Rough Ride through the Earnings Minefield

Markets are constantly in a state of sector rotation, always trying to anticipate the next rising trend of business momentum and this past week is no different.

Every earnings season has a way of re-defining the current market leadership by either reaffirming its confidence in those sectors that led going into earnings season or by rapidly rotating into sectors where unexpectedly good business conditions weren’t priced into the underlying stocks. As to the current earnings season, you just don’t know how the Street is going to react to a stock when its company’s results cross the tape.

A good example of this unpredictability occurred when the big banks kicked off the first-quarter reporting period, and all reported top- and bottom-line results that beat estimates, but their share prices still fell. Whether investors had priced in great earnings or fear arose that an inverted yield curve could pinch margins, no one knows, but the stocks clearly have underperformed on what was seemingly excellent news.

God forbid a company misses its revenue forecast. Phillip Morris (PM), once considered a hallmark of the consumer staples sector, missed top-line first-quarter estimates and its shares plunged by -17% last Wednesday. But how about a company like United Rentals (URI), an institutional fund favorite? The company reported first-quarter results that well exceeded top- and bottom-line growth, announced a $1.25 billion stock buyback, provided stable forward guidance and its share price still fell 7.0%.

There seems to be no rational reason for the stock to take such a beating, but sentiment about construction and homebuilding slowing, as interest rates are grinding higher, has taken hold to some extent. The decision to “sell the news,” regardless of how good the numbers are for United Rentals, is one of those market phenomena that unfolds when there is a barely noticeable shift in sector sentiment.

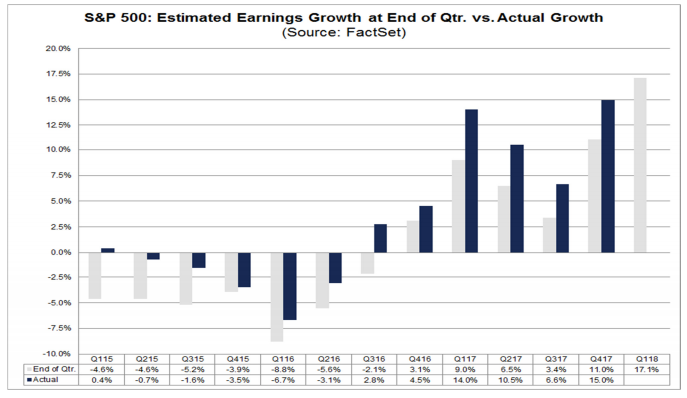

As of Friday, the S&P 500 is expected to report earnings growth of 17.3% for the first quarter. What is the likelihood the index will report an actual earnings increase of 17.3% for the quarter? Based on the average change in earnings growth due to companies reporting actual earnings above estimated earnings, it is likely the index will report earnings growth closer to 20% for the first quarter.

Over the next few weeks, the majority of S&P 500 companies will report results. Of the 87 companies in the S&P 500 that have reported earnings to date for first-quarter 2018, 79.3% have reported earnings above analysts’ expectations. This is above the long-term average of 64% and above the prior four quarter average of 72%.

All 11 sectors are reporting or are predicted to report year-over-year earnings growth. Seven sectors are reporting or are expected to report double-digit-percentage earnings growth led by the Energy, Materials, Information Technology and Financials sectors. How the market reacts to all this expected good news against the crosswinds of geopolitics is anyone’s guess. However, if fundamentals win out, then we should see the market trade higher, but in a more volatile fashion than would seem comfortable for the average investor. Historically, earnings win out over other market forces and I’m of the view that history will repeat itself over the next several weeks.

Looking at what the market is most excited about from a pure price momentum standpoint, the energy sector is receiving plenty of attention. While none of the major oil companies have yet to report Q1 results, stocks of Chevron, ExxonMobil, Royal Dutch, BP plc, Total S.A. and a bevy of other energy stocks are in full-blown rally mode for two reasons. The price of WTI crude oil topped $69/bbl. yesterday and year-over-year earnings growth is expected to lead all 11 sectors.

The Energy sector is expected to report the highest (year-over-year) earnings growth of all 11 sectors at 79.0%. The unusually high growth rate for the sector is due to both a significant year-over-year increase in oil prices and a comparison to unusually low earnings in the year-ago quarter. The average price of $62.89/bbl. for oil in Q1 2018 was 21.5% higher than the average price of $51.78/bbl. for oil in Q1 2017. Additionally, the energy sector is under-owned by institutions and thus is the target of accumulation that supports higher stock prices.

On the flip side, one company’s cautious comments can wreak havoc on an over-owned sector of the market, namely technology. Last Thursday, Taiwan Semiconductor (TSM), the world’s largest contract chipmaker and a major supplier to Apple, revised its full-year revenue target to the low end of its earlier forecast. Apple represents nearly 20% of Taiwan Semiconductor’s revenue and the 6.2% hit shares of TSM are experiencing is having a big and negative ripple effect across the entire semiconductor space. The fear of a peak earnings cycle surfaced with this headline and certainly with Apple being such a huge component (14.60% of the Nasdaq 100), its stock price action carries a lot of sway as to the investor sentiment in the tech sector.

So, while the market sorts out the winners from the losers during the next couple of weeks when the majority of S&P companies report, investors can take comfort that the current uptrend is in their favor. Will the S&P 500 trade back up to challenge its all-time high of 2,872 from its current level of 2,682? Based on the fact that second-quarter earnings growth is expected to exceed first-quarter earnings growth, then yes, but I’m not so sure the market will trade to new highs until later this year. With that said, just making another run at the previous high set in late February will represent a gain of 7%.

And if the market can accomplish that move by the end of May, it will provide a fine opportunity to book some excellent gains in my Hi-Tech Trader advisory service, which is loaded with market leaders identified by active artificial intelligence models that screen all the leading tech stocks for those with the highest probability of capital gains over the next month.

Having the right set of tools at your disposal takes the majority of the guess work out of wading through what can be an earnings minefield for stocks. You can find out more about how the power of artificial intelligence can dramatically improve the performance of your trading portfolio by clicking here and find out which stocks stand out in the tech sector that deserve your trading capital’s full attention.