Dividend Investing Weekly

As reported in Barron’s February 2007 issue, “Financial advisor Bryan Perry’s passion is double-digit income investing.”

That same passion for high-yield stocks is what led Bryan to create his Cash Machine service, his book — The 25% Cash Machine, and now his latest project… Dividend Investing Weekly.

Bryan’s new weekly e-letter combines decades-long expertise in income investing with a simple, easy-to-read format that investors of all stripes can put to work for their portfolios.

Current Article

Markets Embrace Hope of Second-Half Rate Cuts

Over the past two weeks, investors have been on the receiving end of several key economic reports and high-profile earnings releases that have roiled the stock market, generating wide price swings daily. There have been conflicting data on labor markets, where the Employment Cost Index released on April 30 showed that compensation costs accelerated from the fourth quarter, adding to concerns about general price inflation sticking above the Fed’s 2% target for longer than expected.

Fast forward to last Friday’s release of the April Employment data that revealed nonfarm payrolls increased a smaller-than-expected 175,000, average hourly earnings were up a smaller-than-expected 0.2%, the unemployment rate was up a higher-than-expected 3.9% and the average workweek was a smaller-than-expected 34.3 hours. Bond yields spiked and the stock market swooned on Tuesday in reaction to the Employment Cost Index report, which saw both the bond and equity markets steady following the Federal Open Market Committee (FOMC) presser, with bond yields gapping lower and stocks gapping higher following Friday’s release of the labor market data.

In between these two reports was the Federal Reserve policy statement from Fed Chairman Jerome Powell that was essentially what the market expected, holding Fed Funds unchanged at 5.25-5.50%, with some hint that a rate cut for 2024 was not completely out of the question. The body of his message was that the central bank is pushing back its plans for rate cuts as inflation plateaus well above the bank’s 2% target. And he did quell speculation that it is unlikely a rate hike is in Fed’s policy going forward and that interest rate cuts are still likely in 2024.

The higher-for-longer narrative regarding short-term interest rates has helped to shore up the dollar against other currencies even after it was reported the higher revisions for future Treasury fundings. For the April-June quarter, the Treasury expects to borrow $243 billion in privately held net marketable debt. This estimate is $41 billion higher than the announcement made in January and begs the question of the level of new Treasury supply the global market can absorb, with the federal debt growing by $1 trillion every 100 days. Thankfully, this topic is starting to matter, but will likely be tabled into 2025, being 2024 is an election year.

With the first quarter reporting season almost complete, the market’s bullish bias going forward will have to depend on economic data providing the needed catalysts to keep the uptrend intact. Translated, the market needs to see data on inflation move in the right direction during the month of May. If so, bonds can rally, which would remove a big market headwind. Friday’s dovish employment and the pullback in oil prices last week is a good start and did move the needle to favor the bulls for the near term.

Whether rates have topped out is anyone’s guess at this point, the protracted selloff in the bond market leading up to the big jump in bond prices per the employment data shows just how jittery the bond marked is, and how it has now become the ruling instrument to influence market sentiment and the driver of “the narrative.”

Investors should be grateful for the broadly bullish tone of earnings season. Though some popular stocks impressed or disappointed the Wall Street analyst community, on balance, business conditions for most companies that have reported first-quarter numbers are upbeat. However, it is very important for all of us to know and respect how quickly sentiment can shift if certain assumptions fall short of expectations.

To this point, I think the way the market has handled the shift in interest rate cut expectations is remarkable. Six months ago, the bond futures market pivoted hard in early fall of 2023 — anticipating no less than six quarter-point rate cuts for 2024. The greatest odds implied by the futures markets in the final quarter of 2023 priced in year-end 2024 Fed Funds Rate of 3.75-4.00%, representing a 1.5% reduction from current levels in response to what was widely believed to be meaningful economic slowdown.

As we all know today, a recession of sorts did not materialize despite 11 rate hikes. And here we are on the doorstep of summer with the latest set of economic data points forecasting a slowing of sorts that might well help resolve the inflation problem that has handcuffed the Fed and millions of families across the country having to manage higher prices in so many areas of the economy at the local level.

