Option Income Shines When Yield Is Scarce

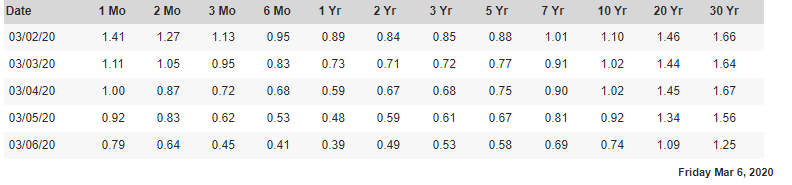

So much for living through one’s golden years off of a portfolio driven by yields in fixed income assets. Anything with a maturity date that is investment-grade is seeing its yield crash. The flight to safety is historical in that Treasury yields have never fallen to the levels that we witnessed last week. There is genuine panic in the bond market in a world awash in sovereign liquidity that wants to own U.S. Treasuries no matter what the maturity is.

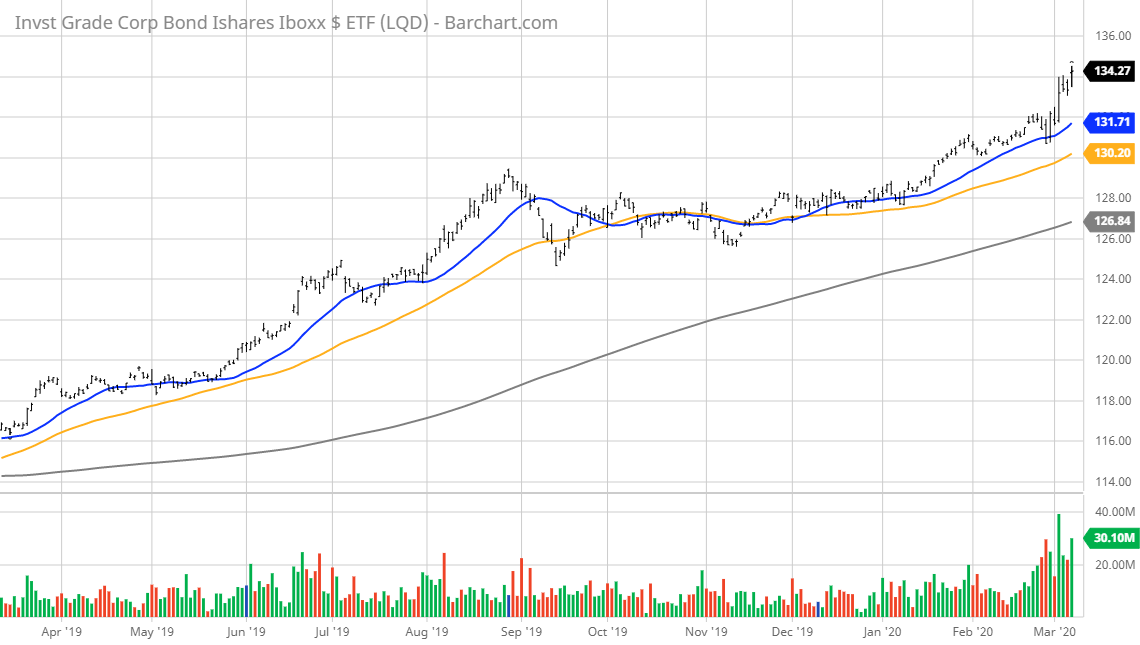

Investment-grade corporate bonds are also in the midst of a herculean rally, as the 10-year chart of the widely traded iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) clearly show. The current yield on LQD is 3.11% and a 2.32% yield to maturity. This exchange-traded fund (ETF) with $33 billion in assets, 1,985 separate holdings with an average duration of 9.45 years and a monthly dividend is all some investors want — simple, safe, paying 3% and experiencing a firehose of capital inflows.

While shares of LQD will retreat by 5%-7% when the stock market settles down, don’t count on that happening anytime soon. The bond market operates out of fear.

