Fed Priming the Liquidity Pump Again

A number of reasons are being touted for the market’s rebound last week, the primary one being the release of the Personal Consumption Index (PCE) that came in fractionally lower than forecast. Using this index for February, inflation is running at an annual pace of 5.0% versus 5.3% in January. The lower reading shows inflation moving in the right direction per the end of February, and the March data will hopefully confirm the trend maintaining its downside bias.

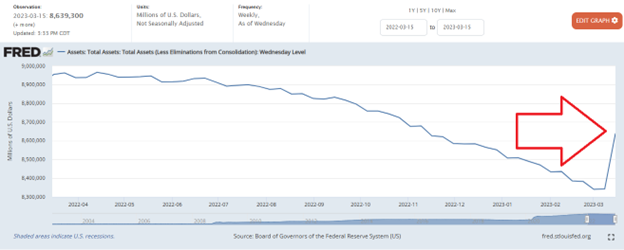

Although the topic of inflation grabs the headlines, I would argue that the main reason the market pivoted higher last week was the activity within the Bank Term Funding Program (BTFP), an emergency lending program created by the Federal Reserve in mid-March 2023 to provide emergency liquidity to U.S. depository institutions. The Fed embarked on this program with an almost “by the way” announcement of its BTFP that has reportedly pushed its balance sheet up by $500 billion.

In the past three weeks, the Fed has done a 180 — reversing the shrinking of its balance sheet through quantitative tightening (QT) and instead injecting massive liquidity into the system. JPMorgan put out a note called “Flows & Liquidity — A Repeat of 2018/2019?”, believing that the Federal Reserve’s Bank Term Funding Program (BTFP) is likely to be massive and the max usage could be around $2 trillion.

The JPMorgan research team analyzed the uninsured deposits of the six U.S. banks with the highest ratio of uninsured deposits over total deposits. That number came out to be $460 billion. The bigger the usage of the BTFP, the more it would increase the size of the Federal Reserve, thus creating more liquidity relief for the U.S. banking system. Section 13(3) is a singular power of the Federal Reserve to permit Federal Reserve Banks to provide liquidity directly to non-bank, commercial entities.

This power is only available in times of crisis, when the Federal Reserve, by a vote of five governors, finds that “exigent and unusual circumstances” exist. Section 13(3) authority has been invoked in times such as during the global financial crisis of 2008, when it took steps to bolster a financial system on the brink of collapse. Section 13(3) was also used during the COVID-19 pandemic.

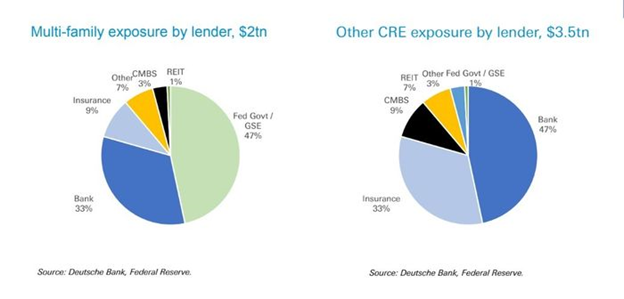

The BTFP program was set up to protect against future runs on deposits, but what about the looming problem with commercial office space debt held by banks? It is estimated there is about $5.5 trillion in commercial real estate debt, of which, roughly $2 trillion is committed to multi-family housing projects, considered relatively safe, and around $3.5 trillion in all other sub-classes of commercial real estate where banks have almost half the exposure, most of which (about 70%) is held by small banks.

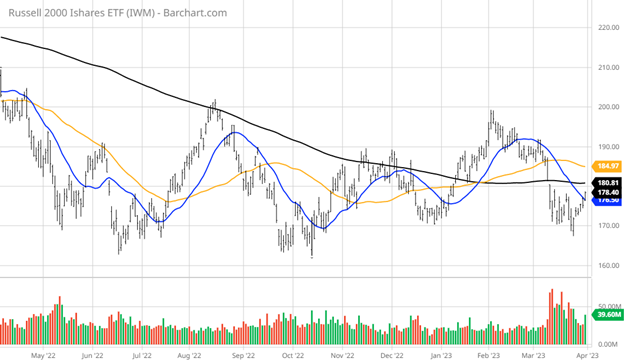

This reality very likely explains why the Russell 2000 is underperforming the other major indexes. Financial companies account for 15.7%, most of which is represented by small banks. Healthcare is weighted at 15.7%, industrials account for 15.5% and the technology weighting sits at 14.1%. The chart of the Russell 2000 ETF (IWM) shows a big break in the index, slicing below its key 200-day moving average on huge volume, which, in my view, will take time to repair.

