Well-Managed Covered-Call Funds Look Timely

Last week, the bond market voted thumbs down to the Fed’s 50-basis-point rate hike as Treasury yields initially paused, assessed the Federal Open Market Committee (FOMC) policy statement and summarily traded to the highest levels since the fourth quarter of 2018.

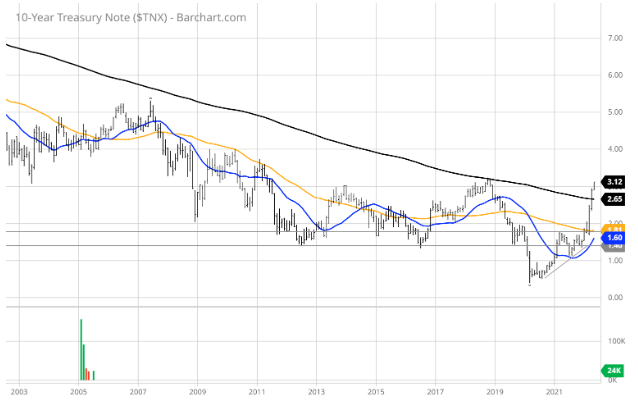

From the 20-year chart of the benchmark 10-year T-Note, the radical move up to its closing Friday yield of 3.14% is unprecedented over the past 20 years. Just a couple weeks ago, the yield curve was inverted, sounding the recession alarm bells off around the globe.

Since then, the curve has somewhat normalized as yields have pushed higher across the entire curve. The 2/10 spread that gets so much attention is now up to 39 basis points.

The bump in yields was prompted by Friday’s jobs report that showed a lower participation rate than forecast, raising concerns about wage pressures persisting against a report of record job openings. Looking at the CME FedWatch Tool, the fed funds futures market is assigning a 78.6% probability to a 75-basis-point rate hike at the June FOMC meeting.

This week, investors will digest the release of Consumer Price Index (CPI) and Producer Price Index (PPI) data. CPI is forecast to come in at 0.2% and Core PPI at 0.6%, offering a meaningfully smaller increase than what was registered for March and helping to lower the bond market’s blood pressure.

Source: www.cnbc.com

At this point, investors will take any sliver of good news that is fit to print, and a cooling of inflation would be a major headline for the market to embrace. However, a more tame set of inflation data doesn’t fix the same issues that have been and will continue to be stiff headwinds. The prolonging of the war in Ukraine, the zero-tolerance COVID lockdown in China and clogged supply chains will keep prices high for gas, food and most everything consumers and businesses need.

As to the first-quarter earnings season, it has been healthy, but with mounting evidence of slowing economic activity. According to FactSet per its May 6 commentary, “Overall, 87% of the companies in the S&P 500 have reported actual results for Q1 2022 to date. Of these companies, 79% have reported actual EPS above estimates, which is above the five-year average of 77%.

“Looking ahead, analysts expect earnings growth of 4.8% for Q2 2022, 10.6% for Q3 2022 and 10.1% for Q4 2022. For CY 2022, analysts are predicting earnings growth of 10.1%. The forward 12-month P/E ratio is 17.6, which is below the five-year average (18.6) but above the 10-year average (16.9). It is also below the forward P/E ratio of 19.4 recorded at the end of the first quarter (March 31), as prices have decreased while the forward 12-month EPS estimate has increased over the past several weeks.”

In the midst of the current market pullback, there is a growing sentiment that gross domestic product (GDP) growth will slow and inflation will remain high. FactSet’s forward earnings forecast is for earnings to trough in the current second quarter at 4.8% and rebound to over 10% in Q3 and Q4. I’m not sure where that level of earnings optimism stems from unless FactSet expects some of the current macro pressures to ease. If FactSet is right, then the market should be near a bottom. But any forecast at this juncture is highly speculative.

For income investors seeking inflation-friendly income, I highlighted energy MLP ETFs last week that pay 6-8% yields with no K-1 forms to complicate tax preparation. And those are sweet spot income vehicles in this market. This week, investors can start to consider some of the covered-call ETFs and closed-end funds that have pulled back with the broad market where yields also now pay out 6-8%.

Market volatility produces extreme option prices, so selling option premium back to the market in the form of covered calls allows fund managers to generate higher option-income-related yield. There are many covered-call ETFs and closed-end funds that use a variety of stocks, preferred stocks, leverage, option overlay percentages, indexes and derivatives to create yield — so spending some time exercising some due diligence before buying any fund is highly recommended.

A couple of the funds that have portfolios weighted in stocks that are in the more favored sectors include:

InfraCap Equity Income Fund ETF (ICAP) — 7.06% Yield — Pays out distributions monthly

JPMorgan Equity Premium Income Fund (JEPI) — 8.21% Yield — Pays distributions monthly

Ideally, finding a covered-call fund that sports an attractive yield such as these two, but still leaves room for upside if the market starts to trend higher again, is as close as possible to having your income cake and eating it too with the potential for capital appreciation.

Staying on top of inflation when it’s running hot is no easy task, but in a sideways to lower market that is very narrow and picky about which stocks win and lose, deriving a fat yield from the volatility is one way to beat back the inflation demons.

P.S. I will be holding a subscribers-only teleconference on May 17 at 3 p.m. eastern time. The event will be called “How to Generate Inflation-Friendly Income.” It is free, but you have to click here to register in order to attend. Click here.