Energy Sector Makes a Case as Best Inflation Hedge

As the world’s energy policies, technologies and investment capital pour into renewable sources that include solar, wind, biomass, hydropower and tidal energy, Wall Street and most of the institutional and retail investment communities have lost that loving feeling for fossil fuel stocks.

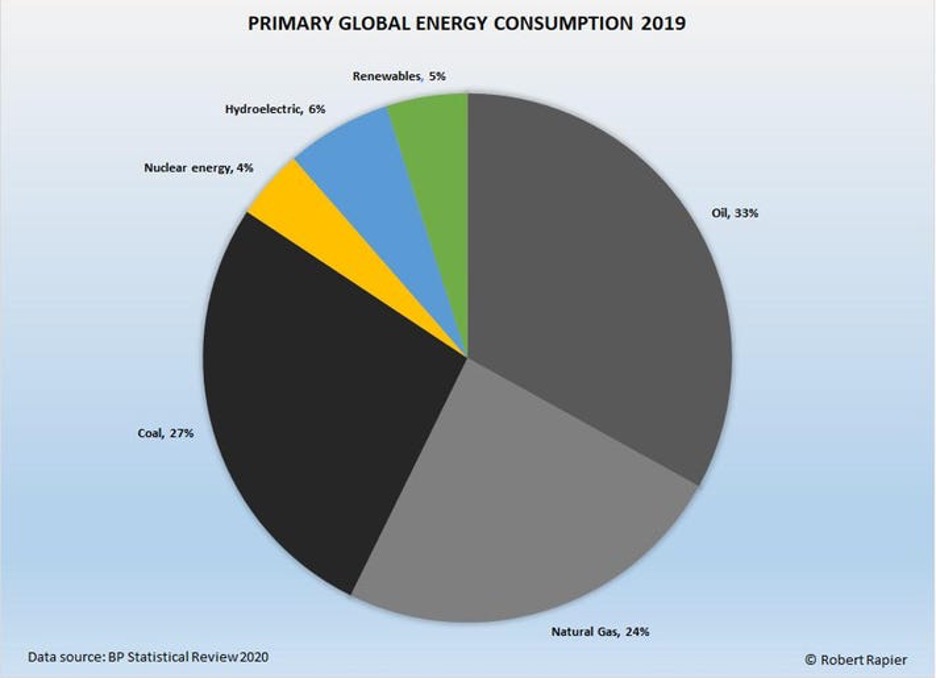

In fact, many investment funds are restricting the purchase of oil and gas stocks as environmental, social and corporate governance (ESG) guidelines are incorporated in funds’ investment statements. While the virtues of renewable energy are all well and good, the reality is that fossil fuels still supply 84% of the world’s energy as of the end of 2019.

On a global basis, renewables made up only 5% of all energy consumption. In the United States, great strides towards replacing fossil fuel with renewables are being made where utility-scale electricity generation is seeing the greatest advancements.

As of 2020, fossil fuels accounted for 60.3%, nuclear 19.7% and renewables 19.8%. The United States is clearly making faster progress than most of the rest of the world, but after all the hype and headlines surrounding renewables, 19.8% is a long way from the grid being anywhere near independent from fossil fuels.

There are five energy-consuming sectors:

- The industrial sector [32% of all energy consumption, including electricity] includes facilities and equipment used for manufacturing, agriculture, mining and construction.

- The transportation sector [29% of all energy consumption, including electricity] features vehicles that transport people or goods, such as cars, trucks, buses, motorcycles, trains, aircraft, boats, barges and ships.

- The residential sector [20% of all energy consumption, including electricity] consists of homes and apartments.

- The commercial sector [18% of all energy consumption, including electricity] includes offices, malls, stores, schools, hospitals, hotels, warehouses, restaurants and places of worship and public assembly.

- The electric power sector consumes primary energy to generate most of the electricity consumed by the other four sectors.”

