Generating Rising Income in a Rising-Rate Market

I get emails from many subscribers about how best to generate a reliable income stream that accomplishes the goals of beating the rate of inflation, isn’t at risk of price erosion because of rising interest rates and sports a yield that greatly exceeds that of the dividend aristocrat stocks and investment-grade bonds, CDs, Treasuries and money markets.

While I delve into a number of rising-rate-resistant, high-yield asset classes such as convertible bonds, energy master limited partnerships (MLPs), private equity stocks, floating-rate business development companies and aircraft leasing, nothing is working better for producing a robust stream of consistent income that outperforms in term of absolute total yield than a well-managed, covered-call strategy.

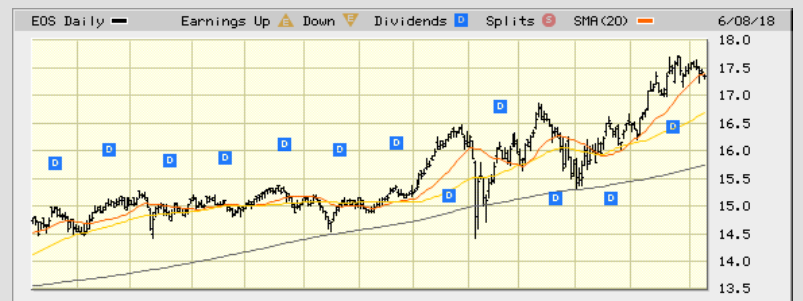

Within my high-yield buy-and-hold Cash Machine advisory service, I have positioned various closed-end covered-call funds that have just knocked it out of the park. A case in point is the Eaton Vance Enhanced Equity Income Fund II (EOS), which has been a rock star for income investors.

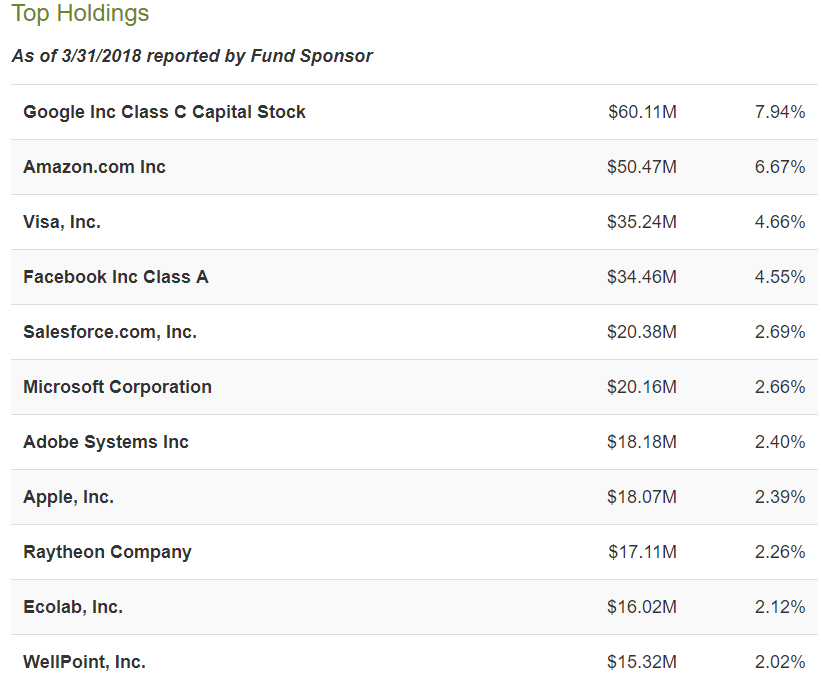

The fund has $810 million in assets and pays out a monthly dividend that supports a current annual yield of 6.02% from an active covered-call strategy. The top 10 holdings are a lineup of crème de la crème market leading stocks.

Since recommending Eaton Vance Enhanced Equity Income Fund II (EOS) on September 8, 2017, the fund has scored a total return of 19.14%, including dividends. That’s a fantastic return for just eight months, and helped smooth out the rough ride the market endured during the February-March volatile period by paying out dividends twice the yield of the 10-year Treasury, 2.93%; more than three-times that of the S&P 500, 1.81%; and 60% higher than the SPDR Portfolio S&P 500 High Dividend ETF, 3.75%.

What I like about closed-end funds like EOS is that I can position subscribers who want to be passive investors in a portfolio of primarily the biggest names in the tech sector that are carrying the torch for the Nasdaq as it hits a new all-time high. Some investors don’t want to put the time in or be tied to the computer by having to actively manage their own covered-call program. Owning EOS affords the investor the ability to hire proven management and to have a heavy weighting in the information technology sector that matters the most, while also meeting the investor’s goal of garnering outsized yield.

Most tech companies retain earnings for organic growth and thus pay low-yielding dividends. Let’s face it, they are primary growth stocks, and who doesn’t want pure growth? And history is well on the side of tech companies outperforming when interest rates begin to rise. Rising rates reflect a growing economy and information technology (IT) is one of the most leveraged sectors to a healthy economy, as evidenced by strong sequential sales and earnings growth.

Generating unconventional yield requires unconventional methods, and I bring a number of customized strategies for income investors at Cash Machine. Click this link to find out how thinking outside the box can make a dramatic difference on the level of income your money can earn when most income classes are lagging against the stiff headwinds of rising interest rates.