High-Grade Bonds Indexed To Inflation Have a Good Future

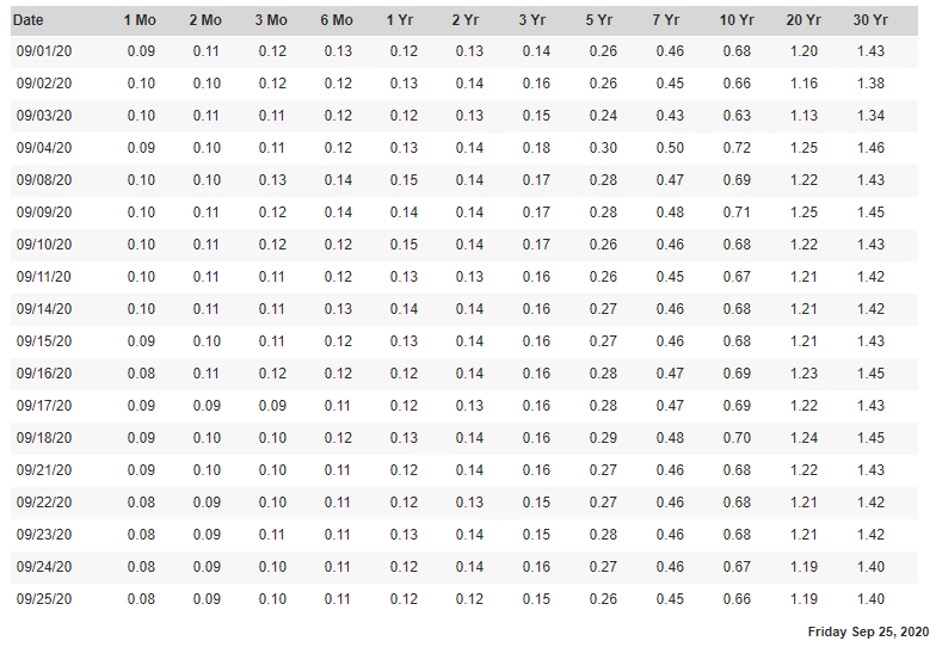

Treasury bond yields have spent most of September unchanged-to-mildly lower as market volatility has surged.

The two are highly correlated but considering the 10.8% decline in the S&P 500 and the 14.9% slide in the Nasdaq over the course of three weeks, one would assume yields of government-backed debt would have rallied more. Below is a chart of the U.S. Treasury market for September.

Source: www.treasury.gov

The low for the S&P 500 and the Nasdaq came last Thursday when the S&P 500 touched 3,210 before snapping back up to close the week out at 3,298. Here, too, bond yields didn’t budge as it appeared the market was taking a “risk-off” tone in what was considered a highly oversold short-term condition, but a two-day rally does not define a trend.

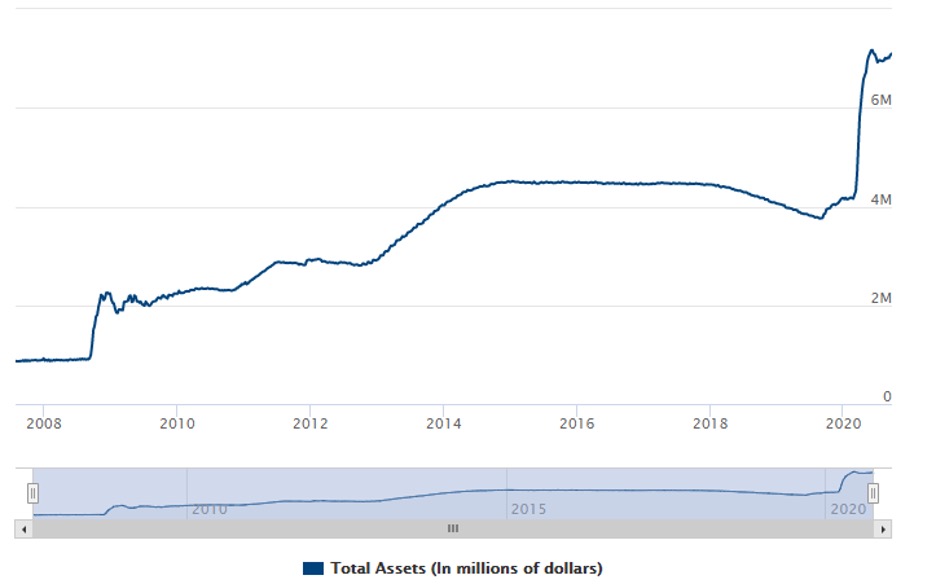

Congress is going to try to pass another stimulus package somewhere in the $1.5-$2.2 trillion range and the Fed has promised to keep priming the quantitative-easing (QE) pump and is encouraging Congress to act swiftly to add needed fuel to a nascent recovery. As is stands, the Fed’s balance sheet has just topped $7 trillion — the highest of all time.

