$5.4 Trillion on Sidelines is Fuel for Further Market Gains

Finally, there are some vestiges of the stock market starting to broaden out from simply being led by the AI-related Magnificent Seven or the Elite Eight mega-cap tech stocks that have hoarded most of the fund flows within the year-to-date rally that has the S&P 500 testing its next overhead resistance level at 4,300. Even with roughly one-third of the S&P 500 companies trading below their 50-day moving averages, there is some fresh improvement in the NYSE Advance/Decline Line occurring over the past two weeks.

To be frank, there isn’t much in the way of the S&P to challenge 4,500 (4.7% higher), and the Nasdaq could be trading up to 14,000 (5.5% higher) by Labor Day if a couple more hurdles are cleared. They include this week’s May inflation data (CPI and PPI) coming at or below forecast, followed by the Fed pausing at this week’s Federal Open Market Committee meeting, where about 70% of those surveyed are forecasting the Fed keep the Fed funds rate at 5.00-5.25%. The Fed will have the luxury of getting both inflation reports before it issues its rate decision on Wednesday at 2:00 pm EST.

The business of forecasting in this current economic backdrop is a major challenge given wide-ranging set of data points showing pockets of real strength (home construction, technology, healthcare, infrastructure) and real deterioration (manufacturing, commercial real estate, retail sales). Retail sales are not adjusted for inflation, so the key takeaway from the 0.2% bump in the April report is that total retail sales were up primarily due to price increases and not as much due to increased demand.

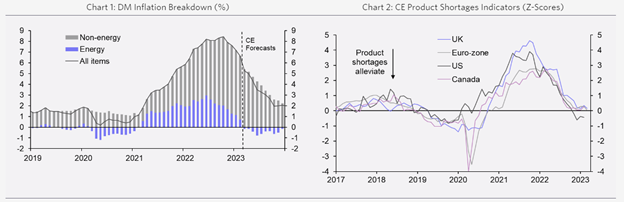

What I am seeing more often are some of the forward-looking charts that bode well for the economy in 2024 — namely, the forecast for inflation and product shortages are both expected to show marked improvement by later this year. A recent Q2 Global Economic Outlook report issued by Capital Economics assumes that tightening credit criteria will rein in lending, thereby adversely impacting both companies and households and have a material affect on the cost of living.

On May 31, Reuters issued a report that lent some credibility to this forecast. It stated that “U.S. domestic banks reported a widespread tightening of lending standards by the end of the first quarter of 2023 — even before the full impact of the regional banking crisis had been felt. Stricter lending criteria are likely to slow the flow of credit to small businesses and households — amplifying the impact of interest rate increases by the Federal Reserve over the last year. The net percentage of domestic banks tightening standards for commercial and industrial (C&I) loans to small businesses with annual sales below $50 million hit +47% at the end of the first quarter.”

China’s reopening boost is now largely over, with its recovery being weaker than anticipated, and there haven’t been any new major stimulus plans announced, which some blame as to why oil prices failed to get a boost from the latest OPEC+ production cut of one million barrels per day and news of the U.S. intending to restock the Strategic Petroleum Reserve. Although crude trades around $70/bbl, it is starting to look like the predictions for $90-100 oil are not going to be realized.

And yet, energy companies will print plenty of profits if crude stays above $65. But cheaper oil and gas prices have a big influence on the rate of inflation, as well as the normalization of global supply chains affecting the cost of goods and commodities. Both lower energy prices and the alleviation of product supply shortages should contribute to lowering inflation.

Hopefully, the May inflation data this week will reflect these two key inputs and the Fed can take a breather. Suffice to say, only about 50% of the rate hikes have worked their way through the system, so it is a good time to see just what kind of impact tighter lending standards on banks will have on consumer spending and capital expenditures for small- to medium-sized businesses. The recent banking crisis just might have done the rest of the heavy lifting for the Fed, and that will all come in in the May and June data.

Additionally, end of the quarter window dressing begins this week, with a war chest of cash on the sidelines. According to Investment Company Institute (ICI), as of June 8, 2023 — Total money market fund assets increased by $36.63 billion to $5.46 trillion for the week ended Wednesday, June 7. Among taxable money market funds, government funds increased by $18.01 billion and prime funds increased by $15.78 billion. Tax-exempt money market funds increased by $2.84 billion.

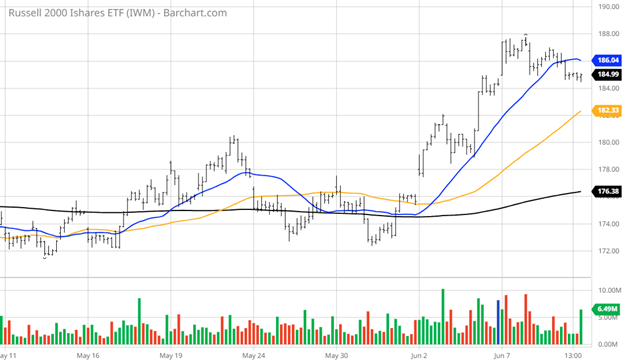

Professional fund managers holding huge cash weightings are likely spending more time in the restroom biting their fists as the “pain trade higher” is taking hold as the quarter comes to a close with second quarter earnings season just ahead. These fund managers must be the 30% that believe the Fed will hike again and hopefully let some air out of the current rally. That, and being a bystander as the Russell 2000 has rallied by 6% since June 1, is probably keeping a lot of cash-rich investors up at night.

Is the rally in the risk-on Russell just another false breakout like the last three attempts going back to July 2022? Hard to say, but it is safe to say we won’t have to wait too long to find out.

P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.