Commercial Real Estate Loan Tsunami About to Hit Bank Sector

Of the more debatable topics among professional and retail investors, the health of the banking sector is always a front and center discussion. Will the heavy loan exposure to commercial office space that requires broad refinancing over the next two years trigger some sort of systemic calamity to the financial markets? Or will the regional banks catch a vine of lower interest rates and a rebound in property values that gets them to the other side of what many believe to be a pending crisis?

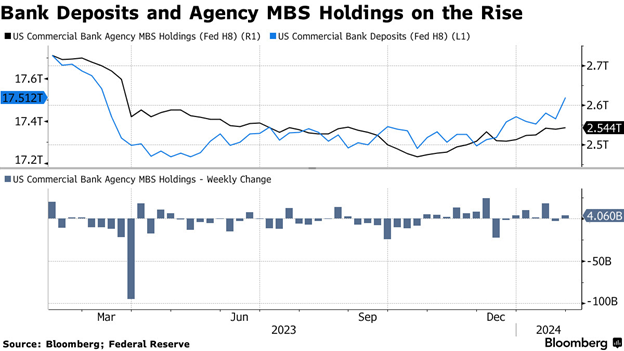

Currently, there doesn’t seem to be a notable wave of high-profile foreclosures or bank closings drawing serious attention away from other areas of interest, including artificial intelligence (AI), earnings, persistent inflation and concerns over a slowing Chinese economy and geopolitical events in the Middle East. Election year politics are not really being factored in yet. But what is evident is that after two years of reducing holdings, U.S. banks have been increasing purchases of mortgage-backed securities (MBS) and collateralized mortgage obligations (CMOs), and have been doing so for the past three months, according to the Federal Reserve.

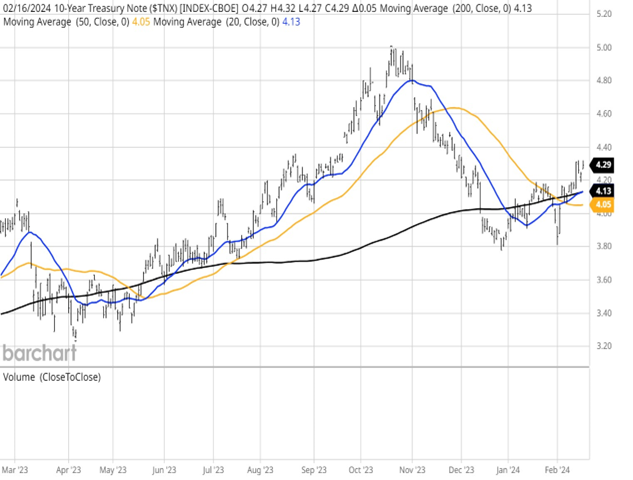

After selling some $800 billion in debt securities over a two-year period during the Fed’s rate tightening cycle, banks and Wall Street firms added $41 billion in debt obligation purchases that fueled the fourth-quarter 2023 rally in the domestic credit markets. The buying pressure, based on the notion of six Fed rate cuts in 2024, took the yield on the 10-year Treasury down to 3.80% from 5.00% before the reality check of a Fed pause in the bond market the past month triggered fresh selling pressure, taking the yield back up to 4.29% as of Feb. 16.

Banks finally came around and started offering higher yields on customer deposits, thereby attracting fund flows back into their coffers. With tighter lending standards enacted following the regional bank selloff of March 2023, loan volumes are down, forcing banks to find other places that can produce decent Net Interest Income (NII). So, they are buying longer-dated securities to capture a not-so-attractive spread between interest bearing securities and the cost of servicing savings accounts.

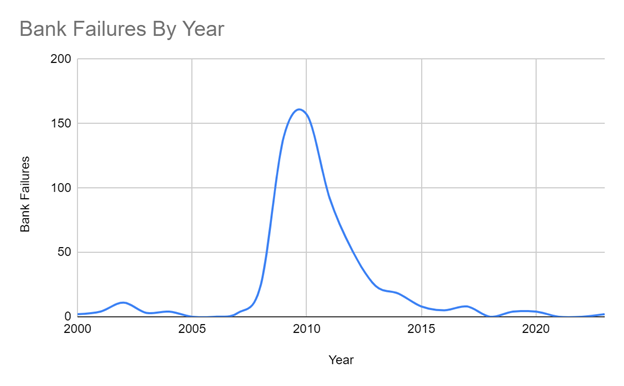

From one man’s perspective, it sure seems as if the banks are blue ribbon winners in the art of chasing large moves. The hard landing for the economy never materialized and the Fed’s 2% inflation target has been elusive, with the latest inflation readings moving in the wrong direction. Hence, the backup in yields right after the banks piled back into the bond market. It makes one wonder why there aren’t more bank failures when the banking sector is largely operating through a rearview mirror.

Forbes reported, “In the wake of the Great Recession, it was typical to see dozens — if not hundreds — of bank failures each year. This slowed significantly from 2015 to 2020, when the United States saw an average of fewer than five bank failures per year. Zero banks failed in both 2021 and 2022. Bank collapses were similarly uncommon in the early 2000s. From 2001 to 2007, the United States saw an average of just 3.57 bank failures per year. For all of 2023, there were five failures, still well below the long-term norm.”

The question now is whether and when market participants will consider the nearly $1.5 trillion of U.S. commercial real estate debt that is coming due before the end of 2025, of which $929 billion (20% of total outstanding commercial real estate debt) comes due by the end of 2024, according to the Mortgage Bankers Association. The volume of loans coming due swelled 40% from an earlier estimate of $659 billion, a surge attributed to loan extensions and other delays rather than new transactions.

According to MSCI Real Assets, commercial property prices are down 21% from a peak reached in 2022, before the Fed began hiking rates. “Office prices have had the biggest decline, falling an average of 35%. An estimated $85.5 billion of debt on commercial property was considered distressed at the end of 2023, with an additional $234.6 billion of potential distress.”

The big question being asked up and down Wall Street and Main Street facing those borrowers is, who’s going to lend to them? “Refinancing risks are front and center” for owners of properties from office buildings to stores and warehouses, Morgan Stanley analysts, including James Egan, wrote in a note this past week. “The maturity wall here is front-loaded. So are the associated risks.” The investment bank estimates office and retail property valuations could fall as much as 40% from peak to trough, increasing the risk of defaults.

It is understood that currently, among the lenders, issuers of commercial mortgage-backed securities (CMBS), collateralized loan obligations (CLO) and investor-driven lenders (private credit) are the biggest players, packaging distressed and potentially distressed loans into bundled securities and resold. Like when the late Anthony Bourdain in the movie “The Big Short” used the example of making fish stew from good fish going bad, investors should be wary of banks that pile into high-yield buckets of distressed securities thinking that diversification somehow reduces risk.

Can the larger economy manage a reset in commercial real estate to the tune of several hundred billion dollars? Probably, but not without a likelihood of elevating market volatility as this wave of debt comes due for refinancing and whether the appetite for these bundled securities dries up just as the issuance of this kind of debt is rapidly coming to market in vast amounts.

Just as the regional bank blow off of March 2023 created one of the best buying opportunities in recent years for stock investors, the coming great commercial real estate reset might well offer the pullback that provides the same kind opportunity to buy into today’s greatest stocks. Time will tell, but it sure feels like it is setting up this way.