Yield Curve Flattening from Strong Demand for U.S. Sovereigns

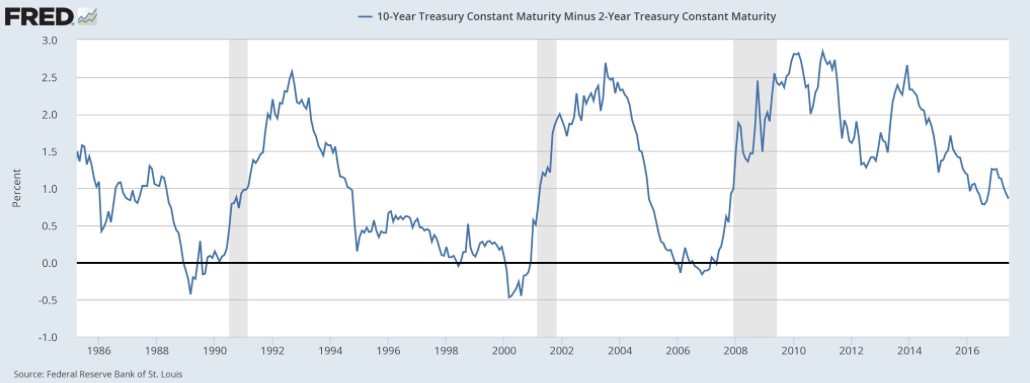

Conventional wisdom would have it that a flat yield curve is typically an indication that investors and traders are worried about the macroeconomic outlook.

From several vantage points, the U.S. economy seems to be doing fine. Growth, for the most part, has been trending upwards, the job market continues to shine and inflation is becoming less of a worry for the Federal Reserve.

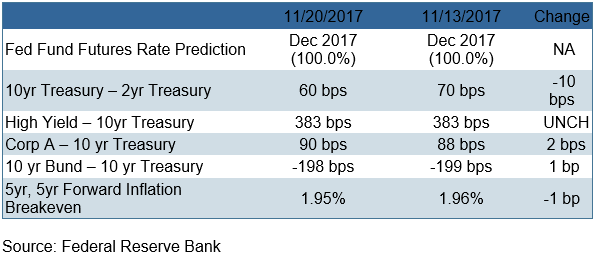

However, the flattening yield curve is suggesting that everything may not be as rosy as it seems. The past week in the Treasury market saw a continuation of the longstanding yield curve flattening theme as longer-dated maturities saw firm demand, while the 2-year note recorded another weekly loss with 2-year note futures posting their eighth weekly decline in the past 10 weeks. The 10-2 year spread, which is the difference between the 2-year Treasury Note and the 10-year Treasury Note, compressed by 10 basis points (bps) to 60 bps.

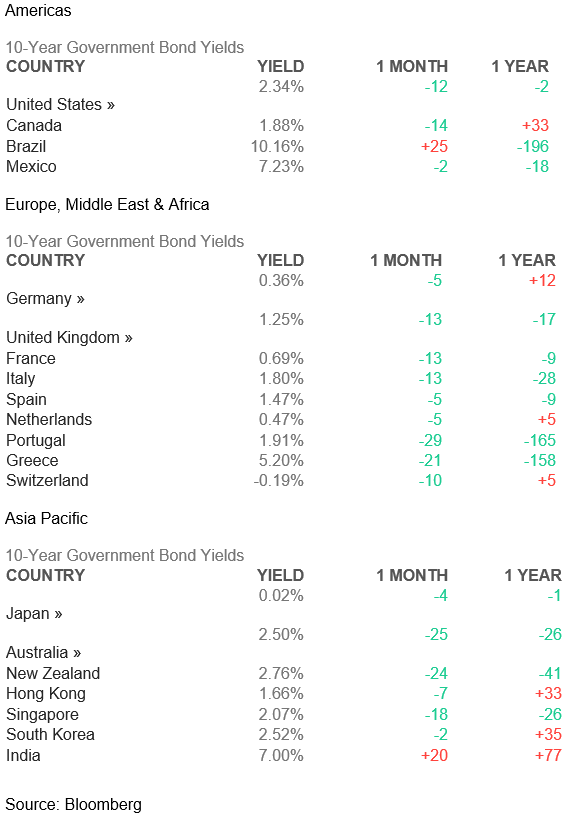

The continued curve flattening has been noticed by analysts and policymakers alike, but Fed officials have been quick to attribute the flattening to international demand for Treasuries stemming from sovereign yield differentials, rather than concerns about a slowdown in U.S. economic growth. The most glaring case in point is the 199-point spread between the 10-year U.S. Treasury and the 10-year German Bund.