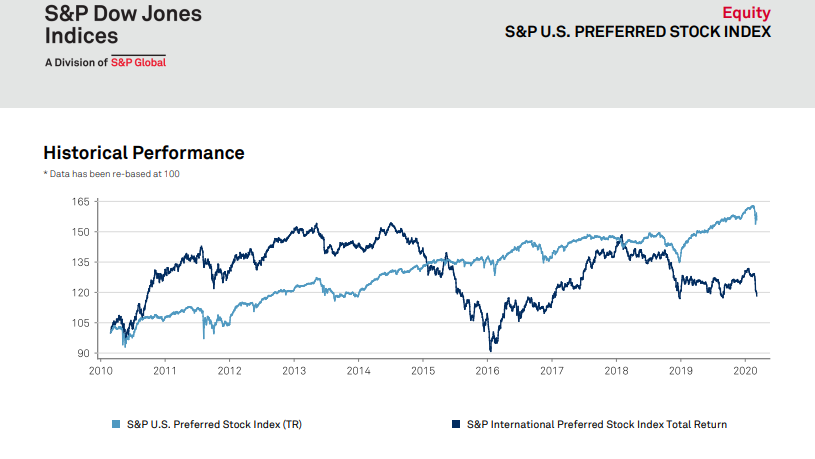

Anything outside Treasuries and investment-grade corporate debt is under severe stress — even investment-grade preferreds that are paying around a 5% yield are seeing spreads widen and share prices start to buckle. This class of security has been the place where corporate debt investors have seen a real nice bonus yield of a couple points over the investment-grade corporate bond market. Since last week, however, it has “lost that loving feeling.”

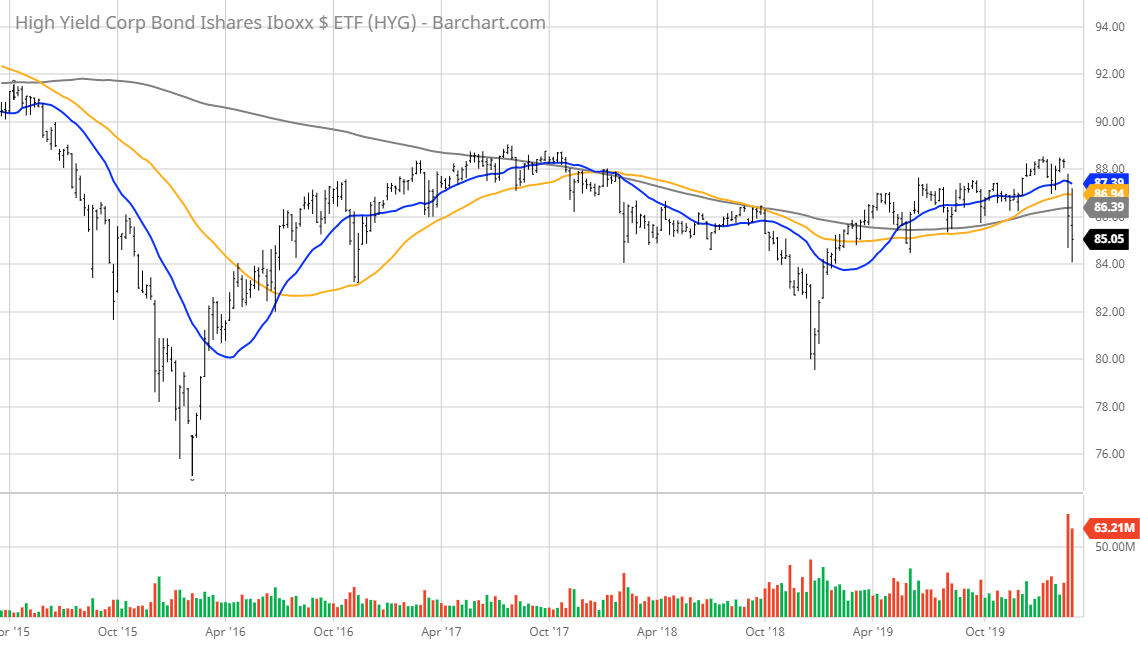

Where there is serious hand wringing and gnashing of teeth is within the junk bond space, where spreads are starting to blow out. From the five-year chart below, we can see how the current selloff in high-yield debt is starting to resemble the corrections in the first quarter of 2016 and the fourth quarter of 2018.

