Two 2023 Sector Lemons Turning Into 2024 Lemonade

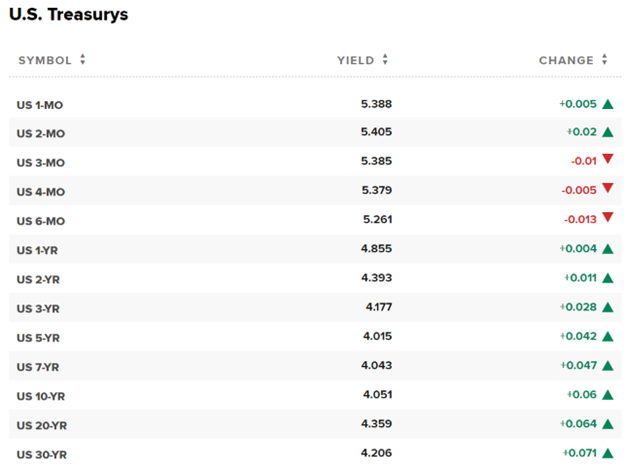

There is a mighty sea change underway within the broader income generation space for investors seeking to lock in yield as the bond market anticipates lower interest rates ahead. The yield on the 10-year Treasury Bond fell to 3.77% from 5.00% within a six-week period, only to bounce back to 4.07% following last week’s stronger-than-forecast headline data, yet under the hood showed downward revisions.

December nonfarm payrolls increased by 216,000 (consensus 162,000). The three-month average for total nonfarm payrolls decreased to 165,000 from 180,000. November nonfarm payrolls were revised to 173,000 from 199,000. October nonfarm payrolls were revised to 105,000 from 150,000. October private sector payrolls were revised to 44,000 from 85,000.

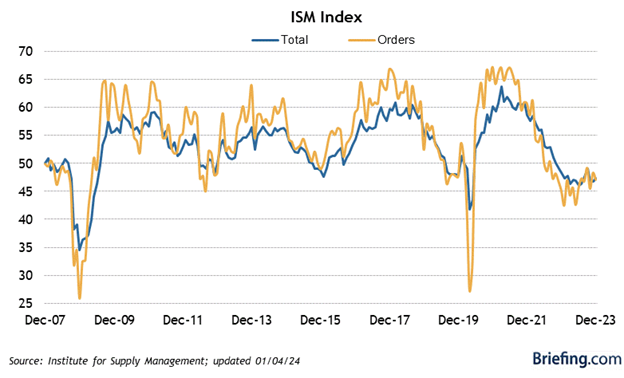

The market received the report as not being weak, and yet the ISM Non-Manufacturing Index that represents the services sector, and the largest sector of the economy, decreased to 50.6% (consensus 52.5%) from 52.7% in November. The dividing line between expansion and contraction is 50.0%, so the December reading connotes services sector activity expanded at a slower pace versus November. December marked the 12th consecutive month of growth for the services sector, but at a pace that threatens to slip into contraction territory in January.

On the other hand, the manufacturing sector continues to contract. The December ISM Manufacturing PMI checked in at 47.4% (consensus 47.1%), up from 46.7% in November. Here too, the dividing line between expansion and contraction is 50.0%, so the December reading indicates an ongoing contraction in the manufacturing sector, but at a slower pace than the previous month. December marked the 14th straight month the PMI reading has been below 50.0%.

Together, the jobs, manufacturing and non-manufacturing data point to an economic slowing in the first quarter of 2024. The one good piece of data released was the Prices Index that fell to 45.2% from 49.9%, reflecting a further easing of inflationary pressures. The yield curve has responded in kind to these softening numbers, inverting further with the 2/10 spread widening out to -35 basis points.

Assuming a nascent deflationary trend is underway, those juicy 5%+ yields for 1-10-year maturities vanished from the market during the past two months, leaving investors with not-so-juicy 4%+ yields, with a rising probability of 3-30-year maturities falling to 3%+ levels over the next couple of months. It looks as if the opportunity to lock in 5% in the Treasury market for something longer than six months has left the station, and with the Fed targeting at least three rate cuts in 2024, rolling six-month Treasuries and CDs seems like a road of income attrition.

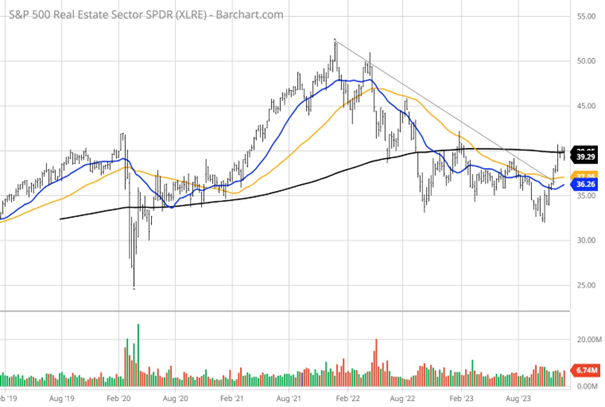

Of the 11 sectors that make up the S&P 500, both the real estate and utilities sectors might provide a nice alternative to low-yielding bonds given the lower inflation outlook and the Fed’s path to bring short-term rates down beginning as early as March. Stocks in both the real estate and utilities sectors reversed off their three-year lows, levels not seen since early 2020 when the pandemic was in full force, and deserve a hard look here, especially with the bond market digesting its torrid fourth-quarter gains.

There are several REITs paying yields in excess of 5% and a handful of blue-chip utilities paying yields north of 4% in qualified dividends that cap the tax rate at 20%. The income from REITs is taxed as ordinary income because REITs by law must pass through 90% of earned income and are not taxed at the corporate level. So, instead of settling for locking in fixed income rates at 4.0% for the next five to 10 years per the table above, investors can get the same or higher yields plus tax preference and the potential for capital appreciation from two sectors that are well off their three-year highs.

While there are many similarities in the electric utility sector, the REIT sector is fragmented into distribution warehouses, data centers, cell towers, healthcare facilities, shopping malls, resort properties, industrial properties, self-storage facilities and office properties, which have come under serious scrutiny in the new world of remote workforces where vacancy levels have soared and property valuations have plunged. It would be prudent to still avoid office space REITs even though the dividend yields are tempting. If the Funds From Operations (FFO) continue to remain under pressure, REIT operators will have to pay dividends in the form of return of capital or just slash the payouts to reflect the lower future income when negotiating new leases.

During the current period of market digestion with bond yields bumping a bit higher, it makes sense there will be some back and filling in the real estate and utilities sectors that coincide with the consolidation in bonds. During this window of time, and well before the Fed starts cutting rates, investors have time to add some attractive dividends to their portfolios from two sectors that are U.S. based and have a history of outperforming when the Fed pivots monetary policy to that of easing.