Health Care-Related Income is Likely to Outperform in 2022

Some of the smartest market forecasters, analysts and chief investment officers are predicting that the first half of 2022 could be quite a turbulent time for the stock market.

This is because the Fed will taper quantitative easing (QE) by the end of March, followed by three interest rate hikes. Recently, Fed Chairman Jerome Powell didn’t mince words and there was an absence of the usual “Fed speak” that investors have come to expect from every policy statement after a Federal Open Market Committee (FOMC) meeting.

The adage of “don’t fight the Fed” will be a steady mantra heading into next year, because it has a history of being relatively accurate regarding the presence of a broad headwind for growth stocks, especially those with high price-to-earnings (P/E) multiples. Some savvy traders will have success in outfoxing the Fed, but the great tailwinds of QE, Congressional stimulus and pandemic checks for all are no longer part of the investment landscape.

The economy and the market are going to have to learn to walk on their own without the financial engineering that has generated huge wealth and asset appreciation. Assuming that inflation persists through the first half of next year before ebbing, it would prove worthy on the part of income investors to investigate defensive sectors with reliable dividends that yields that are well above that of the S&P.

One sector that has a lot going for it from the standpoint of demographics, inflation and yield is the health care real estate investment trust (REIT) space. Following a big first half of 2021, where health care REITs strongly appreciated, most of the leading names in this sector have been consolidating for the past several months. They have also been setting themselves up for another push higher. Real estate tends to be an effective inflation hedge, and health care facilities can easily raise rents and usage fees to adjust for inflationary pressures.

Like any sector, managing assets and growing the business are hallmarks of success for the health care REIT sector, where business conditions are subject to changes in Medicare, Medicaid, private insurance regulations, government legislation and a host of costs associated with operating skilled nursing, assisted care, ambulatory, surgical, hospital, outpatient clinic, medical office and critical care facilities.

Having the right mix of properties has proven to be the key in separating strong, winning health care REIT stocks from those with expenses that threaten their profits and the ability to pay and/or raise dividends. Of the 15 health care REITs that I follow, only a few of these REITs rise to the level to which I would want to allocate my capital. Within my Cash Machine high-yield advisory service, Global Medical REIT (GMRE) is a core holding.

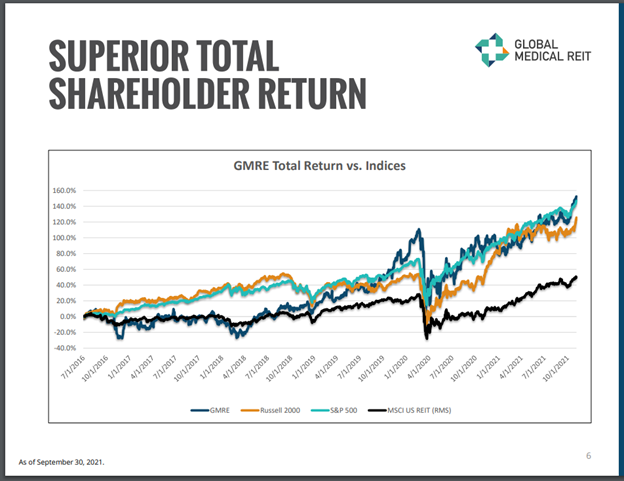

The company is a net-lease medical office REIT that acquires purpose-built specialized health care facilities and leases those facilities to strong health care systems and physician groups with leading market shares. Shares of GMRE have outperformed the Russell 2000, the S&P 500 and the MSCI U.S. REIT Index. They also pay a yield of 4.8% and have traded to a new all-time high this past week.

Source: www.globalmedicalreit.com

I’ll be looking to add one or two more similar health care REITs that demonstrate the character traits that fit the Cash Machine profile. Sometimes the best offensive is a good defense, and I’m in the camp that raising portfolio weightings in health-care related assets will help smooth out what could be a bumpy ride for the market in early 2022. Take some time to check out Cash Machine here and see how income investors can be in the right assets, especially those that favor the changing market conditions.