For the time being, the recent price deterioration might be construed as just another garden variety correction that will right itself over the near-term. But with Saudi Arabia officially sparking a new all-out oil war that is going to crush oil prices, debt-heavy energy companies are now on default watch for sure.

The fallout of OPEC’s meeting with Russia that went south last Friday is going to send a lot of leveraged oil and gas companies over the side and into bankruptcy. And this wave of yet-to-be-determined number of junk bond blowups will impact the broader junk bond market that now stands at over $1.5 trillion in issued paper and up from $700 billion in debt in 2007.

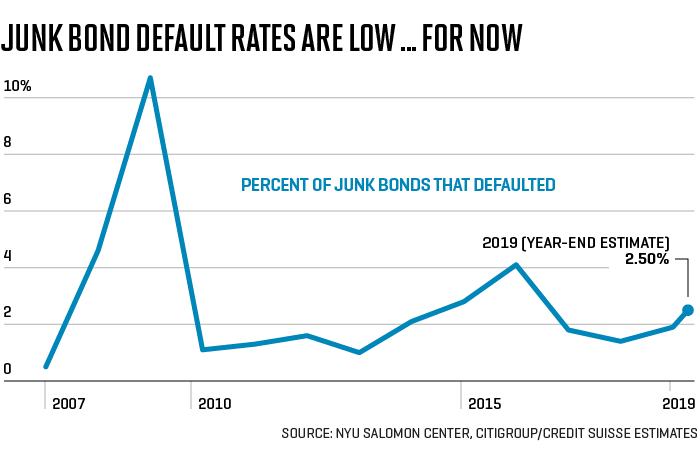

For all of 2019, the default rate in the junk bond market was only 1.9% and well beneath the historical average of 3.3%, according to Deloitte. During the recovery from the Great Recession, the portion of the market that was made up of investment-grade bonds fell to 78.6% from around 90% in the previous two recoveries.

The double whammy of the coronavirus bringing huge stress to global supply chains and the fresh oil price war that was announced over this past weekend has put the junk bond market on high alert. And though I personally believe that this sector, like the stock market, will eventually recover when the number of COVID-19 cases plateaus, this same hope won’t be true for junk debt in the energy sector.

There is real trouble brewing and investors with exposure in the energy sector that is not blue-chip should consider lightening up ASAP. I’m well aware that energy stocks have been severely punished, but it is about to get more volatile, which will be very much reflected in bond and stock price instability.

The ground is greatly shifting under the markets, high-quality yields are in a fast decline and valuations for low-quality debt are sliding hard. So, what can income investors do to compensate for some of this volatility? Sell some out-of-the-money covered calls on the blue-chip stocks and put the market’s volatility to good use.

Most investors I’ve talked to are content to ride out the coronavirus correction, but there will certainly be a hit to earnings. However, no one knows the extent of this hit because the situation is still highly fluid. But that doesn’t mean one can’t keep his or her equity capital busy. Option premiums have expanded big time in the current market, both in puts and calls.

Case in point, shares of MasterCard (MA) are trading 75 points off their recent all-time high of $347.25. Yet, investors can sell the June $350 Calls for over $400 per contract. Do I think shares of MasterCard are going to rally when the virus fears start to subside? Of course. Do I think the stock is going to trade above $350 and to a new all-time high by the June 19 expiration to where the stock gets called away? Nope.

Buying Treasuries and investment-grade debt after this torrid run-up is fraught with risk when the good news surrounding the virus eventually crosses the tape. Why not use these 1,000-point rallies to bank some volatility wherever and whenever possible? After all, selling covered calls is just another name for “free money”. And if we’re going to be mired in a wild trading range and be forced to wait it out, we might as well get paid to watch. My Quick Income Trader and Breakout Profits Alert services should fit the bill.