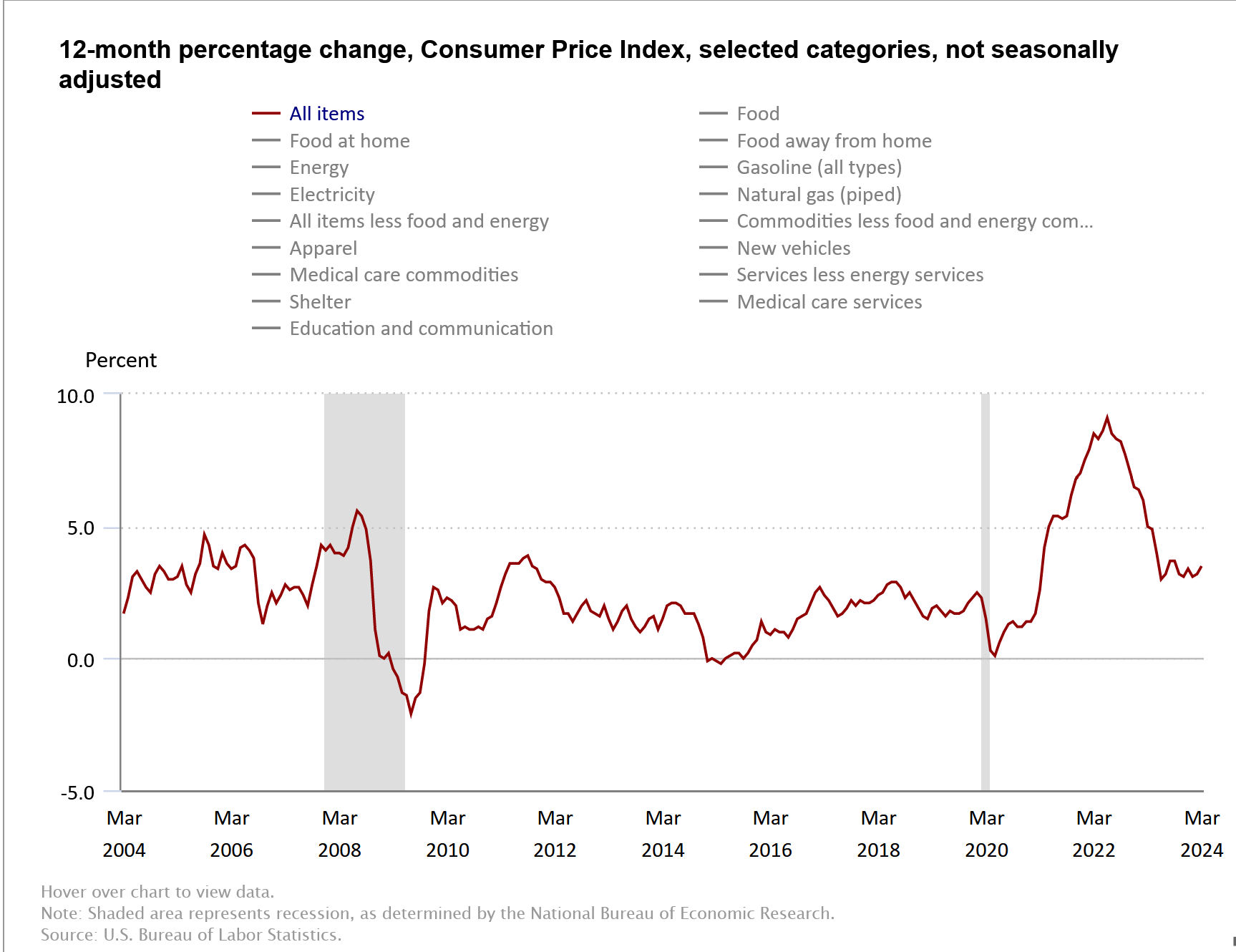

Core inflation is monitored alongside headline inflation, which measures changes in the prices of all goods and services in an economy. The headline inflation rate is typically more volatile than core inflation due to the impact of food and energy prices, which can fluctuate greatly in response to changes in supply and demand. The irony of this carve out of food and energy prices is that consumers care greatly about these two metrics, from an immediate perspective.

While headline inflation provides important information about short-term fluctuations in the economy, core inflation is generally a more reliable indicator of the long-term trend in inflation. The monthly Consumer Price Index (CPI) reports provide various rates of inflation, such as those for headline inflation, which is described as all items, and core inflation, which is noted as all items except for food and energy.

The Fed is looking at the same charts that show headline and core inflation leveling out at the 3.8-4.0% range, which is where the market seems to be in acceptance of. In past times, this would seem to be a new normal that could be lived with. But it is my view that, internally, the Fed is terrified of the size, growth rate and cost to service towards the $34+ trillion in federal debt. There seems to be very little if any coordination or collaboration between the Federal Reserve, the Treasury and Congress to as to how to best manage fiscal and monetary policy.

This week’s upcoming auctions of $67 billion in 10- and 30-year Treasury Bonds, along with $58 billion in 3-year Notes for a total of $125 billion in new supply, will test the appetite of global buyers of longer-term U.S. debt at a time when inflation is, for lack of better expression, a “jump ball.” One good (soft) employment report does not make for a trend. The bond market caught a solid bid on the weaker jobs data and other recent evidence of slowing growth. Some newfound conviction emerged last week that just maybe the inflation genie can be put back into the bottle. Let’s hope so.