Rising Tariffs Could Prick China’s Real Estate Bubble

Increased volatility is a clear and present danger to investor sentiment after the trade war tension ratcheted up a few notches this past week due to increased tariffs on both U.S. and Chinese goods.

Global markets are still betting that a final deal ultimately will be reached, but there is growing evidence that both sides are digging in for the long haul, if necessary, to gain favorable terms. While increased tariffs reaching 25% will be applied to $200 billion of Chinese imports and a not-yet-set date for applying the same 25% tariff on the approximately $325 billion of all other Chinese imports, the Chinese government expressed “deep regret over the development” and pledged to take “necessary countermeasures.”

I’ve never been convinced China would disarm its government-backed espionage and its widespread practice of intellectual property (IP) theft. There are more military uniformed hackers in China working 24/7 to steal U.S. technology than the entire U.S. Marine Corps.

The lack of innovation in China means that agreeing to stop stealing U.S. technology and agreeing to eliminate the forced transfer of technology for U.S. companies to gain access to that market is to compromise China’s current strategy to keep up with the United States and achieve its goal of global economic dominance.

To this point, it’s my view there will be no transparent deal where terms and conditions are verifiable, with violations penalized. If this is the harsh reality of what lies ahead, then there is little choice for the United States than to apply heavy pressure on China’s economic and financial systems. China could manipulate the yuan lower, but at the same time risk a massive flight of capital out of the country, as occurred in 2015.

According to the Institute of International Finance (IIF), China’s debt to GDP is over 300%, and this number is very hard to quantify because of the opacity of the data. It is estimated that about one-quarter of the debt is tied to real estate. I think this is where the real trouble lies for China if the tariffs are in place over the long term. The International Monetary Fund (IMF) noted in an April 2018 report that “a crisis in China’s housing market would be of considerable global concern.”

Chinese investors of domestic real estate have been on a buying spree, with 69% of buyers in 2018 purchasing their second or third home and more than 50% of those purchases bought for investment purposes. Trade tensions and capital outflows already are having an impact. In Beijing, the vacancy rate for investment properties is approaching 20%. Home prices versus incomes are way out of whack.

In Shenzhen, the price per square foot (PSF) is around $760 compared to $636 in Silicon Valley. The big difference is the average salary in Silicon Valley is about $84,000 whereas the average salary in Shenzhen is just over $15,000. Housing bubble?

It is difficult to get one’s arms around China’s real estate market. Not only is 25% of the country’s gross domestic product (GDP) tied to construction, 80% of the nation’s wealth is invested in domestic property holdings at a time when it is estimated there are 65 million vacancies. Real estate sales tanked 44% in early January, which was met with local governments removing some restrictions and relaxing requirements. Normally, this would look like a red flag and sound like a canary in the coal mine.

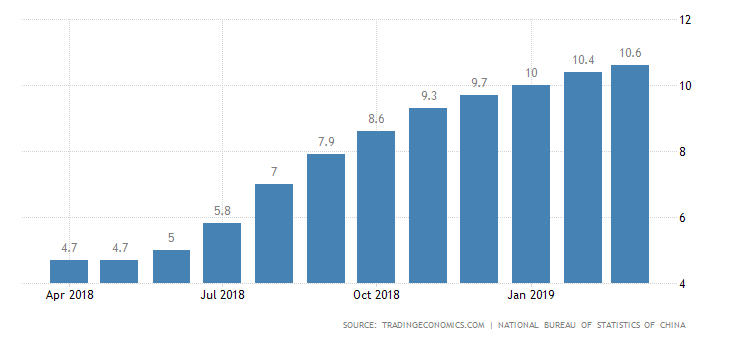

However, the latest read on China’s real estate market shows average prices of homes in 70 cities increased by 10.6% year-on-year in March 2019 to rise from the 10.4% rate in February. It is the 47th straight month of price increases and the strongest annual gain since April 2017.

Some analysts argue the binge buying of the past three months was in anticipation of a U.S.-China trade deal, as buyers leveraged heavily into the what was perceived to be a re-acceleration of the Chinese economy. That still may be the case if a deal does come together in due course, but there seems to be some conflicting data at work here.

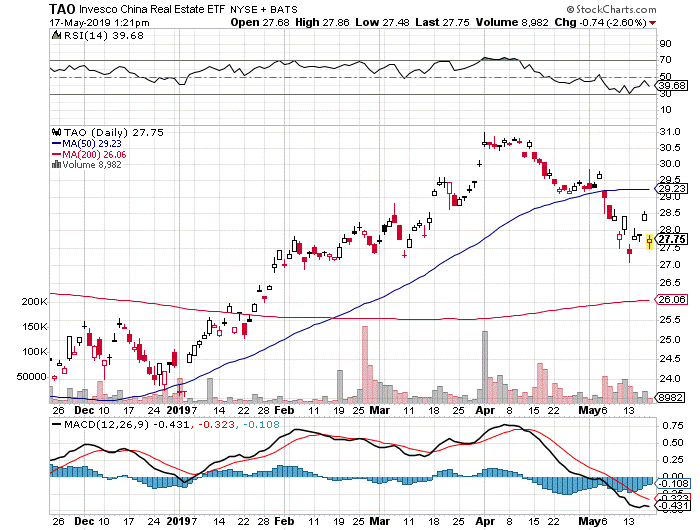

While investors have been keen to follow the Shanghai Composite Index as a measure of the Chinese economy, it might prove more insightful to keep a close eye on the China Real Estate Invesco ETF (TAO) as a more accurate barometer. China’s largest real estate developers have had their debt downgraded to an average rating of CCC, with Moody’s rating the debt of 51 out of 61 Chinese property companies as “junk.”

President Trump has had plenty of experience with junk debt and bankrupt real estate, so he has a good understanding of how a leveraged real estate portfolio can punish investors. If the trade war lowers China’s GDP from 6.4% to anywhere at or below 5.0%, with its real estate market undergoing a 2008-2009 reset similar to what occurred in the United States, then, and maybe only then, will the pain be sufficient to sway China’s leaders to accept long-term and constructive change at the negotiating table.

Trading within this highly fluid investing landscape requires skill and timing to produce consistent results. Many stocks are round-tripping gains and a full 56% of the stocks that make up the S&P 500 are in technical bear markets. I recommend that traders consider my Hi-Tech Trader advisory service, where I use Artificial Intelligence (AI) to trade a portfolio of no more than five high-profile technology stocks.

Within the service, I screen for stocks that have at least an 80% probability of trading higher over the next 22 trading days, or roughly one month. I also recommend a corresponding call option strategy for those who want to leverage each recommendation. Some traders buy only stocks, some buy only options and others will play both the stock and the options.

We’ve been booking serious profits in cyber security, 5G, SaaS software and digital payments stocks lately to pursue the hottest and most bullish price action in the broad market. Take a tour of Hi-Tech Trader by clicking here and put the power of AI to work in your trading portfolio today!