Wayward Leadership Threatens Bull Market

************* Personal Invitation ****************

Each year, at this time, I invite a handful of investors to join my exclusive Income Alliance 100. This includes all of my services for a lifetime with just a one-time fee. This is your invitation to join us now. But hurry, this offer ends at the end of October. To learn more and secure your spot, call Grant Linhares at 202-677-4492 for your personalized quote — every one of my current subscribers will get a prorated refund for any product they currently have when they join (meaning you pay less than others!).

******************************

It already is hard enough for good stocks to buck the negative trend, but when those in charge of monetary policy, government policies and budgets fail to deliver sound fiscal and civil planning while shirking their accountability due to ideological blinders, we have a situation that won’t easily fix itself. For instance, the U.S. Constitution was written to make sure that the states kept individual control of their affairs and not be overlorded by the federal government. That has now changed — and not for the good.

The market always has been able to overcome political ineptness, glaring intrusions and administrative overreach because common sense and entrepreneurial energy have always been a larger force that keeps any extremist agenda on the fringe. But this past week’s jobs report should draw into question what kind of culture is being sowed in Washington, particularly within the progressive movement that has taken a surprisingly strong grip on those who control the Oval Office, the House and the Senate.

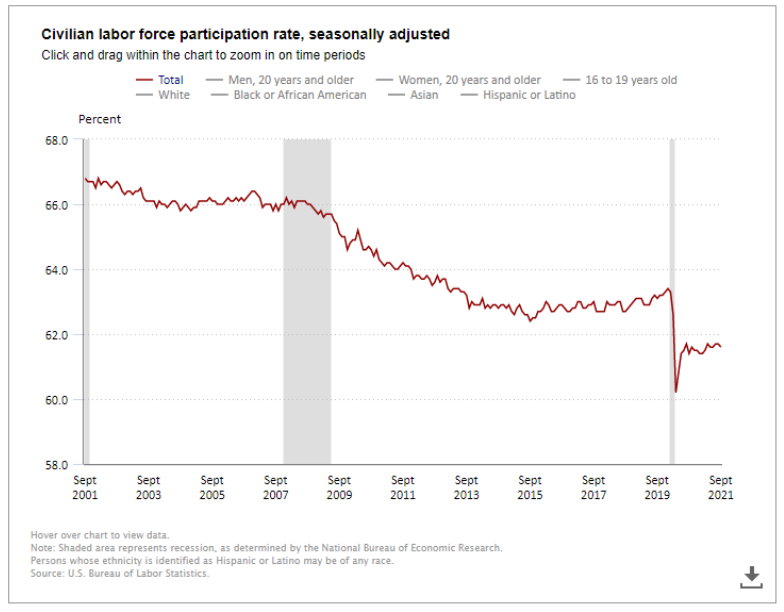

I’ll let the numbers do the talking. The Labor Force Participation Rate — the percent of working-age people who are either employed or are looking for jobs, divided by the non-institutionalized civilian working age population — fell to 61.6%. That means more people left the labor force by taking early retirement, by deciding in favor of taking generous welfare assistance and transfer payments or by just giving up.

There is this weird new anomaly of feeling good about not working, of being paid to not work. This is a very bad development, especially since it hits the most vulnerable people, who struggle the most in our society — the poor, minorities, the disenfranchised and uneducated — those with jobs that aren’t very pleasant.

Millions of former workers have learned to game the system — to make more than their working wage by not working, but in a year or two, they may lose the skills they had and become essentially unemployable. People are leaving the labor force because they believe government programs will somehow make up the difference — and Biden’s “human infrastructure plan” has so far fueled this toxic thought process further.

Even though pandemic paychecks have run out at the federal level, there is a growing feeling among progressive elites that government aid for housing, food, utilities, medical care, education, childcare, paid time off, long term-care and universal income will be funded for tens of millions of legal and illegal U.S. residents just by taxing corporations and the rich to redistribute wealth. This will only force the accelerated offshoring of U.S. businesses and well-heeled Americans.

