Tax Reform Pulls Capital Off Sidelines

The notion of a tax package finding actual passage sparked a fresh rally for stocks that saw the energy, financial, industrial and transportation sectors lead the market higher.

The Dow enjoyed its best day of the year, rising 1.4% and clearing 24,000 for the first time. Other bullish developments fueling the fire under the market included OPEC and non-OPEC members agreeing to extend the production cuts until the end of 2018, as well as news of Aetna and CVS coming closer to striking a merger.

Seeing bond yields tick higher showed for the first time in a while what I view as normalized behavior in which stock prices rise and bond prices fall in reaction to perceived economic growth. Most of the recent economic data points are showing a clear expansion of the U.S. economy.

Just in the past two weeks, New Home Sales (685,000 vs. 629,000 consensus), Q3 Gross Domestic Product (GDP) Second Estimate (3.3% vs. 3.2% consensus), Pending Home Sales (3.5% vs. 0.6% consensus), Personal Income (0.4% vs. 0.3% consensus), Chicago PMI (63.9 vs. 63.0 consensus), Construction Spending (1.4% vs. 0.5% consensus), Leading Indicators (1.2% vs. 0.8% consensus) and the University of Michigan’s Index of Consumer Sentiment (98.5 vs. 97.9 consensus) have supported the bullish thesis of strong earnings expectations for the fourth quarter of 2017 and Q1 of 2018.

It is my view that, regardless of whether the tax reform passes, the organic strength of the broad economy is such that record highs for the indexes have been a byproduct of the great business conditions, labor conditions and consumer sentiment. With no major piece of legislation passing Congress in 2017 and the S&P 500 rising year-to-date by 18.3%, if tax reform is passed by the year’s end, it will set up 2018 as a year that could see earnings for the S&P 500 get a 20% boost. If so, the current forward P/E of 18 times earnings for the S&P would contract to about 13-15 times earnings, making this earnings-driven market look pretty attractive.

The news of tax reform is particularly good for future dividend growth as companies will have more free cash flow to reward shareholders with widespread increases in dividend payouts expected in 2018 and beyond. The number of companies that have been able to double their dividend payouts inside seven years can be counted on both hands. It has been some time since companies have been able to richly reward shareholders in large numbers.

The S&P 500 Dividend Aristocrats is an index that focuses exclusively on a select group of high-quality companies within the S&P 500 — those that have grown their dividends for at least 25 consecutive years. The Dividend Aristocrats currently includes 50 well-known companies, over half of which have grown their dividends for an impressive 40 years or more.

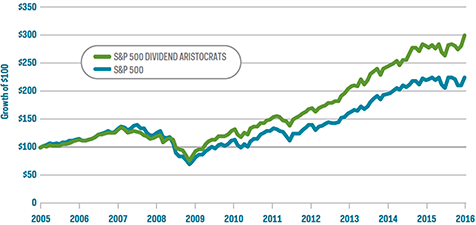

Since its inception in May 2005, the S&P Dividend Aristocrats Index has outperformed the broader S&P 500 with lower volatility.

Dividend Aristocrats Outperformed the S&P 500

Assuming tax reform goes into effect on January 1, 2018, I expect the same list of Dividend Aristocrats to continue to outshine the S&P, given the presumption of higher net earnings growth and corporations being flush with more cash at a time when there is synchronized growth in the global economy. With the Fed set to raise rates three or four more times next year, investors should look to companies with pricing power that have a history of robust dividend policies as a plan to outperform the major averages. Sectors that have such pricing power include industrials, technology, agriculture, financials and energy.

The jury is still out on whether core inflation will return to levels associated with 3-4% GDP growth since certain long-term forces are embedded in the economy; namely demographics, spending patterns, cheaper energy, advances in technology and rising competition for consumer dollars. And though the Fed will attempt to normalize short-term interest rates, the long end of the yield curve may rise only slightly in reaction, as it discounts the lack of future inflation. So, we might be living with a flat yield curve for years, which is actually great news for dividend stocks leveraged to a strong economy.

In case you missed it, I encourage you to read my e-letter from last week about what the flattening yield curve tells us about the economy.