Hedging Oversold Rallies Until the Bear Goes Back Into Hibernation

Investors received some inflation data this week that implied just maybe the month of April was the peak for inflation in the current cycle.

As one month does not make for a trend, it gave some much-needed hope and relief for stocks to trade up off by the end the week, the first such move in two months. Clearly, the market was very oversold and due for a bounce, be it a pivot off a true bottom or something more along the lines of a bear-market rally.

Many technicians argue that the market hasn’t endured the kind of capitulation that defines a genuine bottom that ushers in a new and sustainable uptrend. I tend to agree with this rationale, having been through so many market cycles.

So, when looking at how to hedge long-term growth and income positions, I tend to consider the use of inverse exchange-traded funds (ETFs) on the S&P 500 to “box” my portfolio. Ideally, investors want to hold their stocks and ETFs for a year and a day for tax efficiency purposes.

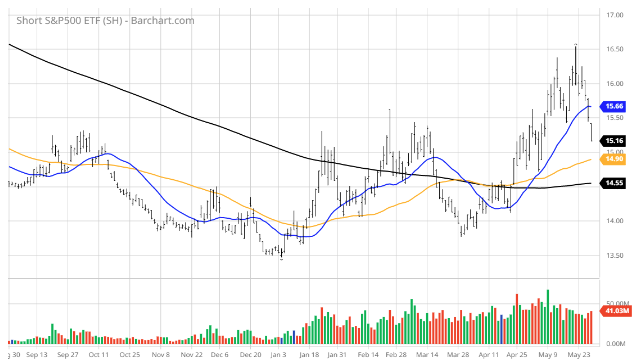

In a market such as the present, it takes an iron stomach to wait out the bearish price action in hopes of averting a recession. This is where the ProShares Short S&P 500 (SH) becomes a viable recommendation and selling covered calls come into play.

When all sectors, save for energy, are under pressure, and there is technical damage galore in a market where the Fed will start conducting quantitative tightening on June 1 and keep raising interest rates, I’m of the view that selling calls on individual positions and buying a broad market hedge is a good plan to preserve capital.

The S&P 500 has just put together a fantastic comeback to end what has been a miserable “sell in May and go away” month of sheer pain. And while this most excellent bounce off the 3,800 low, rising to 4,150, is entirely welcome, WTI crude is trading at $115/bbl., natural gas is hovering near $9/MMBtu., and wheat, corn, soybeans, sugar and other soft commodities are trading near their 2022 highs.

Just maybe 3,800 for the S&P 500 is the low for the year and the market has amply discounted the risks of Ukraine, China, supply chains, soaring gas and food prices, softer housing data and interest rates. Then again, the last rally like this one was followed by a selling wave that took the market to the lows of last week. If 3,800 holds, great! If it doesn’t, then 3,500 is the next level of support.

In the movie “Margin Call,” when the head of risk assessment at Lehman Brothers steps into the elevator after being fired, he hands his USB memory stick to his junior analyst and says, “be careful.” In my view, that very much sums it up.