Market Reaches a Hard Fork in the Road

The next two weeks are likely to be where the S&P finally breaks out of its tight trading range of 4,100-4,150. The number of conflicting data points, adjustments in earnings guidance and Fed rhetoric are giving rise to the notion that the market has to break one way or the other. This past week saw the mighty tech trade with a notably cautious tone as pre-earnings estimates were lowered on several of the leading tech titans. At the same time, the market might reward all the cost-cutting and belt-tightening within the tech sector when companies report their numbers. Hard to say, but investors will know soon enough.

And then, there’s the debate on inflation that doesn’t look likely to be settled anytime soon, at least not after last Friday’s PMI reports that both came in hotter than forecast. The Flash Purchasing Managers’ Index (PMI) from S&P Global was surprisingly strong. The services sector posted a 12-month high of 53.7, considerably higher than the 51.5 expected and higher from last month’s 52.6 reading. The manufacturing sector, mired in a multi-month contraction, rebounded sharply, reaching 50.4, a five-month high. The 50.4 level was well above forecasts of 49.0 and was higher than last month’s 49.2, bringing more confusion just after Thursday’s release of initial and continuing unemployment claims showing a continued slowing in the labor market.

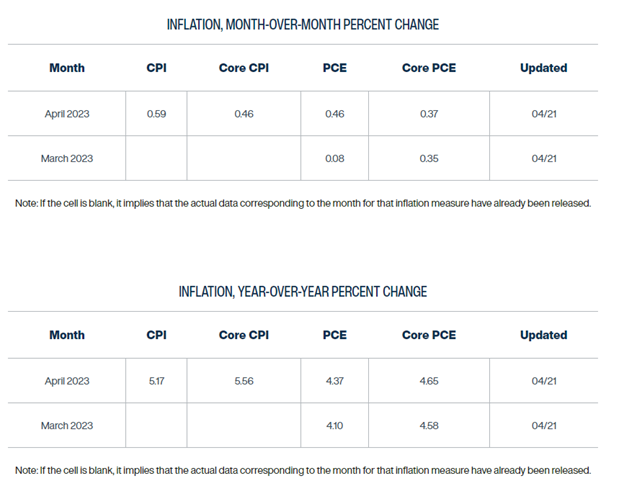

“Executives from both the goods and services sectors reported strong purchasing activity, robust hiring and elevated output,” said Jose Torres in an article for Traders’ Insight. “At the same time, however, cost pressures accelerated significantly, leading to renewed inflation concerns against the backdrop of a still-hawkish Federal Reserve. Prices in both sectors rose at the fastest pace since September of last year. Taken together and consistent with our in-house inflation models and the Cleveland Fed’s inflation nowcast, April inflation is expected to be significantly hotter than March.”

Before the Fed meets again on May 3, they will have the benefit of hearing from the nifty-fifty S&P 500 companies that matter most to market sentiment, while receiving key economic reports that include the S&P Case-Shiller Home Price Index, Consumer Confidence, Durable Orders, Unemployment Claims, Employment Cost Index, Chicago PMI and the Fed’s favorite inflation indicator, Personal Consumption Expenditures (PCE) index. Collectively, these data points are very important, but last week’s PMI reports pretty much locked in a tenth rate hike, while also raising the probability of yet another hike in June.

Chart from The Federal Reserve Bank of Cleveland

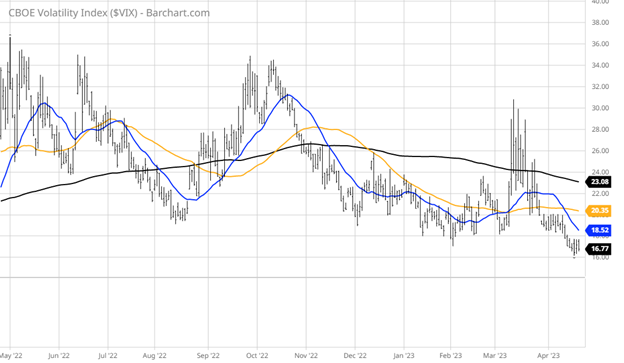

Good news from the strong PMI readings seemingly triggered a shift in the narrative back to sticky inflation, higher rates for longer, stable dollar, lower oil prices, lower gold prices and more pressure on the consumer. Hence the sloppy and choppy price action for much of the market for the past week. But if market participants are truly worried about a potential leg lower for stocks in the coming days, why then is the CBOE Volatility Index (VIX) trading at a new 52-week low? Seems awfully complacent.

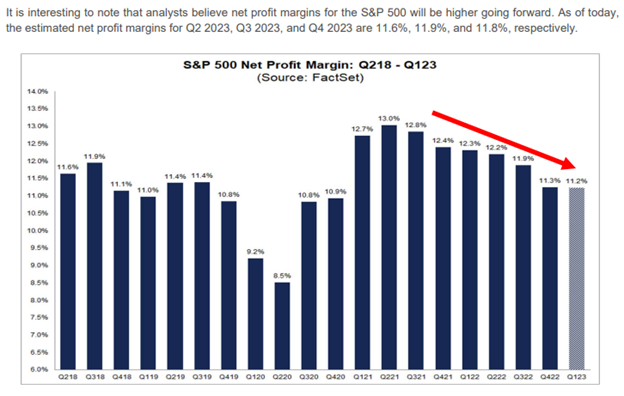

Sometimes it’s OK to admit that one just doesn’t know. Soft landing, hard landing, crash landing, or how about no landing? I think the idea of the earnings troughing in the current second quarter is a valid one as the economy learns to live with the price increases it has had to absorb, especially with the ongoing tight supply of housing.

According to FactSet, analysts are looking for a second-half rebound in profit margins, which makes sense. Coming out of the Great Recession, companies posted record profits on lower sales growth due to broad cost-cutting measures and the implementation of more efficient processes. This time around will be not different. Inflation is forcing radical changes in workforce procedures, cost of goods management and whatever measures can drive enhanced productivity.

The resultant effect is the creation of leaner and meaner corporations where earnings growth will recover after the Fed pauses and the 11 rate hikes work through the system. But for now, when someone asks where the market is headed, or what about inflation or are we headed into a recession? It’s perfectly OK to say, “ask me in two weeks, and I’ll tell you then.”

P.S. Come join me and my Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.