Sell the Rally in Regional Banks

Rising interest rates, commercial real estate losses and increased regulatory scrutiny were the buzz phrases facing the regional bank sector in late May and early June following the collapse of Silicon Valley Bank, Silvergate Bank, Signature Bank and First Republic (FRC).

In response to the early failures occurring in late February and March, the Federal Reserve established the Bank Term Funding Program (BTFP) to offer loans of up to one year to eligible depository institutions pledging qualifying assets at collateral. FRC was closed and sold to JPMorgan Chase & Co. (JPM) on May 1.

Since that time, which now seems so long ago, there has not been much in the way of negative headlines. After all, the Fed threw the regional bank sector an unlimited line of credit, where the BTFP authorizes banks to borrow against eligible holdings up to their par value rather than their market value — a very special arrangement to say the least.

Since bottoming out in early May, the regional bank sector, as measured by the S&P Regional Banking Sector ETF (KRE), has recovered a little more than half its losses incurred from the earlier collapse that took the sector down by 46%. But the regionals were already in a protracted downtrend dating back to when the Fed began raising rates in March 2022. Eleven rate hikes later, they are telegraphing that they are not done.

Despite the rally of late, it stands to reason that many of the forces that triggered the regional banking crises in March are still at work. A further bump in interest rates only puts more downside pressure on valuations of securities held by banks while continuing to incentivize savers to pull money from accounts, seeking higher yields elsewhere. The biggest brokerage firms are paying around 5% for money market deposits. Those same investors are buying six-month T-bills yielding 5.5% as of last Friday, making cash management pretty much a no-brainer. Cash goes where it is best served.

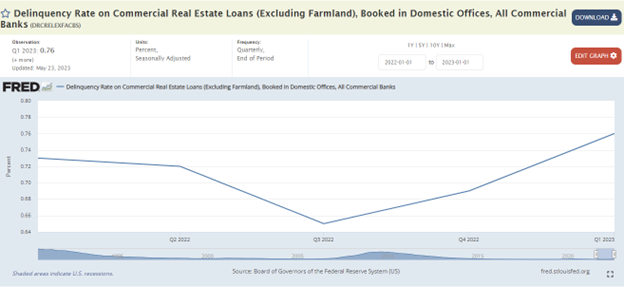

The big elephant in the room, losses on commercial real estate loans, are just beginning to show up as a clear and present danger to balance sheets. As such, there is likely to be a tsunami of bank mergers forthcoming. Half the country’s banks will likely be swallowed by competitors in the next decade, according to Fitch analyst Chris Wolfe.

“Some of these banks will survive by being the buyer rather than the target,” said incoming Lazard CEO Peter Orszag. “We could see over time fewer, larger regionals.”

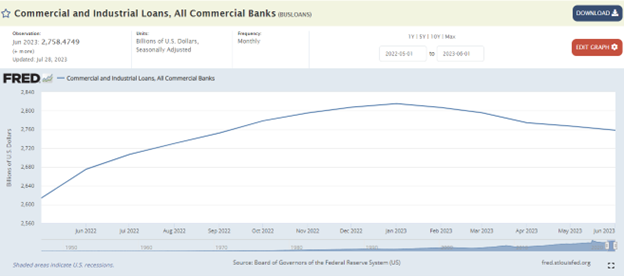

Below are a couple of interesting charts. Even as the Fed has quietly increased M2 money supply since April to facilitate more lending by banks, demand for commercial and industrial loans has weakened. M2 consists of M1 plus time deposits in amounts of less than $100,000, less IRA and Keogh balances at depository institutions and balances in retail money market funds (MMFs) and less IRA and Keogh balances at the funds.

Commercial and Industrial (C&I) loans are made to businesses or corporations, not to individual consumers. These loans can be used for a variety of purposes, including capital expenditures (like buying equipment) and providing working capital for day-to-day operations. They are typically short-term loans with variable interest rates.

C&I loans are a key driver of economic growth because they provide small- to medium-sized businesses with the funds they need to expand, invest and hire, which can stimulate economic activity. They are a major line of business for many banking firms. But as interest rates have risen, it has become more expensive for banks to borrow capital for lending. This increased cost is typically passed on to businesses in the form of higher interest rates on commercial and industrial loans.

So, with the cost of capital now the highest it has been in over two years, businesses are more hesitant to take on debt, especially floating rate debt, which in turn will likely show up in depressed earnings growth for banks in upcoming quarters. This downward trend in loan demand is being aggravated by the rising rate of delinquencies on commercial property, coupled with defaults and foreclosures on residential properties.

ATTOM, a leading curator of land, property and real estate data, released its Q1 2023 U.S. Foreclosure Activity Report, which shows a total of 95,712 U.S. properties with a foreclosure filings during the first quarter of 2023, up 6% from the previous quarter and up 22% from a year ago. The report also shows a total of 36,617 U.S. properties with foreclosure filings in March 2023, up 20% from the previous month and up 10% from a year ago — the 23rd consecutive month with a year-over-year increase in U.S. foreclosure activity. A total of 65,346 U.S. properties started the foreclosure process in Q1 2023, up 3% from the previous quarter and up 29% from a year ago.

Bear in mind, these are first-quarter numbers, three rate hikes ago. I would venture to say that when the second-quarter data is released, the data will show further deterioration, again appearing in future bank sales and earnings forecasts and final quarterly results. In my view, the Fed is in its own self-made bind, fighting inflation that it failed to address early on, being too relaxed on banks with under $250 million in deposits and now staring at gas prices hitting an eight-month high with the CRB index trading at a 10-month high.

While the market has indeed broadened out in the number of sectors participating in the summer rally, one might consider how much of a weighting regional banks should occupy in one’s portfolio. A lot of stocks and sectors get a free ride when the wind is to the back of the market. But August and September have historically proven to be a more challenging market landscape for investors. This rally in the regional banks might be a good one to sell into.

P.S. Come join our Eagle colleagues on an incredible cruise! We set sail on Dec. 4 for 16 days, embarking on a memorable journey that combines fascinating history, vibrant culture and picturesque scenery. Enjoy seminars on the days we are cruising from one destination to another, as well as dinners with members of the Eagle team. Just some of the places we’ll visit are Mexico, Belize, Panama, Ecuador and more! Click here now for all the details.