Market Gets Caught in the Grip of a Seesaw in Sentiment

The major averages became caught up in a technical tug-o-war this past week, trying to regain bullish momentum only to have every rally attempt cut short of extending a one-day move.

Just 10 trading days ago, the S&P 500 was at 2,715 and, as of last Friday, March 2, the index trades at 2,670. The big two-day 75-point rally in the S&P that occurred on Feb. 23 and Feb. 26 had investors feeling like the correction had run its course, it was clear sailing ahead and February would close out on a positive note.

That expectation was cut short following the release of the lower-than-forecast Durable Goods Orders for January (-3.7%), a softer Chicago PMI reading (61.9 vs 64.5 expected), very soft Pending Home Sales for January (-4.7% vs 0.4% expected) and Fed Chairman Jerome Powell’s testimony to the House Financial Services Committee that stoked fears of four interest rate hikes instead of the three-hike consensus followed by President Trump’s tariff headlines. Powell focuses more on frankness and less on “Fedspeak,” which is something the market is going to have to get used to. And Trump focuses on just being Trump. It was a one-two gut punch to the market’s already-sour stomach of volatility.

Powell made his second appearance on Capitol Hill to the Senate Banking Committee where he dialed back his more hawkish language to the House, stating that there is “no strong evidence of a decisive move up in wages.” Powell also testified that he sees some slack in labor markets to allow improvement and believes this can happen without moving up wages. Investors showed a sigh of relief and stocks initially traded out of the red only to get clobbered by President Trump’s talk of tough tariffs.

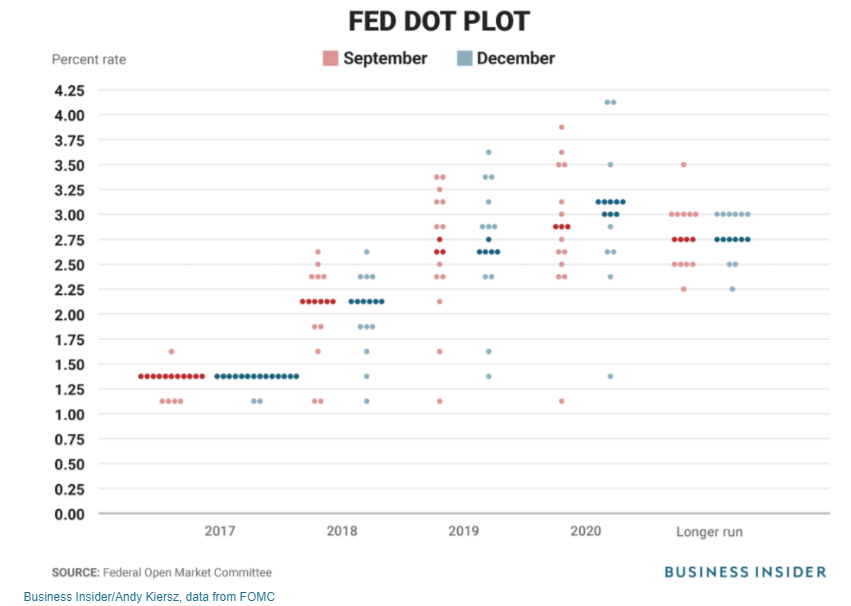

Fed policy lays out its interest rate forecast in what is called the Fed Dot Plot, essentially a dot graph on the direction of short-term interest rates. The median Federal Open Market Committee (FOMC) member is represented by the darker dots. According to the Fed Watch Tool put out by the CME Group, there is a 98.50% probability the Fed will raise the Fed Funds Rate at the March 21 FOMC meeting to 1.75% from 1.50%. The Personal Consumption Expenditure (PCE) is the most closely watched inflation indicator the Fed adheres to when dictating policy and currently it is running at an annual rate of just 1.5% and well below the Fed’s 2.0% preferred target.

So, with crude oil production now at a multi-year high capping upward price momentum, the dollar getting its mojo back after being talked down by Treasury Secretary Mnuchin and the strong bid-to-cover ratio seen at the most recent Treasury auctions — the bond market sell-off has curtailed with the 10-year Treasury trading with a yield of 2.86%. The threat of the 10-year yield breaching 3.0% will come into play when the February payroll figures are released on March 9.

Until then, the economic calendar is favoring a tame bond market since much of the data has come in the past week below forecast, and the stock market should right itself in the days ahead and continue its march higher, led by the two strongest sectors to date — aerospace/defense and information technology. The market has excellent leadership in stocks like Boeing, Northrup Grumman, Raytheon, Amazon, Microsoft and Adobe Systems. The semiconductor, retail and the electronic payment sectors are also showing excellent relative strength during this period of broad consolidation.

Looking specifically at the global payments markets, there is a definite oligarchy of stocks that control the space. They include Visa, Mastercard, American Express, Discover Financial, PayPal, Global Payments, Fiserv, Total Systems and WorldPay. The growth driver for all these companies is widening use of mobile e-commerce. A research report by Allied Market Research (AMR) forecasts that the global Mobile Payments Market is expected to garner $3,388 billion by 2022 and grow at a compound annual growth rate (CAGR) of 33.4% from 2016-2022.

According to the research, increased penetration of smartphones, growth in m-commerce industry, change in lifestyles and the need for quick and easy transactions are the major factors that drive the growth of the mobile payment market. The Asia-Pacific region is expected to be the fastest growing during the forecast period. By segment, mobile payments using mobile wallets/bank cards are anticipated to witness the highest growth rate.

While there are some high-profile and popular investment themes getting a lot of attention — cannabis, cryptocurrency, green energy and virtual reality gaming — these sectors make for great conversation but are also fraught with a high level of risk due to their young stages of development. These sectors will endure radical change along the way of growth and the clear winners are yet to be determined. In contrast, the global electronics payments industry touches almost every business and every person on the planet and has a definite glide path of stellar growth prospects in front of it.

Make 2018 a year of intelligent investing and trading. Part of that smart investing plan should include a cutting-edge artificial intelligence (AI) system for selecting the very best stocks with the highest probability of delivering total return and how it can be hugely instrumental in your portfolio’s performance. I oversee a trading service that utilizes a highly customized AI model designed to cherry pick the best positioned blue-chip tech stocks that are set to make a bullish move higher over the next 22 trading days.

Within the digital payments sector, I recently recommended PayPal (PYPL) both as a stock purchase and a call option strategy. Trading at around $73, my AI model had a price of $84 targeted for a four-week timeframe. That’s a 15% move higher in a market that’s been, let’s say, less than cooperative. As it turned out, we bought PayPal on Dec. 22 at $73.29 and sold the position on Jan. 19 for $83.52 for a gain of 13.96%. The related call options booked a profit of 202% in less than a month.

I can’t guarantee this move will happen with every trade, but the AI system has since produced more triple-digit-percentage option winners and I intend to trade the digital payments stocks as hard as I can all the way through 2018 for what should be a steady stream of profitable trades both in the stock and the call options. If this is how your trading capital should be dedicated, then take a tour of Hi-Tech Trader by clicking here and put the power of artificial intelligence to work today so you can have a sharper edge on the market tomorrow.

In case you missed it, I encourage you to read my e-letter article from last week about why I think 2018 is gearing up to be a great year for the stock market.