Major Averages Hit New Highs on Fed-Induced Hopium

Last week’s rally that led the Dow, S&P and Nasdaq to new all-time highs truly defied the logic and warnings coming from many market pros.

The trade truce with China is anything but reassuring, tensions with Iran are simmering, an abnormally high number of companies are issuing revenue and profit warnings and Morgan Stanley came out publicly to suggest it may be time to sell equities. One would have thought a pullback for stocks against this backdrop would be warranted.

The old Wall Street maxim of climbing the “wall of worry” has to do with the stock market surmounting a number of negative factors to keep ascending to new high ground. As of last week, the market’s resilience to any stumbling blocks is to be admired, if not respected. So much for calling for the S&P to hit 3,000 by the year’s end. We’re there.

The impressive stand by the bulls has come at a time when skepticism about further market gains is running high — leaving many to wonder how and why this torrid 10% rally for the S&P off the June 4 low came to be. After all, the current takeaway from the G20 Summit is that nothing has really changed. The current tariff structure remains in place and the United States gave in to corporate pressure to sell products to Huawei. Talk of new tariffs on European goods is getting traction and tensions with Iran are on the rise.

Much of the credit for the June rally is being awarded to Fed Chairman Jerome Powell and other Fed officials for putting their oral stamp on the assumption that a rate cut of at least a quarter-point is a done deal at the upcoming Federal Open Market Committee (FOMC) meeting scheduled for July 30-31. The latest Fed speak is that a rate cut will be for “insurance purposes” and not because the economy is faltering. Who says a good old-fashioned Twitter lashing from the White House doesn’t work?

Conversely, the institutional bond investors would have nothing of it and are operating in lockstep by hoarding U.S. and other investment-grade sovereign bonds as if the world was going to run out of newly issued debt. Global bond markets have rallied sharply in response to weakening economic data and dovish fiscal narratives from leading central banks, taking the benchmark 10-year Treasury yield down to 2.15%, a level not seen since the fourth quarter of 2016.

Amazingly, 25% of all the government debt around the world now has negative yields, most of which is issued by 14 European nations. This is rather perplexing and underscores the level of rising worry among investors about a hard landing for the European economy.

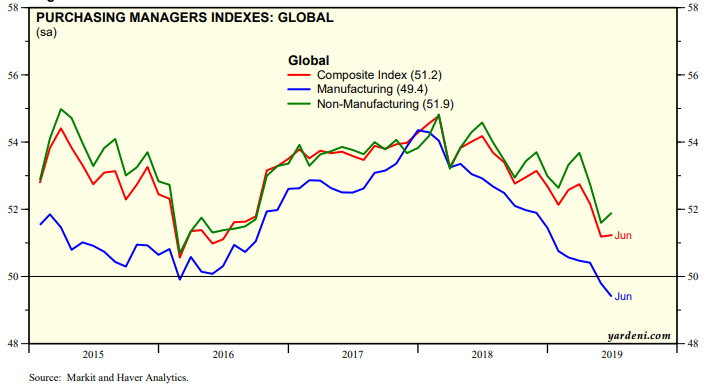

Recent Global PMI surveys signaled that manufacturing further contracted during the month of May, posting its lowest reading since October 2012. The JPMorgan Global Manufacturing PMI — a composite index produced by JPMorgan and IHS Markit — posted 49.8 in May, down from 50.4 in April. Any number below 50.0 shows the world’s factory output is contracting.

More importantly, the ISM Manufacturing PMI in the United States fell to 51.7 in June from 52.1 in May, marking the slowest pace of expansion in the factory sector since October 2016. The U.S. economy accounts for 21.6% of global gross domestic product (GDP), while China is at 12.7%, Japan totals 7.7%, Germany measures 4.8% and France generates 3.6%. When this group that makes up 50.4% of global GDP sneezes, the rest of the world gets a cold.

What raised a lot of eyebrows is that, according to the JPMorgan Global Manufacturing PMI report the downshift in growth in the Unites States was the main driver of the slowdown in global manufacturing, as the U.S. PMI slipped to its lowest level in almost a decade since September 2009. With this information in hand, it’s safe to say that the Fed, the European Central Bank and other global reserve banks will be cutting short-term interest rates in the weeks and months ahead.

Forget the short-term negative factors that typically would derail a market, that up until the Fed’s publicly dovish drumbeat had investors walking on eggshells. Instead, investors have bought into the macro argument that the Federal Reserve will begin aggressively cutting interest rates while central banks in China, Japan and Europe will also pursue more aggressive fiscal stimulus measures.

It is believed that coordinated central bank intervention among the most powerful economic nations will provide a floor under the global economy where a second half re-acceleration of growth can be anticipated. Investors also can buy equities in that market climate. It is a conundrum for sure. At the same time, the “fear of missing out” (FOMO) has under-invested professional and retail investors paying up for stocks, which led to a melt-up of sorts this past week. So much for summer doldrums in the stock market.

That’s the big picture. Investors love rate cuts, which provide the “hopium” for a higher stock market, even as the S&P trades at forward price-to-earnings (P/E) ratio of 17x that is above its five- and 10-year historical averages. Additionally, with the world awash in low to negative bond yields, juicier yields from stock dividends that enjoy preferential tax treatment are driving capital flows into equity markets with less regard for earnings growth — at least for now.

This might be why price-to-earnings multiples are expanding while earnings growth is decelerating. I find this fluid situation one of the most interesting times in my investing career, and though I, too, wonder if the current slowdown is just temporary, I’m not about to fight the tape.

The rally is being led by none other than the tech sector, which can be traded actively with my Hi-Tech Trader advisory service, which uses artificial intelligence (AI) to screen for the best and most timely trades. Coming into the second week of July, we booked profits in 22 out of our prior 26 trades both in stocks and corresponding call options. Together, that’s 44 trades where we’re ringing the register and we’re winning 85% of the time we put our trading capital to work.

We’re trading some of the hottest companies in the market, like Microsoft (MSFT), Micron Technology (MU), Fortinet Inc. (FTNT), Zscaler Inc. (ZS), Advanced Micro Devices (AMD), Twilio Inc. (TWLO), PayPal Holdings (PYPL), Applied Materials (AMAT), CyberArk Software (CYBR) and Cisco Systems (CSCO).

Hi-Tech Trader is a proven winning AI-based trading system that is laser-focused on what the market and traders care about most — high tech stocks and options. Take a tour of Hi-Tech Trader by clicking here and put the power of AI to work in your trading portfolio today.