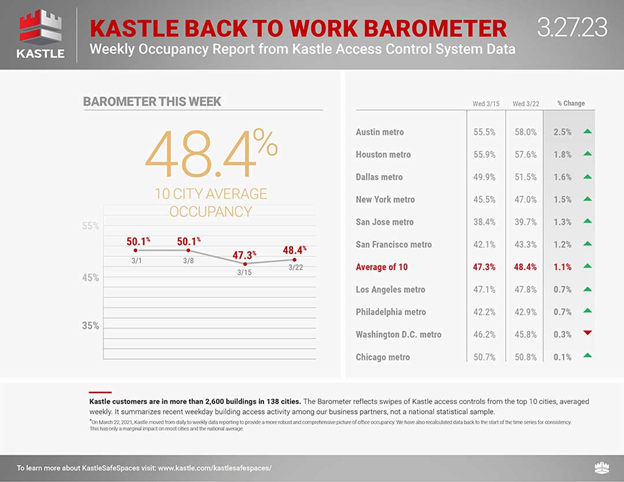

The latest Kastle Systems’ gauging of office vacancy in its 10-city barometer at only 48.4%, as of March 22, is not a healthy development for the sector.

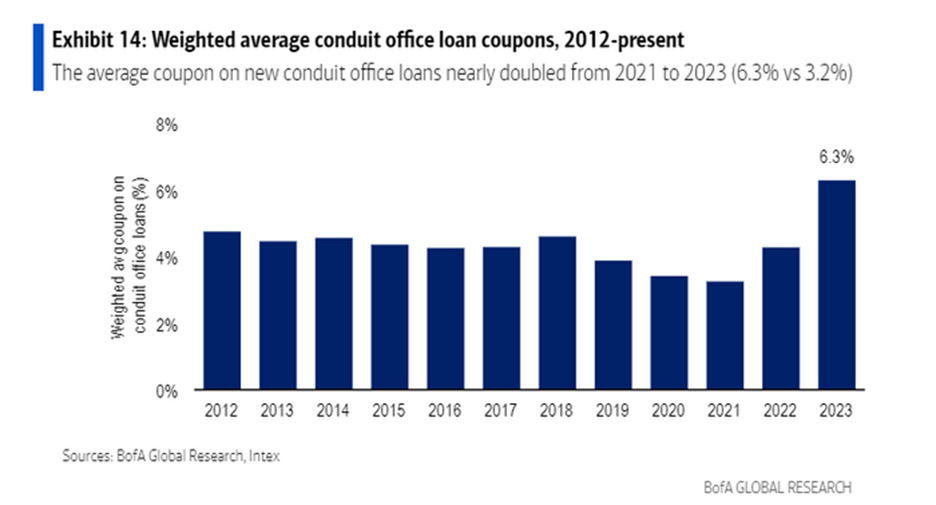

The concern with the hybrid work environment today is that the sub-50% occupancy rate is the new norm, which is highly likely to drag down property prices that bring rising pressure to landlords with billions of debt coming due in the next few years, likely at higher rates. While some borrowers will get loan extensions or modifications, a “more expensive funding regime” could force others to “hand back the keys,” said Bank of America Global’s Alan Todd, who leads the bank’s commercial mortgage-backed securities (CMBS) research effort, in a recent client note.

To help gauge borrower costs, the average coupon for office loans in multi-borrower, or “conduit,” commercial mortgage bond deals has almost doubled to 6.3% since 2021.

At the median U.S. bank, commercial real-estate loans account for 38% of loan holdings, according to an analysis by KBW Research. The Federal Reserve recently said it would accept bonds and other assets at face value as collateral from banks, making bank runs less likely. Still, “small and regional banks could run into trouble quickly if they have to sell commercial property loans to raise capital,” said Richard Jones, a partner with law firm Dechert LLP. “In such a situation, the banks likely would be required to reclassify loans as being held for sale, and that often means valuing them at what their collateral is currently worth rather than the face value of the loan,” he said.

While the commercial office space loan risk is high on the list of inherent risks to banks’ balance sheets, the market sees it as something to think about months from now. At the present, and over the very near term, markets seem to only care about the huge injection of money and the view that the Fed, through the BTFP, has indeed pivoted, pausing on QT and flooding the system with fresh dollars to fix the problem it created. And stocks rallied big time on the news. Oh, how markets do love liquidity.

P.S. My colleague, Jon Johnson, will be holding a free teleconference on “How We Closed 19 Winning Trades in a Row.” The event will take place on April 12 at 2 p.m. EST. The event is free to attend, but you have to register here to be able to attend. Don’t miss out!