Putting Together a Plan that’s Simple to Understand

We need to face the many complexities of a market beset by central government financial engineering, crashing commodity prices, a pending wave of junk bond defaults, slowing growth in China and a recession in Brazil and other emerging markets. We also need to weigh the risks of the visceral politics of a presidential election year and the ongoing possibility of future terrorist attacks such as the one that hit Paris on Nov. 30. Those threats loom over the investing landscape like dark thunder clouds.

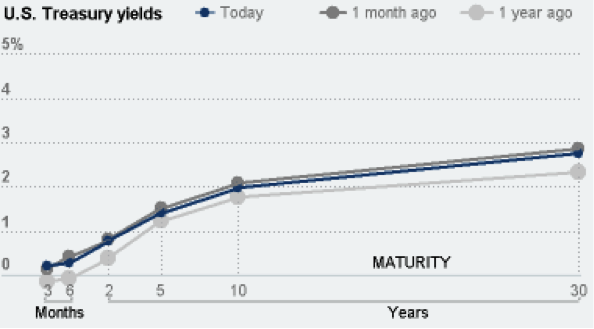

Income investors need to decide how best to construct a plan that is resistant to those prevailing risks. Their plans also should deliver yield that is superior to that of money market funds, CDs, Treasuries and investment grade bonds, all of which pay between 0.10% and 3.7%. When adjusted for taxes and inflation, the net yield is close to 1.0% for investors in the higher tax brackets.

And with the Fed trying to rationalize another quarter-point hike this March before stepping aside for the election cycle, the idea of going out on the yield curve for bonds may be a risky proposition.

Rather than trying to outflank all of the colliding market forces, and extreme levels of volatility that are exacerbated by high-frequency trading, investors who desire to be invested in this particularly skittish environment still have access to good safe-haven opportunities. This approach is the clearest path to having market exposure and getting a good night’s sleep. A suitable plan for income investors is one that offers the path least of resistance in terms of risk but still provides capital appreciation potential.

Following the worst start of any year in recorded history for the U.S. stock market and global markets in general, there are fresh signs of coordinated central bank intervention in the making to add fiscal stimulus in various forms. Markets rallied Friday on this notion of more liquidity that will help to shore up equity markets and spur global growth. Whether this is a turning point or just another one-day anomaly within an intermediate-term downtrend remains unanswered.

Until there are true signs of a bottom that invites risk-on allocation back into economically sensitive sectors or a jump back into the FANG stocks (Facebook, Apple, Netflix, Google) in front of the heart of earnings season, beware. Further price-to-earnings (P/E) multiple contraction is a very real risk if fourth quarter results fail to satisfy expectations.

Keeping it simple is a good plan in the current landscape. I recognize that dividend yields in the 4-6% range provide investors with stability of their investment principal. Potential investments that pay such yields include property real estate investment trusts (REITs) that operate skilled nursing facilities, self-storage facilities, data center facilities and neighborhood strip malls, which offer local service and are less at risk from the competitive threat of online shopping that hurts mall traffic. Utilities that provide power, water and telecom services offer the other space in which to target capital for income and incremental growth. These sectors are seeing positive capital inflows and their share prices are showing impressive resilience.

Within my Cash Machine income investing-focused newsletter, I launched a new Safe Haven Portfolio in late December as it became clear the market was going to suffer an extended correction exacerbated by the confluence of issues noted above. While the S&P 500 has shed roughly 10% and left no market sector unscathed, the focus of professional attention is squarely on selected investments. With five buy recommendations in the new Safe Haven Portfolio, room exists for five more such picks. Now is an ideal time for income investors to subscribe to Cash Machine and take part in what is working and working well.

Join me at The MoneyShow in Orlando, March 2-5!

Receive free admission to the MoneyShow in Orlando, Florida, as a guest of Eagle Financial Publications and me. The show’s new venue is at Disney’s Contemporary Resort near the company’s famous theme parks. I especially encourage you to attend my presentations, as well as those of my colleagues Nicholas Vardy and Dr. Mark Skousen, among more than 150 other speakers who will address a range of income and growth investments. Register today.

In case you missed it, I encourage you to read my e-letter column from last week about how I’m investing defensively in this market. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.