Inflation May Have Topped Out in November

Investors are having to deal with a whipsaw market, where huge price swings and fierce sector rotation are making it very difficult to get a sense of sustainable direction and where everything isn’t just a short-term trade.

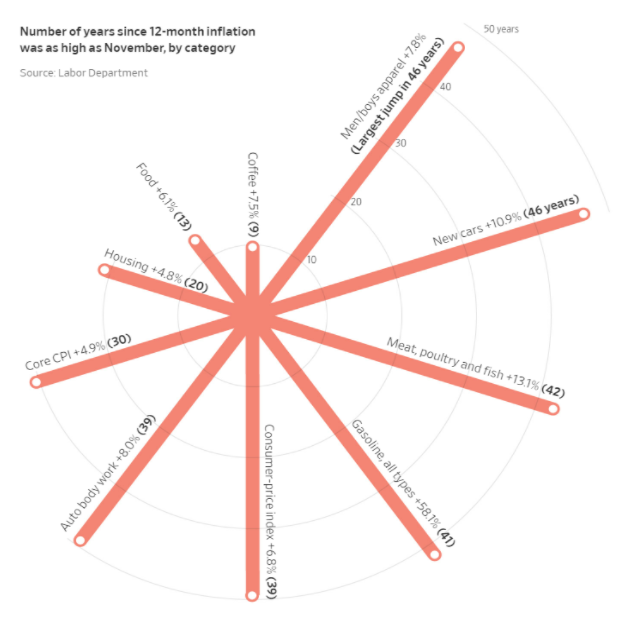

Eye-popping inflation data for November has rattled even the most ardent bulls, as it led to the Fed’s new hawkish stance and triggered a rolling correction that complicates asset allocation.

With inflation near a 40-year high, economists are scrambling to provide forecasts that consider factors that will curb price increases and continue to stoke inflation next year and possibly beyond. Because the highly transmissible Omicron variant is not nearly as deadly as the prior variants of COVID-19, hopes are high that this strain could be the wave that expands herd immunity, leading to the relaxing of stringent coronavirus protocols that are the primary reason why the ports and key distribution hubs are congested.

The Wall Street Journal reported on Nov. 21 that supply chain problems were showing signs of easing, but that labor shortages could persist. Any level of progress in this area will contribute mightily to helping alleviate upward pressure on inflation of goods, shipping and logistics costs.

Two areas of concern are rising employment and housing costs. Rents make up nearly one-third of the Consumer Price Index (CPI) and wages and salaries, along with rents, are typically indexed to CPI and are expected to be adjusted higher into 2022. How much higher is anyone’s guess at this point, but already there are reports of employers not willing to raise pay to levels that match the hot inflation data, which in theory would lead to slower consumer spending.

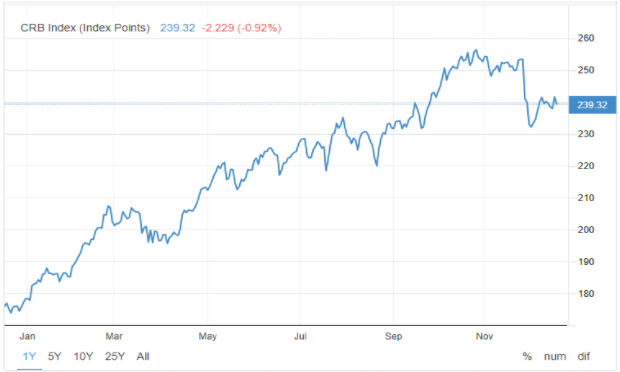

Another positive set up for those claiming that peak inflation is here is that the prices of many commodities are starting to decline. Looking at key commodities futures this week, as reported by Investor’s Business Daily, prices for cattle, chicken, lean hogs, wheat, soybeans, sugar, cocoa, oil, natural gas, cotton and copper are all coming down from late October-early November highs. Prices of corn, coffee and lumber remain elevated, but by most measures, food and raw material inflation is ebbing.

The CRB Index consists of 19 commodities: Aluminum, Cocoa, Coffee, Copper, Corn, Cotton, Crude Oil, Gold, Heating Oil, Lean Hogs, Live Cattle, Natural Gas, Nickel, Orange Juice, RBOB Gasoline, Silver, Soybeans, Sugar and Wheat.

