Global Markets Bucking Bearish Data – Time to Buy?

The latest read on the first-quarter gross domestic product (GDP) of 3.2% for the U.S. economy has provided another empirical piece of evidence that the bull market’s prosperity has legs.

The notion of a 2019 recession has faded quickly, even in light of some high-profile earnings misses from the likes of Intel Corp. (INTC), 3M Corp. (MMM), Tesla Inc. (TSLA), Xilinx Inc. (XLNX) and Intuit Inc. (INTU). There have also been plenty of big industrial names spiking higher on better-than-expected Q1 results that are stoking the flames of a sustainable bull market.

The shares of all three major railroads — CSX Corp. (CSX), Norfolk Southern (NSC) and Union Pacific (UNP) — all rallied to new all-time highs after they beat Wall Street estimates. Shares of Honeywell International (HON) hit a new all-time high as well, as the company topped consensus estimates and raised guidance.

These types of results are not the stuff of a recession, even though some well-known chief investment officers (CIOs) have argued about it and summarily retreated into their bear caves. For instance, Morgan Stanley made a bold call to stock investors back in early February. The firm’s chief equity strategist Mike Wilson advised investors to exit the market following the strongest January for U.S. stocks since 1987.“We struggle to see the upside in hanging on just to see how long we can,” Wilson wrote in a report. “We think it is better to hop off now and rest up for the next rodeo.” Oops!

The ongoing diatribe about the U.S.-China trade war quickly has been losing its thunder following the latest economic data out of China. This data shows a rebound in the world’s second-largest economy that was catalyzed by strong stimulus measures from the Chinese government. The higher-than-expected 6.4% read on China’s first-quarter GDP quelled fears about how the trade war was putting pressure on China’s economy.

No fewer than three banks raised their 2019 forecasts for China’s economic growth outlook following the surprising GDP data. Citi, Barclays and ING all jumped in the pool of investment banks that were clamoring to call a bottom in the emerging market slump. Hence, we have what looks to be the seeds of a recovering global stock market, where despite all the worries about currency crises, geopolitical fallout, recessionary macro data from global economic ivory tower watchdogs, negative interest rates in Japan and socialist cries in D.C. for an end to capitalism…stocks around the world are in rally mode.

Trying to determine the wisdom and timing of whether to venture back into foreign markets when the U.S. market has been so reliable and steady deserves serious scrutiny. The current forward price/earnings (P/E) ratio for the S&P 500 is 16.8 and is above the five-year and 10-year averages. Conversely, the forward P/E of the MSCI All World Index is 14.77 and the MSCI Emerging Markets Index forward P/E is 11.84.

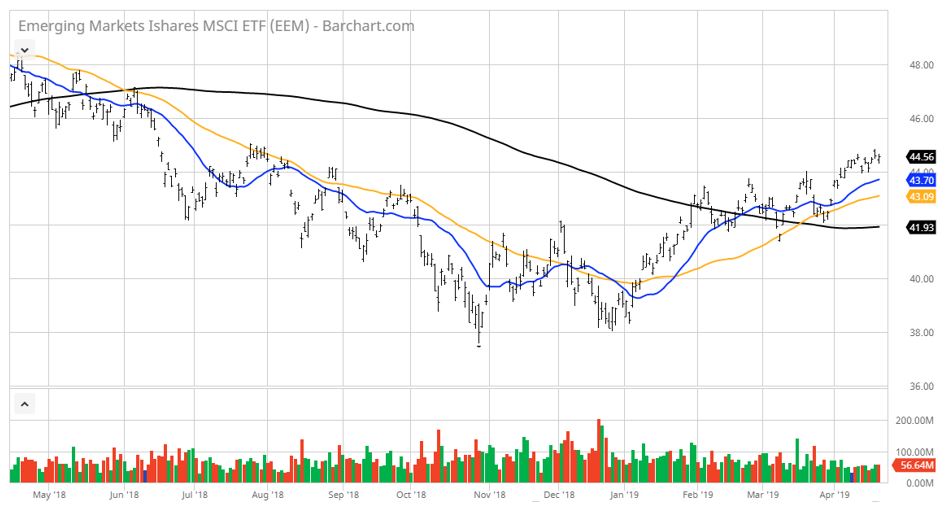

Without a doubt, there is a premium to be paid for a secure, NYSE and Nasdaq accounting and listing standards and the pro-business agenda of the Trump administration. But I’m beginning to think that, as unpopular as it is with the majority of investors to allocate capital to markets outside the United States, it is just this kind of unfavorable atmosphere that defines a buying opportunity. Rather than stock picking, investors might want to consider legging into the iShares MSCI EAFE ETF (EFA) and/or the iShares MSCI Emerging Markets ETF (EEM) that track both of the indexes I noted above.

Both EFA and EEM have charts showing “golden crosses” where the 20- and 50-day moving averages move up through the 200-day moving averages which typically indicate that a new uptrend is in place. So, while the current global macro data may still come in soft, the charts are telling a different story. What course should an income investor take?

Here’s a good place to start (and collect a fat dividend payout, as early as next month). Click here for more information.

Charts courtesy of Barchart.com

I intend to utilize my Quick Income Trader advisory service to buy these ETFs, sell covered-calls and sell naked puts against these positions as a way to generate outstanding income and capital gains. But it’s all about timing — when to buy and sell these ETFs and which put and call options to own and trade at the right prices. That’s where Quick Income Trader does the hard work and lays out clear-cut strategies to maximize this unfolding scenario. Click here to learn about how to join my Quick Income Trader service today and take a proactive stance in the global market recovery.