With the Federal Reserve not showing much concern over the flattening yield curve from recent interviews with Fed officials, the market remains certain that the Federal Open Market Committee (FOMC) meeting on Dec. 12-13 will produce a decision to increase the fed funds target range to 1.25%-1.50%. The implied likelihood of a 50-basis-point rate hike remains slim.

There was no significant change in inflationary expectations as the 5-year, 5-year forward rate, a measure of expected inflation (on average) over the five-year period that begins five years from today, remained just below the 2.00% mark.

A quick glance at what the rest of the world offers in the way of sovereign yield tells the story. Within Europe, Greece is the only country with debt paying a higher yield than the United States. In Asia Pacific, only Australia, New Zealand and South Korea offer a slight yield advantage, but not without a much higher level of inherent economic risk. One always can roll the dice on big yields offered by Mexico, Brazil and India.

So, rather than a red flag being waved of a looming recession just ahead, I’d argue that foreign central banks and institutions awash in liquidity and freshly minted currency are continuing to pounce on U.S. government debt like a cat on tuna. And until wage inflation shows up in a material way, the yield curve will remain flat and, in turn, feed the stock rally further.

Base Case for Risk Assets Remains Sound

Although the current bull market is the second longest in history, and will become the longest bull market if it trades higher past August 2018, the technical landscape supporting an optimistic base case for a higher stock market is sound. The 2-year yield already has been working higher for the past few months and, contrary to popular belief, a flattening yield curve that does not invert has historically shown to be a precursor to very strong equity returns.

Quite frankly, it’s interesting the conversation of yield curves gets so much attention. The Bank of Japan (BOJ) in essence eliminated the yield curve altogether. Core inflation in Japan is near zero and the BOJ has stated it is committed to an over-shoot of 2.0% inflation, which means they are committed to keeping the yield on the long end of their yield curve down for a long, long time. In Germany, there is no yield curve and the European Central Bank (ECB) has said it will be printing money until the fourth quarter of 2018.

It is the impacts of powerful central banks and not markets that manage the various yield curves. So, I’m not sure why we are talking about concepts from the 70s and 80s that were market driven when today’s Fed policy determines that path of the yield curve. In my view, the Fed is content with a flattish yield curve. The costs of mortgages and credit is attractive, and the United States is one country that can ill afford higher interest rates against its $20 trillion mountain of government debt and expected higher deficits to be created in the near term by tax reform.

In light of the expectation of tighter Fed policy coming into view next month, I just don’t see the setup of a major market downturn on the horizon. I think equity investors will shrug off a quarter-point rate hike. The breadth of the rally has been very broad-based. It’s not just large-caps. This past week, mid-caps made new highs, as did small-caps. Rallies led by many stocks and not just a few tend to continue. The current action is consistent with middle innings bull market conditions where investors should look to ride the back of the bull into 2018 with a high level of confidence. The flattening yield curve represents a bullish tailwind for high-yield assets and I invite readers of this column to explore my high-yield advisory Cash Machine by clicking here to see how I’m positioning portfolios for subscribers heading into 2018.

In case you missed it, I encourage you to read my e-letter from last week about the effect of the latest tax reform proposal on income-seeking investors.

Upcoming Appearances

Personal Note: I’m going to be one of the featured experts on the Legends of Wall Street Cruise from January 12-January 22, 2018. My subscribers are invited! For more information and to request a brochure, click here.

I’m excited to be a special guest at the Investor’s Blueprint Live event in Orlando from January 30 — February 1, 2018. This conference focuses on how to unlock enormous income potential in your portfolio. This is a small, intimate conference and I only have 50 seats available, so click here now to learn more and reserve your seat. Hurry, the Early Bird Discount expires on Dec. 3 and I expect the 50 seats to fill up quickly.

Orlando MoneyShow, February 8-11, 2018: I’m delighted to return to the Orlando MoneyShow, where I will be giving a new presentation on “How To Profit From Hi-Tech Income,” “Trading Tech Stocks for Juggernaut Profits” other workshops on generating high-yield income that are always a favorite with show attendees. Make sure to register at www.moneyshow.com and I’ll see you there.