The double-barreled approach to saving the economy from recession or a long-term downtrend is clear. As long as interest rates and yields remain near zero, the cost of financing the pandemic bailout is of little concern.

Source: www.federalreserve.gov

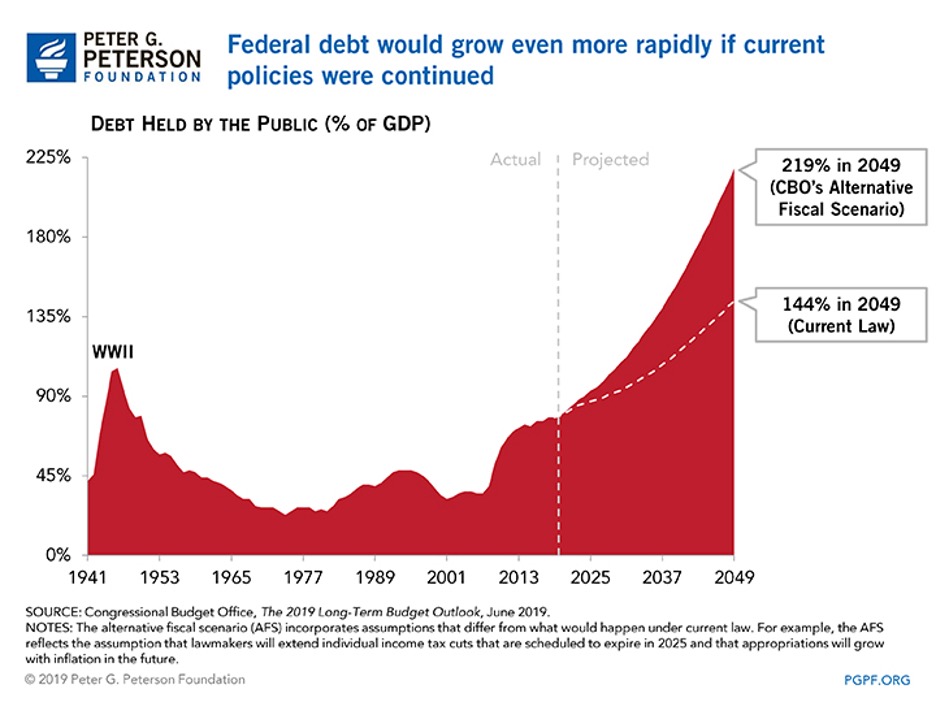

Spending will continue to soar, something President Trump and big government proponents on both sides of the aisle are fully in support of doing.

“It will be hard to ratchet down this spending going forward, and we are going to be entering a long stretch of deficits well above historical averages,” said G. William Hoagland, a senior vice president at the Bipartisan Policy Center and former Republican staff director for the Senate Budget Committee. “But as a matter of national politics, the deficit was not a matter of concern before the pandemic and it won’t be after.”

The Fed’s latest policy statement was centered on doubling the rate of inflation to an average of 2%, potentially helping to lift wages and to boost consumer buying power. While that directive is all well and good, the Fed has a mixed record of actually being able to impact prices. Fed Chair Powell acknowledged this in his latest press conference that Congress will need to do more to fuel a full recovery where the rate of unemployment falls back below 5%.

So, if current Fed policies are to remain in place indefinitely and Congress is expected to do its part in replacing lost gross domestic product (GDP) with stimulus packages, then the trajectory of the national debt begins to radically steepen in 2023 if the models put forth by the Congressional Budget Office are anywhere near accurate.

Assuming the efforts of the Fed to raise inflation, in conjunction with further big spending increases in Congress, are realized in the next couple of years, it’s hard to imagine the cost of living coming down when wages are increasing.

First used by George Bush Sr. in criticizing Ronald Reagan’s economic policies, “voodoo economics” became a popular, widely used phrase to dismiss ambitious economic pledges made by politicians. I would venture to say the Fed’s desire to double the rate of inflation without seeing yields rise as a byproduct of inflationary forces falls into the category of “voodoo Fed policy.” Soaring debt loads, a falling dollar and higher inflation will invariably lead to higher bond yields down the road.

The European Central Bank (ECB) is also working off the same template. The ECB aims at inflation rates of below, but close to, 2% over the medium term. Despite the euro’s strength, the ECB’s inflation forecast for this year remains unchanged at 0.3%, has been revised up to 1% next year and is expected to hit 1.3% in 2022.

