Bullish August Puts the Sizzle on Summer Rally

The month of August really bucked the historical trend for the stock market.

Not only did the month turn out to be quite a positive one for stocks when it is typically the worst month of the year to be invested, but records were shattered in the process. Capital flows into U.S. equities seemed unquenchable, and heavyweight favorite tech stocks charged to new all-time highs. Shares of Apple (Nasdaq: AAPL), Amazon (Nasdaq: AMZN), NVIDIA (Nasdaq: NVDA), Cisco Systems (Nasdaq: CSCO), Microsoft (Nasdaq: MSFT), Salesforce.com (NYSE: CRM), Visa (NYSE: V) and Mastercard (NYSE: MA) all saw record highs along with several other top tech standouts, making for a sizzling summer of big gains for the IT sector.

Euphoria is running high for the U.S. stock market, which is now considered the only game in town relative to global investing. All the right elements needed to keep the rally in an uninterrupted run are falling into place, and that has caught many fund managers underinvested and aggressively upping their equity weightings so as to at least keep pace with the major averages.

One additional element fueling the ongoing rally is that many elements of the U.S. economy are positive. Third-quarter gross domestic product (GDP) is set to challenge 5.0%, core inflation is holding at the Fed’s 2.0% target, the yield on the 10-year Treasury is camped out below 3.0% and the dollar has pulled back on the narrative that further Fed tightening will cease in 2019, quite possibly after the Sept. 26 Federal Open Market Committee (FOMC) meeting.

Also, positive developments on global trade and a lack of serious geopolitical risks lately have undoubtedly done much to help this rally. Aside from the mid-term elections, which are a complete toss-up, the upside breakout for the market is legit. Last week’s trade deal with Mexico looks like it will include Canada and sets a positive tone for some progress with China. The details of the Canada and Mexico agreements may take many months to iron out, but so far, a trade war has failed to kill this rally and traders have seized on the narrative.

As evidenced by strong weekly rotation from sector to sector, with technology and consumer discretionary stocks outperforming the other nine market sectors, the rally is broad-based. However, it’s more impressive to me that the market rally is grounded on solid earnings growth, rather than simply optimism. With 91% of the companies in the S&P 500 reporting results for the second quarter, 79% have reported a positive earnings per share (EPS) surprise and 72% have reported a positive sales surprise. Sure, tax reform can juice up earnings, but there is no substitute for strong top-line revenue growth.

The second-quarter numbers we’ve seen recently have been historic. For Q2, the blended earnings growth rate for the S&P 500 is 24.6%, which marks the second-highest earnings growth since Q3 2010 (34.1%). The blended sales growth rate for the S&P for Q2 2018 is 9.9%. Spending by businesses on technology and automation led the uptick in the growth rate. For Q3, analysts currently expect earnings to grow by 20.3% and revenues to grow by 7.7%. Just like we saw with the Q2 forecasts, these expectations will likely be exceeded.

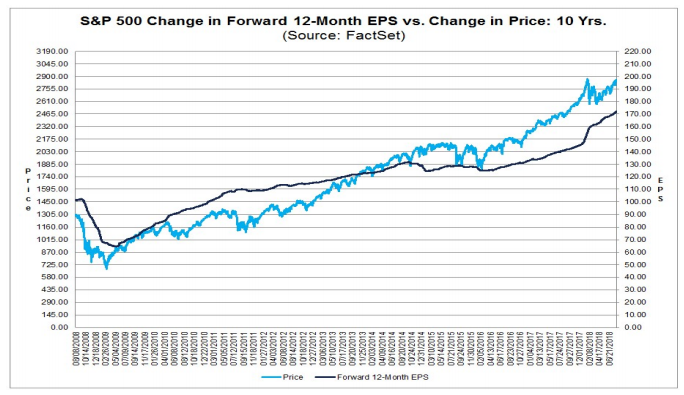

If you look at the chart below, it tells a bullish story for the S&P 500. While the market is trading at all-time highs, earnings are robust enough to maintain a forward price-to-earnings (P/E) ratio for the market of around 16.5, which is slightly above fair value but not overvalued relative to double-digit-percentage earnings growth. Stocks are moving higher in tandem with earnings growth, and with analysts currently expecting earnings to grow near 20% for the rest of 2018, the prospect of the S&P 500 trading to 3.000 is quite good.

With four months left in the trading year and coming into the strongest season for stock performance, I’m looking for the market to take a breather over the near term to relieve some of its overbought condition and then make a strong run as we approach the end of the year. There is just too much global liquidity seeking profits from growth and dividend income where the underlying currency driving robust consumer spending is stable interest rates, tame inflation, proactive tax policy and full employment.

While the last week or so has been peaceful and prosperous for investors, there are several events that are worth watching. More news on trade deals with Canada and the European Union has yet to cross the tape. Investors have turned a blind eye to the additional upcoming tariffs on China, the meltdown in emerging market currencies in Turkey and Argentina and the possible geopolitical implications of tightening sanctions on North Korea, Iran, Russia and Turkey. Separately, these issues are of small consequence to the U.S. stock market, but collectively, they could provide a reason for a constructive pullback for the major averages.

Should that happen, the markets would be beautifully set up for a strong finish to the year. While I don’t expect any sort of serious market correction to occur, my Hi-Tech Trader advisory service is designed to buy the dips in trusted tech stocks that are a must-own for any investor with a large technology component in his portfolio.

Technology lies at the heart of this bull market, and there is no better place to be than with these market darlings. To put in place an action plan that is centered on making the very most of this bull market, check out Hi-Tech Trader by clicking here.

In this service, I harness the power of Artificial Intelligence (AI) to unearth top tech stocks that are timely purchases. The data from my AI system provide a buy signal with a 22-day time horizon for each trade to produce results. In addition to selecting specific stocks, I recommend a corresponding call option strategy with each stock for those traders that want to leverage a recommendation.

It’s exciting, and best of all, it works!