Global Minimum Tax Increase Shows a Two-Edged Sword

One of the hotter topics within the wider discussion of the Biden administration’s future tax policy is how to generate more taxes from revenues corporations produce outside the United States.

The Trump administration led this movement as the Tax Cuts and Jobs Act (TCJA) introduced several new rules for taxing the foreign profits of U.S. multinationals, including rules related to Global Intangible Low Tax Income (GILTI) that result in a minimum tax of 10.5% on foreign profits. The Biden administration, led by Treasury Secretary Janet Yellen and many Democratic members of Congress, wants to make some material changes to the GILTI tax standards, and policymakers are busy assessing the tax ramifications that may burden corporations.

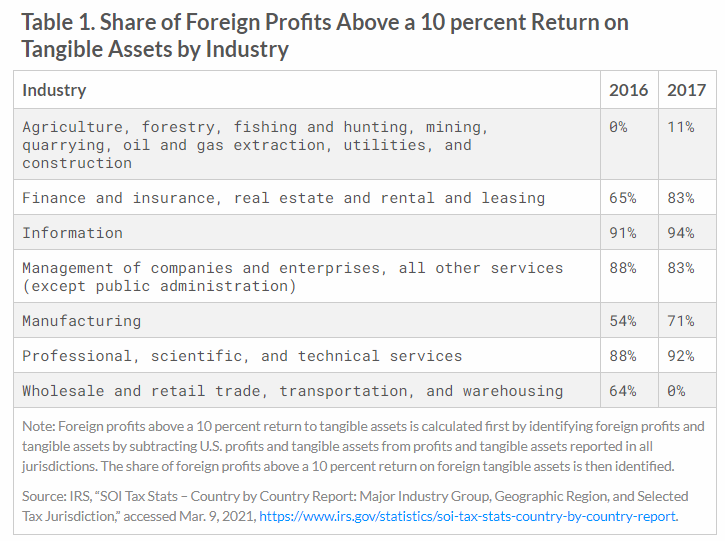

According to the Tax Foundation, GILTI is generally defined as profits above a 10% return on foreign tangible assets like equipment, buildings and machinery. Companies whose foreign profits are mainly from intellectual property (IP) are not likely to have many tangible assets and are thus more likely to have their income taxed under GILTI.

The tax burden on GILTI was intended to fall on profits from intangible assets, such as patents, that U.S. companies hold abroad, but the policy has come to have much wider implications — affecting not just information technology businesses but also multinational companies in the manufacturing industry and other non-agricultural industries.

Within the new infrastructure bill being pushed, the Senate Finance Committee released the new version of a “GILTI Framework.” Janet Yellen expressed support for President Biden’s international tax policy proposals and reported that she is working with other G-20 nations to agree to a global minimum corporate tax rate.

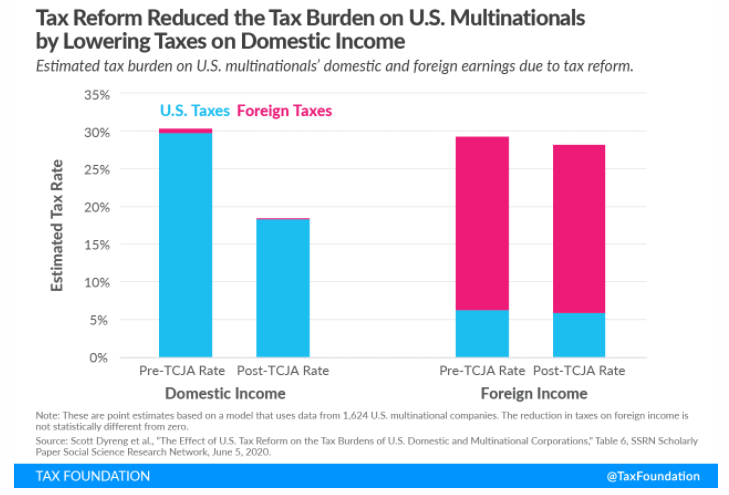

GILTI was designed to have a lower effective tax rate to avoid full double taxation of foreign earnings, but U.S. businesses that pay both foreign taxes and taxes on GILTI are subject to two layers of tax. Additional foreign tax rules can mean much higher effective tax rates on GILTI that could approach 20%.

The Biden blueprint for corporate taxes was reinforced by Yellen last week.

Yellen stated, “Together we can use a global minimum tax to make sure the global economy thrives based on a more level playing field in the taxation of multinational corporations and spurs innovation, growth and prosperity.”

Biden has called for increasing the domestic corporate tax rate from 21% to 28% and he is also seeking a doubling of the current 10.5% minimum tax on foreign profits to 21%.

Yellen aims to advance Biden’s goals by forging international agreement on a minimum tax and leveraging negotiations through the Organization for Economic Cooperation and Development on altering cross-border tax rules in the increasingly digitized worldwide economy. More attention for this agenda will be forthcoming this week at the annual International Monetary Fund and World Bank spring meetings where Yellen will be a key participant. This trend pivots entirely against the Trump administration’s position to move away from multilateralism in economics so as to not allow China more room for creating even greater leverage within large global governing organizations.

Critics of the proposal say a global minimum corporate tax rate will harm workers, who will feel the pain if corporations are forced to pay more in taxes. “It is hard to see how raising the corporate income tax, the burden of which will be ultimately shouldered by workers and shareholders, will do to help with inequality,” said Veronique de Rugy, senior research fellow at the Mercatus Center at George Mason University.

“Also, raising corporate costs will lead to less investment in fixed assets and that helps no one considering the private sector is the driver of ownership in infrastructure and investment in infrastructure,” she added.

To summarize, Biden’s proposal for increasing taxes on domestic and foreign income would raise the amount of money collected from corporations by 38%, according to the Cato Institute. Cato’s director of tax policy studies warned that raising the tax rate in the United States will cause American corporations to move their profits and investments abroad and slash costs.

A net increase of 38% is pretty severe, and I personally don’t think it has much of a chance of materializing once lobbying efforts are in full swing. Maybe striking the right balance is where the final tax package will land. Raising the domestic rate from 21% to 24% and the GILTI tax from 10.5% to 21% would reduce the incentive to move operations offshore.

It is all targeted to pay for Biden’s $2.25 trillion infrastructure plan, and if it doesn’t come from corporations, then it will come from other sources in the form of higher individual income taxes, eliminating qualified dividends, eliminating step-up basis for estates, taxing unrealized capital gains, applying new gas/carbon taxes and possibly imposing a national value-added tax (VAT) tax at some point. The United States is the only major country in the world without a VAT in place.

Whatever the endgame is for policymakers, taxes for corporations and for individuals are about to rise by varying degrees. To date, the stock market has paid no attention to this soon-to-come reality, instead opting to focus on Fed quantitative easing and Congressional stimulus. At some point, it would seem this transformational change in tax policies will matter to the stock market, but then again, maybe not.

P.S. With just 10 trades and nine months, I have shown my readers how to make more than $1 million in trading gains. In my short presentation, I show — step by step — how I pulled it off… PLUS, I reveal my brand-new plan for what could be my next million-dollar haul. Click here now to learn more.