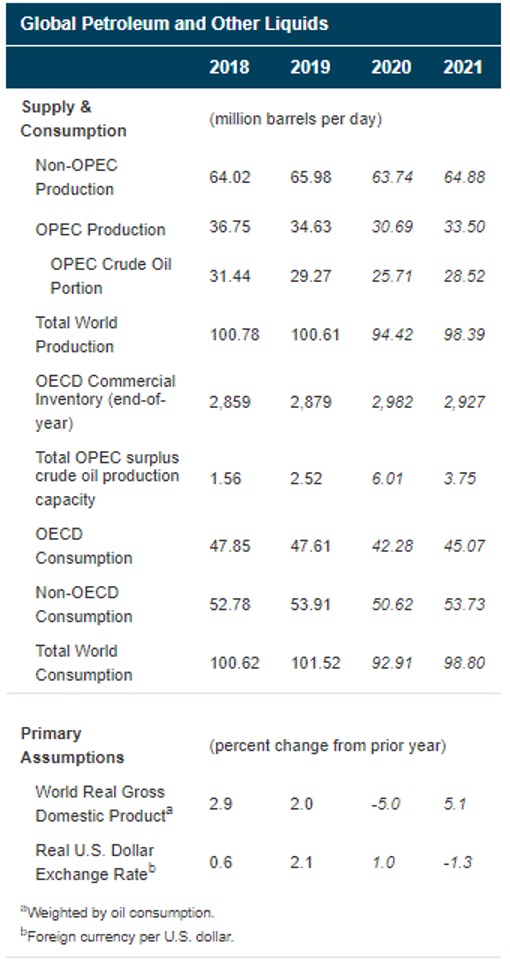

However, oil production may have seen its best days, according to the latest data. The short-term energy outlook by the U.S. Energy Information Administration (EIA.gov) tells pretty much the same story — that the supply/demand curve is flat as forecast for 2021 when economists are predicting global gross domestic growth (GDP) growth to rebound by 5%.

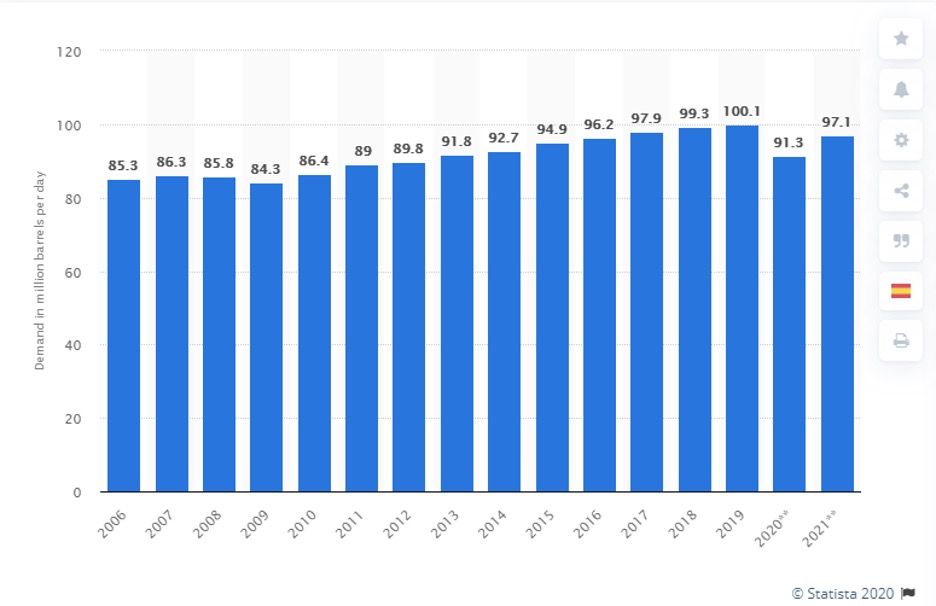

Estimated global daily production of crude came in at 100.1 million bbls/day in 2019 and will recover to just over 97 million bbls/day in 2021. Plus, it seems every time WTI crude prices trade above $40/bbl., the global oil production spigots are opened all the way up by both OPEC and non-OPEC nations.