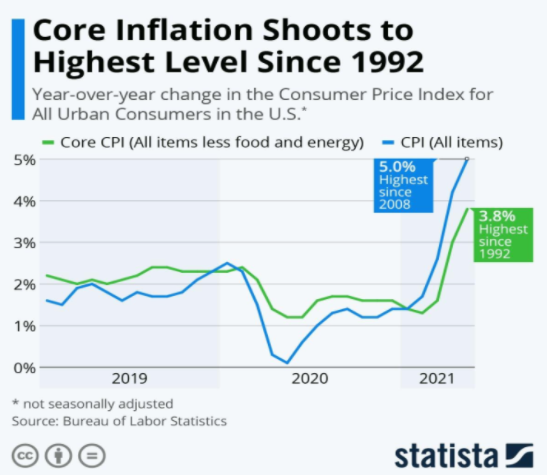

Let’s look at another statistic. Inflation is running at 5% on an annual basis (before this week’s data is released). When the prices of everything go up, so does the nominal GDP, which actually dampens the “debt-to-GDP ratio,” even as Congress and the Fed raise the total federal debt. Sound weird? It is, since inflationary growth is not organic growth. And this inflation is not “transitory.” Wages and services are way more permanent than commodity inflation. I think the Fed knew this all along, but didn’t want to upset the markets, since if there is any acceleration in the current rate, that could be very troublesome.

Note: “Core inflation” subtracts food and energy prices, due to their higher volatility, but ask the person on the street what two things are blowing a hole in their household budget, and it’s likely that food and energy would top the list.

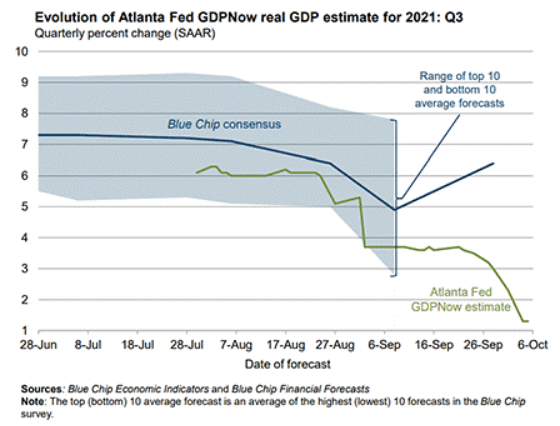

When you take out inflation, GDP growth is slowing down. The latest Atlanta Fed GDPNow estimate for Q3 GDP growth is 1.3%, down from over 6.0% in August, but the saddest statistic these days is that there are 11 million unfilled jobs, as government incentives and COVID-19 fears are keeping people from looking for work. Plus, global supply chains are still bottled up. You can’t get delivery of a sofa for nine months.

Wage growth rose substantially this past month by 0.6% (that’s over 7% on an annual basis). If wages were growing 7% because of corporate productivity growth, then all would be good. But, if you’re just trying to catch up with inflation to satisfy worker demands, that’s a real problem, and I’m afraid corporations are just trying to catch up to inflation — or desperately trying to lure reluctant workers out of the shadows.

As I’ve shown in recent columns here, more than 80% of what powers and fuels America are fossil fuels, and that will remain true for the next decade. Perhaps the current spike in energy prices is an intentional move by the Biden administration as global progressives seek to accelerate their climate change agenda. In the real world, however, it will take about 20 years to convert from fossil fuels to electric vehicles for most budgets, so why not manage the transition in a manner that is smart — and with empathy and dignity?

Going forward, stock picking will be at a major premium, and I believe that income stocks and exchange-traded funds (ETFs) that are skewed to benefiting from inflation will outperform. Money will flush out of the bond market, as the 10-year Treasury yield pushes toward 2.0%. That money has to go somewhere. Dividend stocks in companies with powerful sales and earnings growth will be targeted by investors seeking income and growth. That will continue to be true, despite all the recent and concerted attacks on capitalism.