Dividend Investing Weekly

As reported in Barron’s February 2007 issue, “Financial advisor Bryan Perry’s passion is double-digit income investing.”

That same passion for high-yield stocks is what led Bryan to create his Cash Machine service, his book — The 25% Cash Machine, and now his latest project… Dividend Investing Weekly.

Bryan’s new weekly e-letter combines decades-long expertise in income investing with a simple, easy-to-read format that investors of all stripes can put to work for their portfolios.

Current Article

A Bullish Earnings Season Can Fix a Troubled Market

The current stock market correction has its roots going back to April 4, when the S&P 500 broke its short-term 20-day moving average, three days after Israel destroyed the Iranian consulate annex building adjacent to the Iranian embassy in Damascus. That action put into motion a high-profile chain of geopolitical events, coupled with a much higher-than-expected non-farms payroll report, a hotter-than-forecast Consumer Price Index (CPI) report and a couple of cautionary guides from two leading semiconductor industry companies.

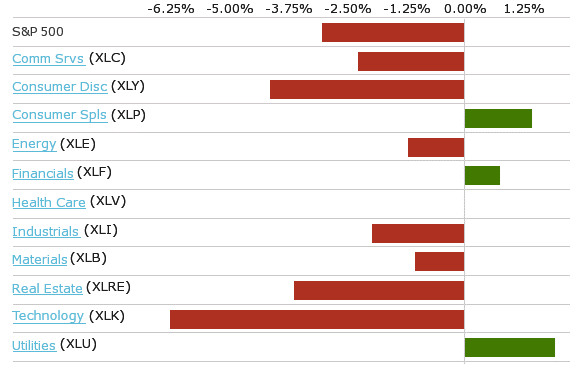

The chain reaction has been textbook: spiking oil prices, higher bond yields, a record high for gold prices resulting in a 5.5% decline (so far) for the S&P 500 and a 7.5% pullback for the Nasdaq. Even the S&P 500 Equal Weight ETF (RSP) was down 5.8% over the same period. So, to say that it was the mega-cap tech stocks that pulled everything lower is simply not the case. It’s been a broad-based correction with high-profile stocks in each of the 11 market sectors coming under pressure.

Stocks don’t trade lower unless there are more sellers than buyers, and the events of late have fund managers spooked. It was reported by Goldman Sachs that the combination of a strong economy and rising rates has prompted the planning by state and local government pension funds to unload $325 billion in stocks this year, locking in what are still pretty solid price gains for equities, and shift their money into bonds. With some market strategists predicting lower stock market returns for the current year, the idea of locking in 5% for two years appeals to many seeking to balance market risk.

How much of this plan has already been acted on is unknown, but this past week surely put some conviction on that trade. Trading volume was heavy and comes at a time when the Treasury Department is looking to auction off $189.3 billion in two-, five- and seven-year notes this week, with the Fed’s favored inflation report, Personal Consumption Expenditures (PCE), due out this Friday. Bond yields are right back up to levels last seen in November, when the market was pricing in six rate cuts for 2024.

As of Friday, April 19, the CME Fed Watch Tool said the first sign of a rate cut will likely be at the July 24 Federal Open Market Committee (FOMC) meeting, where there is currently only a 36.4% chance of the Fed reducing the Fed Funds Rate by a quarter-point to 5.00-5.25%. Such a low conviction level by bond traders for Fed easing is being rapidly priced into the market and much is riding on the strength of the bond auctions this week.

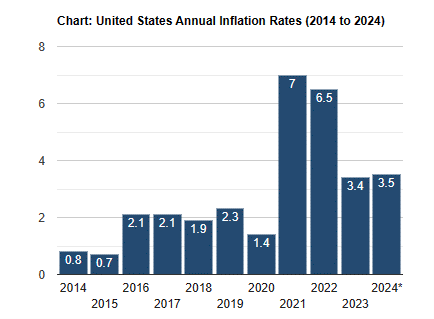

Adding to investor concerns, Chicago Fed President Austan Goolsbee said progress made by the Federal Reserve in easing inflationary pressures has “stalled,” and it “makes sense” to extend the pause rather than cut interest rates. It was on Nov. 20 when Goolsbee stated the economy appears to be on a “golden path” toward lower inflation. Here, too, this Friday’s PCE report will be more significant to the market narrative, with economists forecasting the March headline PCE to be 0.4% and Core PCE to come in at 0.3%.

Current U.S. Inflation Rates: 2000-2024 (usinflationcalculator.com).

As has most always been the case, the stock market is very efficient at being a forward discounting mechanism, pricing in what is and what could be from both bullish and bearish standpoints. Presently, the market is on the defensive.

Weekly Sector Performance, Source: ICE Data Services

Against this backdrop of freshly brewed market worries, it is no doubt time for the S&P 500 to deliver a “sales fixes everything” first-quarter earnings season amply reinforced with bullish forward guidance. That could limit the current correction to that of a “garden variety” dip.

If the economy is on the sort of good footing the macro data implies, then it should also show up in the top- and bottom-line numbers for the vast majority of the S&P 500 companies. And so far, earnings season is off to a particularly good start. As of April 19, for Q1 2024 (with 14% (70 companies) of S&P 500 companies reporting actual results), 74% of S&P 500 companies have reported a positive earnings-per-share (EPS) surprise and 58% of S&P 500 companies have reported a positive revenue surprise, according to FactSet Earnings Insight. Fund managers and investors don’t just need the mega-cap tech names to put up great quarterly numbers, they need to see high-quality robust results from the leading companies in each sector to remove the bearish grip on this market.

In simple terms, it’s “put up or shut up” time for the bulls because the headwinds of sticky inflation, soaring federal debt and rising geopolitical tensions are stiff and need to be aggressively addressed to quell the legitimate concerns about the threats they present. At this point, it’s every stock for itself. Great stocks can trade higher in tough markets, but they must post great numbers. Stay tuned.

P.S. I will be holding a subscribers-only teleconference on April 24 at 2 p.m. EST entitled “The AI Game is the Same — But the Names Have Changed.” The event is free to attend, but you must register here. Don’t miss out!