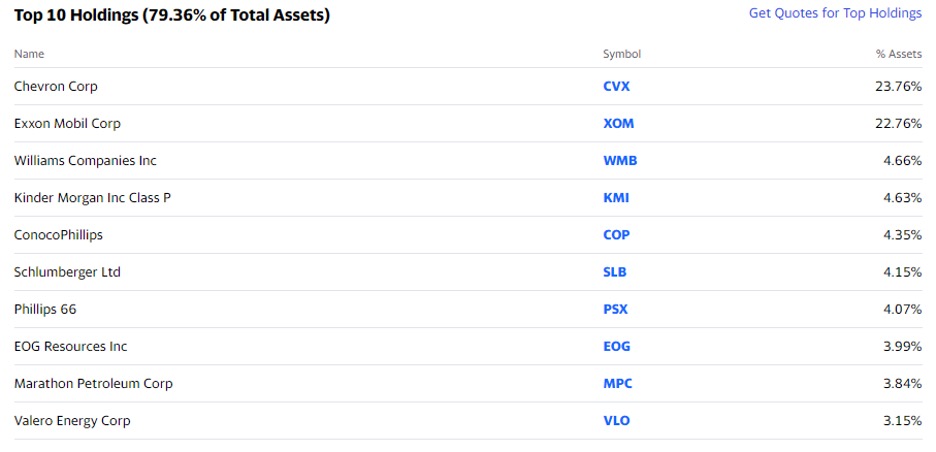

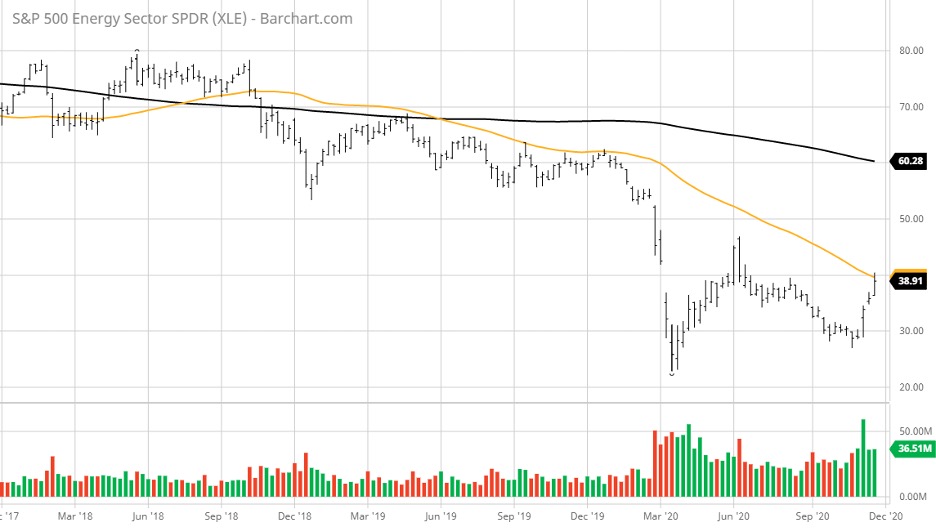

Looking at the most widely traded energy fund — the Energy Select Sector SPDR ETF (XLE), it is made up of integrated energy companies, pipeline operators, refining producers and oilfield services companies. The top 10 holdings account for 79.36% of total assets. So, what you see here is pretty much what you get.

From a purely technical standpoint, shares of XLE have rallied back up to their 50-week moving average (MA)(orange) in what has been a phenomenal momentum trade and short-squeeze massacre that now has investors wondering if this upside move is legit.

My take is that the rebound could be short-lived. This would be especially true if the runoff in Georgia produces two Democrats winning their respective Senate races. If a blue wave of Democrats takes control of the Senate, the perception of what the environmental policy-making might hold for the oil and gas industry will be roundly negative.

One near-term catalyst that might bid oil prices higher is last week’s assassination of a prominent Iranian nuclear scientist. Rising tensions in the Middle East always provide fuel for spiking oil prices and Mohsen Fakhrizadeh was considered the brains of Iran’s nuclear program. It will be very interesting to see how crude prices react this week.

This action, blamed on the Israelis, will likely incite some low-level retaliation by state-funded Hezbollah, Hamas or Palestinian Islamic Jihad, but probably not start any kind of a war scenario.

It is hard to put much faith in this rally in energy stocks. In fact, it might be one of the more timely fade trades of 2020. Just speaking for myself, owning a portfolio of energy stocks would keep me up at night.

Instead of trying to figure out if legacy oil and gas companies are a great buy, why not just stay focused on the blazing hot solar, biomass, wind, hydropower, geothermal, lithium battery and hydrogen fuel cell stocks?

They’ve all recently soared, but when the next piece of negative news takes the market lower and these stocks pull back, have your shortlist ready to go. While the stocks noted in the XLE represent the past, those of solar, biomass, wind, hydropower, geothermal, lithium battery and hydrogen fuel cell companies represent the future.