Again, central bank forecasting and reality tend to be wide apart. Inflation in the eurozone sank to an annual negative 0.2% in August, with “core” inflation (stripping out the prices of food and energy) at a historical low of 0.4%. With the ECB lending rate at a negative 0.50%, there is really no room to take rates lower, which means look for a resumption of increased fiscal stimulus.

What should income-hungry investors do if they want the security of the investment-grade bond market without taking on the risk of yields making a surprise move higher due to currency devaluation and unimaginable amounts of government debt?

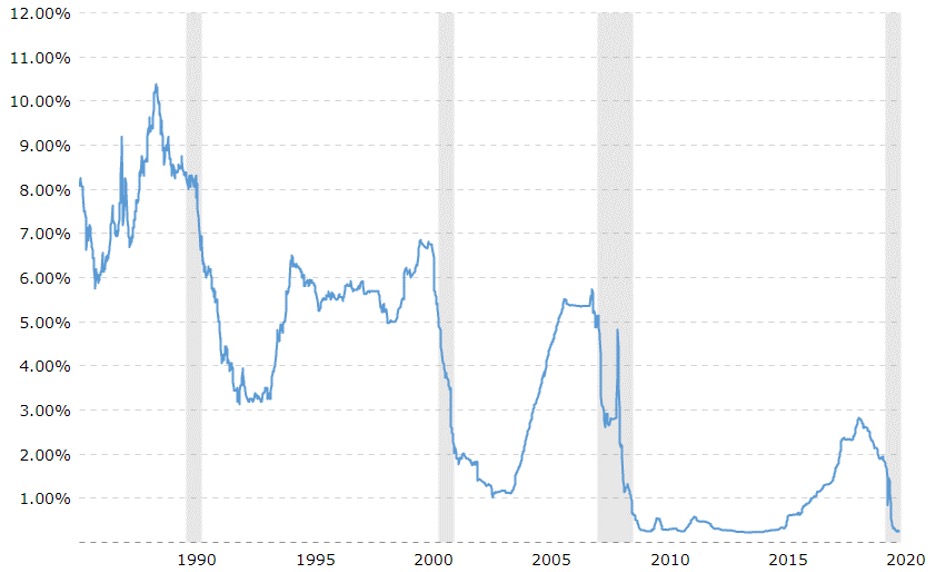

Well, one asset class to consider at this juncture is floating-rate investment-grade corporate assets tied to the Fed Funds Rate or the three-month London Inter-bank Offered Rate (LIBOR). The current Fed Funds Rate is 0.25% and the Three-Month Libor Rate is 0.22%. Can they adjust downward further? Sure, but the risk is probably 0.25-0.5% versus whatever number you want to apply to the upside for yields.

Source: www.macrotrends.net

The opportunities to invest in floating-rate securities are many. For those seeking fortress-type security, floating-rate investment-grade bonds that are bought individually are the best bet as ETFs loaded with these floating-rate bonds were hit hard in March as money flew out of everything.

These ETFs tend to be heavily weighted in financials — hence the related volatility. When market corrections come, bank stocks and related holdings get shwacked hard and thus are not safe from big market downdrafts.

Issuers in economically defensive businesses make more sense. Here is a smattering of current issues traded:

1.38% Verizon Communications Inc. Notes due 5/15/2025 BBB+

1.43% AT&T Inc. Notes due 6/12/2024 BBB

0.64% Florida Power & Light Co. due 7/28/2023 A

1.26% Vodaphone Group Plc due 1/16/2024 BBB

1.25% General Electric Co. due 3/15/2023 BBB+

1.00% Qualcomm Inc. due 1/30/2023 A-

0.91% Comcast Corp. due 4/15/2024 A-

0.75% United Parcel Service due 4/1/2023 A-

0.74% Apple Inc. due 2/9/2022 AA+

0.60% Intel Corp. due 5/11/2022 A+

0.90% Abbvie Inc. due 11/21/2022 BBB

Granted, the yields are low, but the credits are investment grade, the maturities are short-term and are liquid. While there are plenty of other high-grade bonds to buy with short maturities that yield more, there is no built-in inflation kicker.

Today’s column is not to recommend these types of bonds in the current low-rate environment that could persist for quite some time, but to simply make familiar how investors who are very risk-averse, want the surety of investment-grade bonds and seek to benefit if and when interest rates rise, then this is one class of security that provides for such a profile.

If, for any reason, or number of reasons, Fed Funds and LIBOR start moving higher, individual short-term inflation-indexed bonds will be a go-to instrument that will deliver safety and rising income. It is something to think about when the Fed eventually tightens.