Low Inflation Fuels High Returns

The latter weeks of summer are historically a choppy time for stock market performance, so it should be no surprise after a strong showing for stocks during June and July that some volatility would enter the market landscape during the month of August.

Buffering some of that volatility was Fed Chair Janet Yellen when she testified in front of Congress and made it clear that any interest rate increases would be gradual and data dependent, signaling that key interest rates would not need to rise much further. Her words were sweet music to market bulls.

Ms. Yellen acknowledged the recent softness in inflation and said that the Fed could alter its policy if inflation weakness proved to be more stubborn than the Fed expects. This was a pleasant surprise and a very dovish statement by Yellen, who also said, “We’re watching this very closely and stand ready to adjust our policy if it appears that the inflation undershoot will be persistent.”

As a result, the Fed Futures market reacted in favor of a potential delay in the next Fed interest rate hike until as late as December. The delay offers more sweet music for bulls.

Underscoring this modified view of the economy was the recently released Fed Beige Book survey, which showed that economic growth was “slight to moderate,” and less upbeat than its previous Beige Book Survey. The Beige Book survey revealed that with wages rising only modestly, some senior Fed officials believe inflation is likely to remain on the low side for a longer period than previously forecast. Now we have Goldilocks singing karaoke.

Fed Walking Back Blueprint for Normalizing Rates

The Beige Book survey revealed that the Fed clearly wants to take a cautious approach on raising interest rates until more evidence of inflation emerges. In her testimony before Congress, Yellen said that she believes the slowdown in inflation is temporary, and only time will tell if she’s right. This position gained some support late last week, when Treasuries succumbed to selling interest across the curve following gains in each of the two preceding weeks. The selling pressure was more pronounced at the long end of the curve as demand softened in the face of a relatively good second-quarter gross domestic product (GDP) report, another week of strong earnings reports and a better-than-expected jobs report on Friday.

In addition to slow wage gains suppressing inflationary pressures, low crude oil prices are also contributing to a lack of inflation. The U.S. Energy Information Agency reported that total crude oil production rose to almost 9.4 million barrels a day in the latest week. The fact that non-OPEC crude oil producers are boosting their production and OPEC is not abiding by its self-imposed quotas is helping to keep crude oil prices below $50/bbl. for WTI during peak demand in the summer months. The next decline in crude oil prices likely could occur in September when worldwide demand falls after Labor Day and the heat of summer passes.

More tempering inflation data: The Labor Department announced that its Producer Price Index (PPI) rose 0.1% in June. Excluding food, energy and retail trade margins, the core PPI rose 0.2% in June. In the past 12 months, the PPI rose 2% (down from 2.4% in the previous month) and the core PPI rose 2% (down from 2.1% in the previous month). In addition, the Consumer Price Index (CPI) was unchanged in June.

In the past 12 months, the CPI has risen 1.6%, while the core CPI has risen 1.7%. The Fed’s favorite inflation indicator, the Personal Consumption Expenditure (PCE) index, decelerated to only a 1.4% annual pace in the past 12 months and probably accounts most for Ms. Yellen’s modified testimony. So, no matter how you slice it, inflation is decelerating on the consumer level, which is why the Fed is now reluctant to raise key interest rates and explains why the yield on the 10-year T-Note has declined to 2.24% from 2.62% five months ago. At the same time, S&P earnings are accelerating into the third quarter. These indicators signal to me it is time for more cowbell sounds to keep market bulls moving.

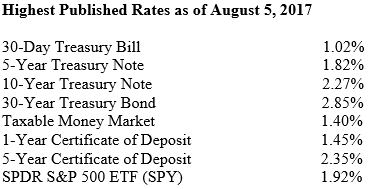

As long as interest rates bump along the bottom end of the range, the case for an extension of the stock market rally gains credence, both from a valuation and earnings standpoint. The alternative to qualified tax-favored stock dividends are paltry money market, certificates of deposit and Treasury yields taxed at ordinary income tax rates. Back out 1.5-2.0% inflation and taxes and the table below shows it’s still a zero-sum game for would-be savers in the safest of havens that have guaranteed returns.

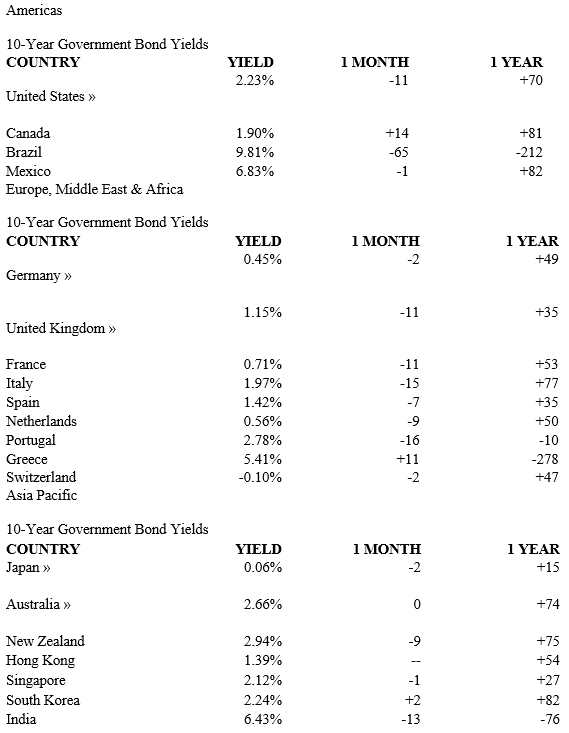

When looking outside of the United States for yield, it doesn’t get any easier unless one is willing to take currency and repayment risk in sovereign debt issued by Portugal, Brazil, Mexico, Greece, Australia, New Zealand and India. With the dollar at a seven-month low, it also means U.S. investors will own less face amount of foreign debt when purchasing foreign bonds with weak dollars. I would argue that waiting for a rally in the dollar makes considerably more sense if one wants to invest in foreign sovereigns. With the strong jobs data, the Dollar Index (DXY) saw buyers step in at a key technical support level of 92.5, which I pointed out in last week’s update.

GLOBAL 10-YEAR RATES As of August 5, 2017

Daily, Monthly and Yearly changes are in basis points; 100 basis points = 1%

To sum it up, Fed Chair Yellen’s testimony, the Beige Book survey and the PPI, CPI and PCE all confirmed that inflation is less threatening than it was six months ago, and government bond yields in the United States, Europe and Japan all ratcheted lower to reflect this reality check. Bond prices now have stabilized following a bout of selling in late June and that is simply good news for dividend-paying stocks. Quite frankly, there is nowhere else for money to go for liquid yield.

One of the go-to places for liquid yield that is diversified is Cash Machine, my investment newsletter that uses a high-yield strategy to target the most advantageous asset classes that are leveraged to the current economic conditions. The investment model incorporates a macro approach in determining the overall investing landscape, combined with a bottom-up approach for specific asset selection. Both serve to complement the objective of garnering a blended yield of 8-10% while delivering capital appreciation. For income investors, it comes as close as you can get to having your cake and eating it too as any income advisory available in the marketplace today, anywhere. To find out more about Cash Machine, click here and take a tour of how we get it done for income investors every day, week after week, year after year.