Lower Inflation Will Lead to a Much Higher Market

This past week’s inflation data came in as forecast with a few components still showing some stubbornness to come down, but the big picture that investors should embrace is that inflation is, indeed, trending lower.

It would not surprise me to see the core annual Consumer Price Index (CPI) rate drop into the 3% range within the next three months as the big inflation numbers from 2022 drop off.

If core inflation does drop to the mid-3% range while Fed Funds are at 5.25-5.50%, and the Fed keeps rates higher for longer, it would be restricting economic growth, which should lead to the Fed cutting rates in Q1 2023. This should be a time when a serious rotation occurs as rates on money markets and short-term, fixed rate securities fall to 3% or lower and money pours back into dividend-paying stocks.

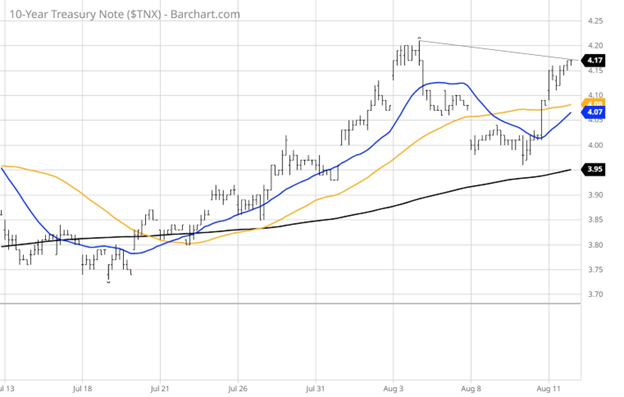

As of last Friday, the yield on the benchmark 10-year Treasury traded up to 4.17%, right below the recent high of 4.21% seen on Aug. 3. Of course, I might be entirely wrong, but I think this is it for the bond market sell-off, as bond traders have been pricing in the forthcoming issuance of Treasury supply since Congress raised the raised debt ceiling.

The second-quarter earnings season has been generally pretty decent, ex-energy, which, in its own way, will print some bullish numbers for the current quarter. Once we get through August, under the assumption that rates have topped out this month, there should begin to be a shift in sentiment toward an early earnings recovery cycle that historically pushes the S&P 500 price-to-earnings (P/E) ratio higher until actual earnings catch up, implying the market could easily trade at 22-23 times earnings.

And with the dollar expected to decline in a more risk-on landscape, the current FactSet estimate for 2024 S&P earnings of $235 could be raised to $255-260, implying an upside move of 25% to S&P 5,600 from Friday’s close of 4,464 by Christmas 2024. I’m not sure anyone is calling for this target, but if not, you heard it here first.

If my research and development (R&D) outlook is correct, then investors will want to be using this second half of what has been a messy August to get long in equities, and specifically equities with juicy dividends. And let’s put into perspective where we are right now, in a 4% world, which is a good thing in that it keeps too much capital from forming (easy money) but is still at a level where companies can make a lot of money. Historically, it’s a sweet spot for the economy, corporate profits and P/Es.

We’re already seeing the green shoots emerge in the junk bond market, where sentiment about improving credit quality is taking hold as fears of recession fade. At a time when Treasury prices are pulling back, prices of non-investment grade bonds are rising. The credit market has always been a harbinger of direction for stocks. The direction of the junk bond market historically precedes that of the stock market and the price action of the largest high-yield corporate bond exchange-traded fund (ETF) of the past five months has been choppy, but slightly up and to the right (as shown below).

I’m old enough to remember when 4% seemed impossibly low, and now the market is so bearish when the longer end of the curve is breaching 4%. Recent selling in the bond market is being blamed on rating reductions, new bond issuance and concerns about sky-high debt levels. I would bet my bottom dollar that the biggest issue on the campaign trail for the White House next year will be fiscal responsibility. Fitch lit the match, Moody’s poured gas on the fire and I hope the American taxpayer is going to give a damn when voting on who is going to begin to reverse the current debt spiral.

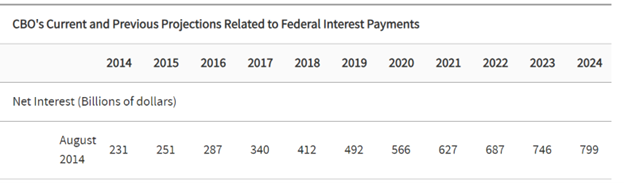

When the debates are full of how are you going to save Social Security, Medicare, Medicaid and the federal government pension program from going bankrupt as interest payments on the national debt approach $800 billion in 2024, I believe the market will glom on to the perception that a new course of action on Capitol Hill will begin. Lawmakers who want to maintain their careers in Congress might be forced to adjust.

I honestly believe smart-thinking Americans are done with rearranging the fiscal deck chairs on the Titanic and risking the nation’s balance sheet and the ability to fund these key programs for future generations. Most folks of all income classes have been complacent to speak out, and yet inflation has taken a huge bite out of the household budgets of millions of families.

It stands to reason the noise level of frustration with wasteful tax and spend government will reach a tipping point that forces upon the electorate a new public debate on balancing the federal checkbook. It is a big macro discussion, but one that will likely emerge with fire and brimstone next year that will be a catalyst for the market — simply because it will be a center stage campaign issue.

Whether anything legislatively actually happens in Washington is quite something different. That’s all to come, but since perception is greater than reality, the market will likely respond favorably to balanced budget rhetoric. If so, August 2023 will be remembered as a great time to buy dividend-paying stocks.

P.S. My Eagle colleagues will be hosting a free teleconference on Aug. 16 at 2 p.m. EST entitled “How to Turn $2k Into $10k in 90 Days.” The event is free, but you must register here to attend. Don’t miss out!

P.P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture, and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.