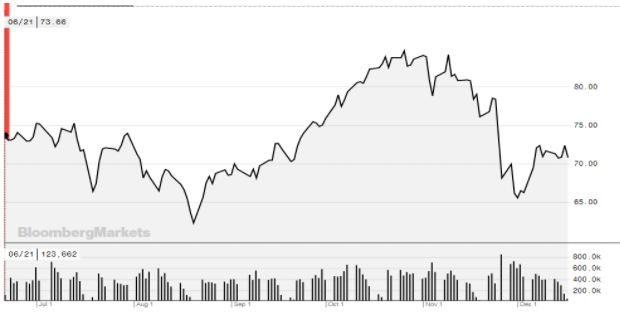

Seeing the price of WTI crude pull back is a major development for consumers. Even as gas prices on the national level are still near the high end, they too will start to fall into January, as there is always a one-month lag effect before gas prices pull back in conjunction with falling oil prices. This is an encouraging development that contributes strongly to consumer discretionary spending patterns.

If the chain reaction of the pandemic that agitated the supply chain chaos starts to reverse itself, as is currently being evidenced by falling commodity prices and reports of goods getting to markets on improved timelines, then the November CPI and Producer Price Index (PPI) numbers might just mark peak inflation — just as the Fed is addressing the issue with newfound conviction. Their timing has a lot to be desired. “My concern is that we’re going to go from a patient to a panicked Fed on inflation,” said Diane Swonk, chief economist at accounting firm Grant Thornton and a longtime Fed watcher.

Consumers should start to see lower prices at the pump and the grocery store beginning in January. Even though Omicron-related cases are surging, hospitalizations related solely to Omicron are very few. Most current hospitalizations are related to unvaccinated patients infected with the Delta variant. Wider usage of a variety of novel drugs to treat Covid symptoms at the onset of infection is also proving to be effective.

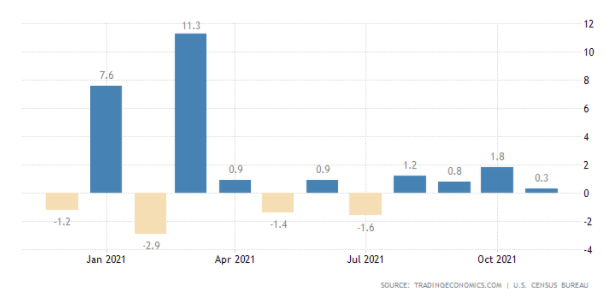

The bond market is taking its cue from soft consumer sentiment, the winding down of quantitative easing (QE) and the curtailment of further government stimulus that fueled both business and consumer spending for 2021, resulting in strong stock market gains. Retail sales for November were up by only 0.3%, missing forecasts of 0.8% and well below the 1.8% gain reported in October. Granted, supply chain concerns prompted early holiday shopping in October, but economists worry spending will really slow in January.

It’s still very early in the Omicron cycle to know the full extent of its impact on the economy. If protocols, mandates and restrictions are tightened once again, then inflation could fester at higher levels going forward. At the same time, Sen. Joe Manchin just put the Biden Build Back Better (BBB) plan on ice this past weekend, saying he won’t support it and stating funding for the $2 trillion bill is inadequate, pushes the national debt higher and may exacerbate inflation further. So, expect no new Congressional spending.

What is evident is that the Fed reacted to the latest inflation data with its hawkish talons fully on display, and central bank leaders intend to do what is in their power to dampen the easy money enthusiasm that has defined their dovish and transitory inflation policy to date. If bond yields continue to trend lower into the year’s end, then it might serve the Fed well to dial back the need for speed on tapering and the three proposed rate increases for 2022.

Raising the Fed Funds Rate can be a weapon against inflation, but it can also slow economic growth by increasing the cost of borrowing for everything from mortgages to all other goods and services. The yield curve is flattening, which by definition is a sign of rising concern over future economic growth and uncertainty about monetary policy. The Fed won’t vote on policy until the next Federal Open Market Committee (FOMC) meeting slated for January 26, but the bond market votes every day, and it is telegraphing slower growth ahead.