Source: www.eia.gov

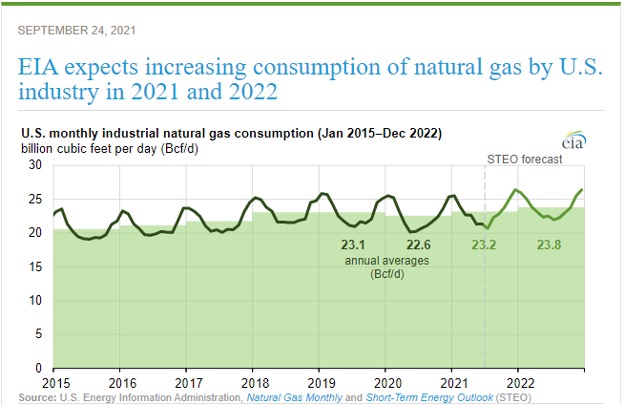

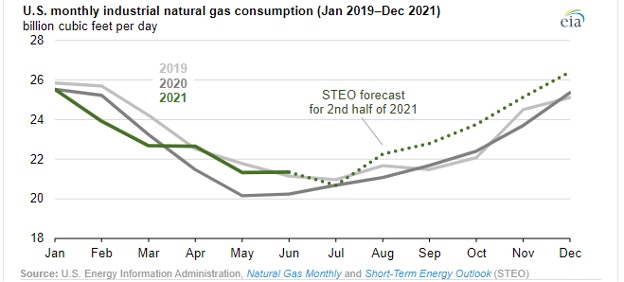

While it is thought that fossil fuel consumption would decline in proportion to more renewable sources coming online, it might come as a surprise that the U.S. Energy Information Agency is forecasting higher consumption of natural gas in 2022 over that of 2021.

Industrial gas consumption is estimated to exceed 23.8 billion cubic feet per day in the second half of 2021. That reveals record consumption rates with the forward trajectory in demand looking very bullish for natural gas prices that are already at multi-year highs, after closing last Friday at $5.14 in Metric Million British thermal units (MMBtu).

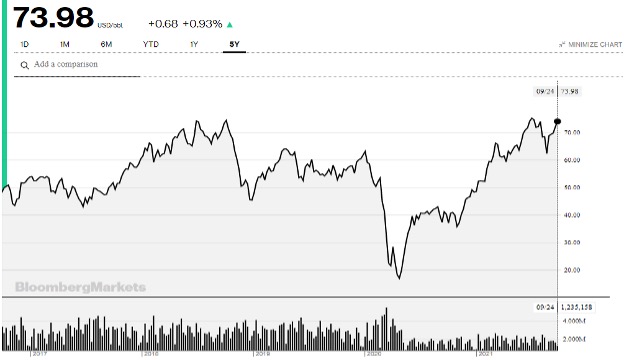

Oil prices are also seeing strong movement in light of recovering demand around the world while inventories are being drawn down. U.S. crude inventories last week fell by 3.5 million barrels to 414 million barrels to dip to the lowest levels since October 2018. Also supporting prices have been the difficulties presented by Organization of Petroleum Exporting Countries (OPEC) members that are struggling to raise output with energy market shortages causing a supply crunch in Europe and Asia. WTI crude is about to take out the previous highs

It certainly seems that the politics of pursuing renewable energy at the expense of diminishing fossil fuel inventories is a bad policy. Weaning the United States and the rest of the world off of oil gas is a noble endeavor, but it should be done in a manner that doesn’t compromise affordable supply. The Biden administration and the progressive wing in the Democratic party are stifling oil and gas production, which, in turn, is fueling inflation.

Until renewable energy can be a bigger percentage of supplying the grid and fuel needs of the transportation industry, there should be a much more responsible approach to managing and meeting the energy needs of the United States and the rest of the world. Pushing up oil and gas prices intentionally higher so they are comparable for argument’s sake to the cost of renewables isn’t fooling anyone. Its blind policy is negatively impacting the middle and lower-middle classes the most.

Based on the current demand trends of a recovering global economy while also heading into the holiday travel and winter heating season, these elevated oil and gas prices look anything but transitory. It is a stark reality that has yet to fully be appreciated by the stock market. In fact, most fossil fuel energy stocks are trading well off their 2021 highs.

For what it’s worth, the Energy Select Sector SPDR (XLE) pays a dividend yield of 4.25%, and its top holding, ExxonMobil Corp. (XOM), sports a yield of 6.04%. Exxon also just happens to be the second-largest natural gas producer in the world. (I have no position in either security.) For investors seeking inflation-sensitive assets with blue-chip dividend yields trading at pretty sizeable discounts with the underlying commodities showing further upside pricing momentum, then consider the oil and gas sector.

Over the long term, renewables will win out. I don’t think anyone refutes this eventuality, but sometimes, an unloved sector that is responsible for supplying over 80% of the world’s energy needs makes for a powerful intermediate-term investment proposition.

Join Bryan Perry Live at the MoneyShow Virtual Expo on October 6, 2021

Join financial expert Bryan Perry live at the MoneyShow Virtual Expo, October 6, 2021, for his discussion on “Profiting from Naked Put Strategies 83% of the Time”. He will discuss in detail how his Quick Income Trader advisory service uses naked puts to win 83% of the time. He will lay out just how easy this money-making method is for even the novice options trader to put to immediate use and show how time decay in the options market can be a powerful weapon of profit generation. Click here now to reserve your seat.